Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Solve this asap In the 1980s, Bankers Trust developed index currency option notes (ICONs). These are bonds in which the amount received by the holder

Solve this asap

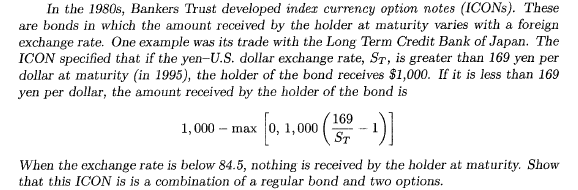

In the 1980s, Bankers Trust developed index currency option notes (ICONs). These are bonds in which the amount received by the holder at maturity varies with a foreign exchange rate. One example was its trade with the Long Term Credit Bank of Japan. The ICON specified that if the yen-U.S. dollar exchange rate, St, is greater than 169 yen per dollar at maturity (in 1995), the holder of the bond receives $1,000. If it is less than 169 yen per dollar, the amount received by the holder of the bond is 1,000 - max When the exchange rate is below 84.5, nothing is received by the holder at maturity. Show that this ICON is is a combination of a regular bond and two optionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started