Answered step by step

Verified Expert Solution

Question

1 Approved Answer

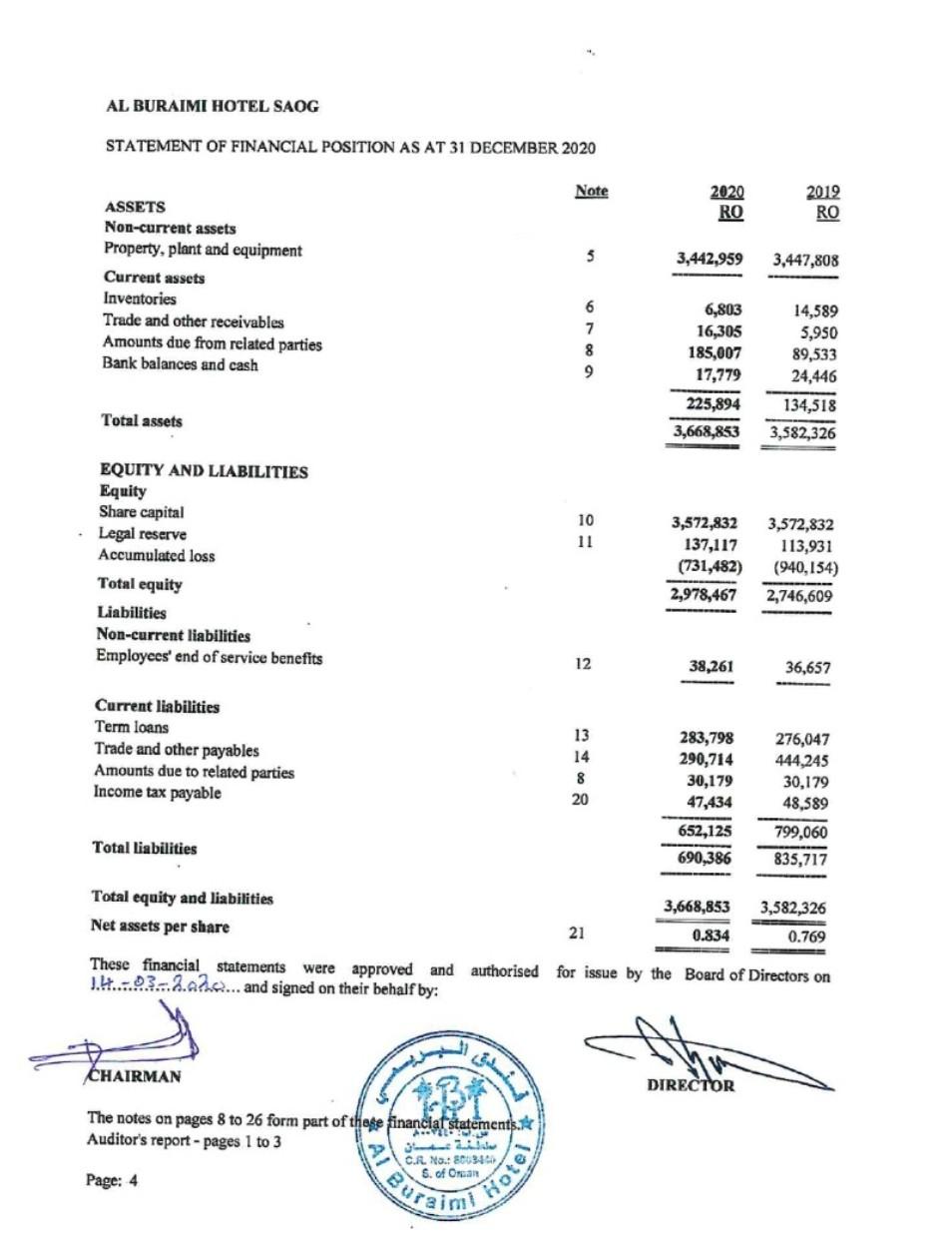

Solve this balance sheet by horizontal analysis AL BURAIMI HOTEL SAOG STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2020 Note 2020 RO 2012 RO

Solve this balance sheet by horizontal analysis

AL BURAIMI HOTEL SAOG STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2020 Note 2020 RO 2012 RO 3 3,442,959 3,447,808 ASSETS Non-current assets Property, plant and equipment Current assets Inventories Trade and other receivables Amounts due from related parties Bank balances and cash 6 7 8 9 6,803 16,305 185,007 17,779 225,894 3,668,853 14,589 5,950 89,533 24,446 134,518 3,582,326 Total assets 10 11 EQUITY AND LIABILITIES Equity Share capital Legal reserve Accumulated loss Total equity Liabilities Non-current liabilities Employees' end of service benefits 3,572,832 137,117 (731,482) 2,978,467 3,572,832 113,931 (940,154) 2,746,609 12 38,261 36,657 Current liabilities Term loans Trade and other payables Amounts due to related parties Income tax payable 13 14 8 20 283,798 290,714 30,179 47,434 652,125 690,386 276,047 444,245 30,179 48,589 799,060 835,717 Total liabilities Total equity and liabilities Net assets per share 3,668,853 0.834 3,582,326 0.769 21 These financial statements were approved and authorised for issue by the Board of Directors on J.H..03.-2.2.... and signed on their behalf by: CHAIRMAN DIRECTOR The notes on pages 8 to 26 form part of these financiat statements. Auditor's report - Pages 1 to 3 C.A. No.: 00340 6. of Oman Page: 4 ALB Botel CuraimStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started