Answered step by step

Verified Expert Solution

Question

1 Approved Answer

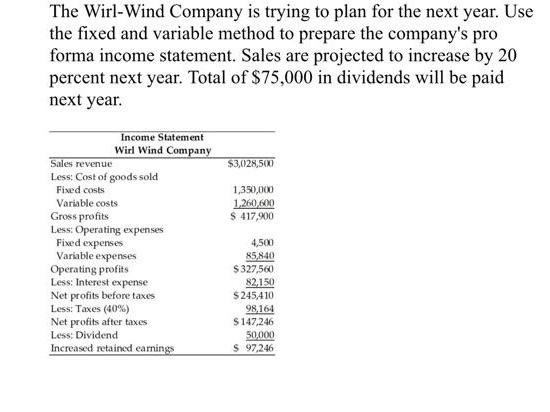

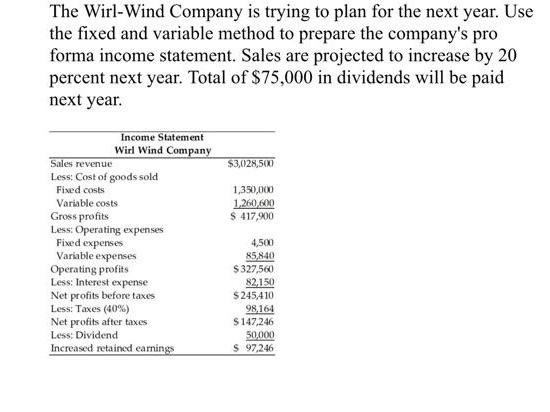

solve these questions The Wirl-Wind Company is trying to plan for the next year. Use the fixed and variable method to prepare the company's pro

solve these questions

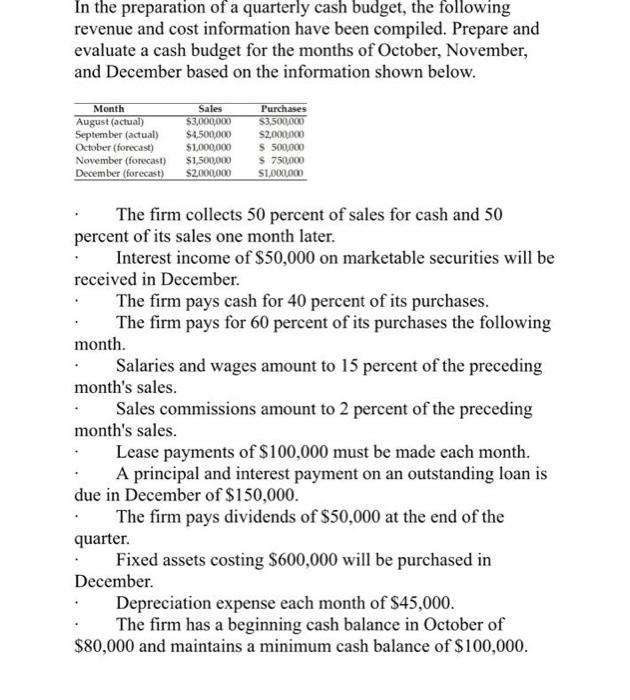

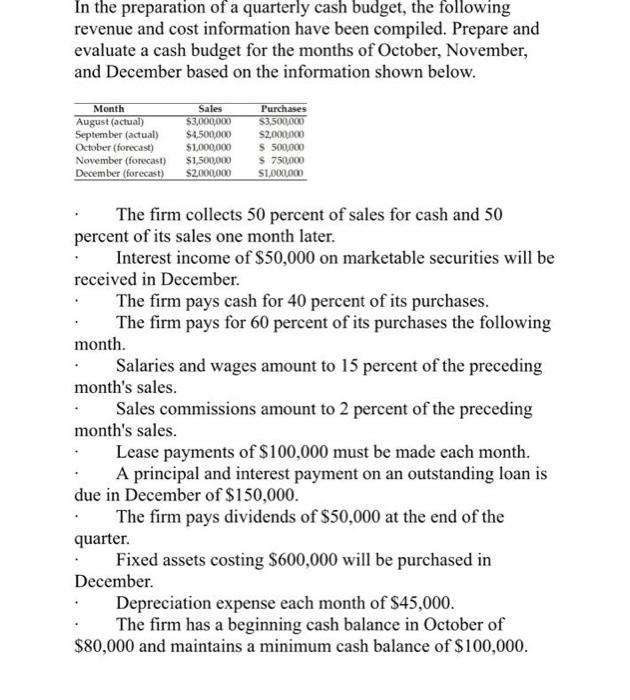

The Wirl-Wind Company is trying to plan for the next year. Use the fixed and variable method to prepare the company's pro forma income statement. Sales are projected to increase by 20 percent next year. Total of $75,000 in dividends will be paid next year. Income Statement Wirl Wind Company Sales revenue $3,028,500 Less: Cost of goods sold Fixed costs 1,350,000 Variable costs 1,260,600 Gross profits $ 417,900 Less: Operating expenses Fixed expenses 4,500 85,840 Variable expenses Operating profits $327,560 Less: Interest expense 82,150 Net profits before taxes $245,410 Less: Taxes (40%) 98,164 Net profits after taxes $147,246 Less: Dividend 50,000 Increased retained earnings $ 97,246 In the preparation of a quarterly cash budget, the following revenue and cost information have been compiled. Prepare and evaluate a cash budget for the months of October, November, and December based on the information shown below. Month Sales Purchases $3,500,000 $3,000,000 $4,500,000 $2,000,000 August (actual) September (actual) October (forecast) November (forecast) $1,000,000 $ 500,000 $1,500,000 $ 750,000 December (forecast) $2,000,000 $1,000,000 The firm collects 50 percent of sales for cash and 50 percent of its sales one month later. Interest income of $50,000 on marketable securities will be received in December. The firm pays cash for 40 percent of its purchases. The firm pays for 60 percent of its purchases the following month. Salaries and wages amount to 15 percent of the preceding month's sales. Sales commissions amount to 2 percent of the preceding month's sales. Lease payments of $100,000 must be made each month. A principal and interest payment on an outstanding loan is due in December of $150,000. . The firm pays dividends of $50,000 at the end of the quarter. Fixed assets costing $600,000 will be purchased in December. Depreciation expense each month of $45,000. The firm has a beginning cash balance in October of $80,000 and maintains a minimum cash balance of $100,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started