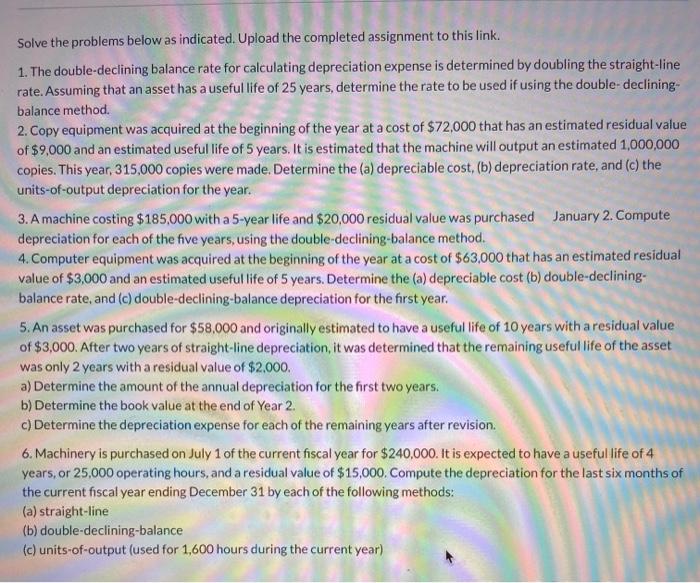

Solve the problems below as indicated. Upload the completed assignment to this link. 1. The double-declining balance rate for calculating depreciation expense is determined by doubling the straight-line rate. Assuming that an asset has a useful life of 25 years, determine the rate to be used if using the double-declining balance method 2. Copy equipment was acquired at the beginning of the year at a cost of $72,000 that has an estimated residual value of $9,000 and an estimated useful life of 5 years. It is estimated that the machine will output an estimated 1,000,000 copies. This year, 315,000 copies were made. Determine the (a) depreciable cost, (b) depreciation rate, and (c) the units-of-output depreciation for the year. 3. A machine costing $185,000 with a 5-year life and $20,000 residual value was purchased January 2. Compute depreciation for each of the five years, using the double-declining-balance method. 4. Computer equipment was acquired at the beginning of the year at a cost of $63,000 that has an estimated residual value of $3,000 and an estimated useful life of 5 years. Determine the (a) depreciable cost (b) double-declining- balance rate, and (c) double-declining-balance depreciation for the first year. 5. An asset was purchased for $58.000 and originally estimated to have a useful life of 10 years with a residual value of $3,000. After two years of straight-line depreciation, it was determined that the remaining useful life of the asset was only 2 years with a residual value of $2,000. a) Determine the amount of the annual depreciation for the first two years. b) Determine the book value at the end of Year 2. c) Determine the depreciation expense for each of the remaining years after revision. 6. Machinery is purchased on July 1 of the current fiscal year for $240.000. It is expected to have a useful life of 4 years, or 25,000 operating hours, and a residual value of $15,000. Compute the depreciation for the last six months of the current fiscal year ending December 31 by each of the following methods: (a) straight-line (b) double-declining-balance (c) units-of-output (used for 1,600 hours during the current year)