solve these problems

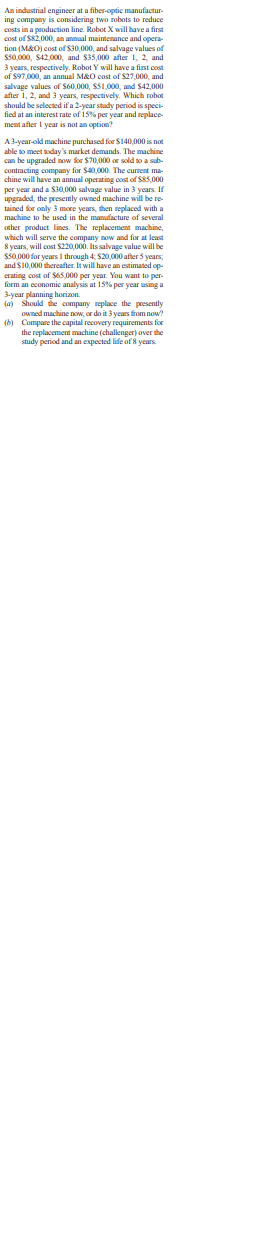

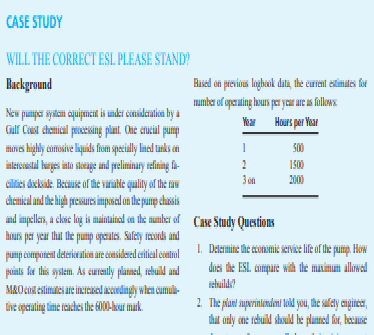

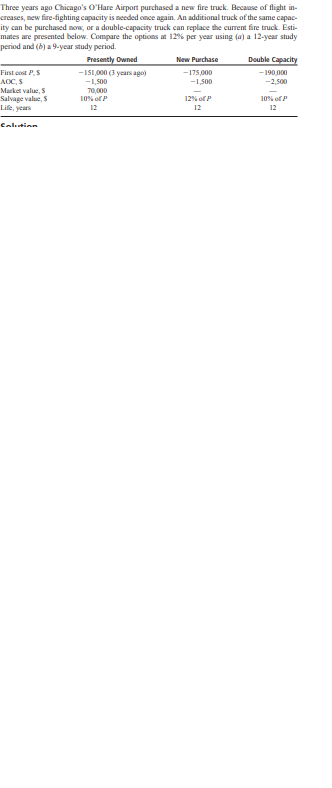

A recent environmental engineering graduate is try- ing to decide whether he should keep his presently owned car or purchase a more environmentally friendly hybrid. A new car will cost $26,000 and have annual operation and maintenance costs of $1200 per year with an $8000 salvage value in 3 years ( which is its estimated connomic service life) The presently owned car has a resale value now of $5000; one year from now it will be $3000, two years from now $2500, and 3 years from now $2200. Its operating cost is expected to be $1900 this year, with costs increasing by $200 per year. The presently owned car will definitely not be kept longer than 3 more years. Assuming used cars like the one presently owned will always be available, should the presently owned car be sold now, I year from now, 2 years from now, or 3 years from now? Use annual worth calculations at I = 10% per year and show your work.A pulp and paper company is evaluating whether it should retain the current bleaching process that uses chlorine dioxide or replace it with a proprie- tary "oxypure" process. The relevant information for each process is shown, Use an interest rate of 13% per year to perform the replacement study Current Process Oxypure Process Original cost 6 -450,000 years ago, 5 Investment cost -700,00D now, $ Current market 35 000 value, $ Annual operating - INI,OOD -7070OD Sahage value, $ 50,DOD Remaining life, YearsThe table below shows present worth calculations of the costs associated with using a presently owned machine ( defender) and a possible replace- ment (challenger) for different numbers of years. Determine when the defender should be replaced using an interest rate of 10%% per year and a 3-year study period. Show solutions (a) by hand and (b) by spreadsheet. FW If Kept/Used Stated Number of Years Number of Years, $ Kept/Used Defender Challenger -36,000 -84,DO0 -75,DO0 -96,000 -125,00D - 102,DO0 -166,000 -217,DOD -149,000An industrial engineer at a fiber-optic manufacture ing company is considering two robots to reduce costs in a production line. Robot X will have a first cost of $82,000, an annus and opera- tion (M.&Oj cost of $30,000, and salvage values of $50,000, $42,000, and $35,000 after 1, 2, and years, respectively. Robot Y will have a first cost of $97,000, an annual M&( cost of $27,000, and salvage values of $60,000, $51,000, and $42,000 after 1, 2, and 3 years, respectively. Which robot should be selected if a 2-year study period is speci- fied at an interest rate of 15% per year and replace- ment after I ye an option? A 3-year-old machine purchased for $140,000 is not able to meet today's market demands. The machine can be upgraded wow for $70,000 or sold to a sub- contracting company for $40,000. The current ma- chine will have an annual operating cost of $85,000 per year and a $30,000 salvage value in 3 years. If upgraded, the presently owned machine will be re- taimed for only 3 more years, then replaced with a machine to be used in the man facture of several other product lines. Th which will serve the company now and for at least years, will cost $220,000. Its salvage value will be $50 000 for years I through 4: $20,000 after 5 years; and $10,000 thereafter. It will have an estimated op- erating cost of $65,000 per year. You want to per- form an economic analysis at 15%% per year using a 3-year planning horizon. a) Should the company replace the presently owned machine now, or do it 3 years from now? [bj Compare the capital recovery requirements for the replacement machine (challenger) over the study period and an expected life of 8 years.CASE STUDY WILL THE CORRECT ESL PLEASE STAND? Background Based on previous logbook data, the current edimiles for number of operating hours per year are as follows New putiper ayala equipment is under consideration by a Gill Col chemical processing plant One crucial puny Hours per Year mines highly erosive liquids from specially lined tanks an SO Intercoastal barges into cleage and preliminary refining fa 1501 cilities docloude. Because of the variable quality of the raw chemical and the high pressures imposed on the pump chassis and impeller, a choc log to maintained on the number of Case Study Questions hours per year that the purtip operates. Safety records and pimp compareal deterioration are considered critical control I. Delermine the economic service life of the pump, How points for this salem. As curreally planned, rebuild and does the ESL compare with the maximumn allowed MRO call enlimited are increased accordingly when cumul cchuilder the operating time reaches the cook-hour mark. 1. The plant superintendent hold you, the safely anginca, that only one rebuild should be planned for, becauseThree years ago Chicago's O'Hare Airport purchased a new fire truck. Because of flight in- creases, new fire-fighting capacity is needed once again. An additional truck of the same capac- ity can be purchased now, or a double-capacity truck can replace the current fire truck. Esti- mates are presented below. Compare the options at 12%% per year using (a) a 12-year study period and (b) a 9-year study period. Presently Owned New Purchase Double Capacity Fintest P.S -151,000 (3 years ago) -175,000 -190 000 AOC, S -1,500 -1,500 -2,500 Market value, $ Salvage value, $ 10% ofP 12% of P 10% of P Life, years 12 12 12 Exlution\f