Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Solve this please. #1 Garden Sales, Inc sells garden supplies. Management is planning its cash needs for the second quarter. The following information has been

Solve this please. #1

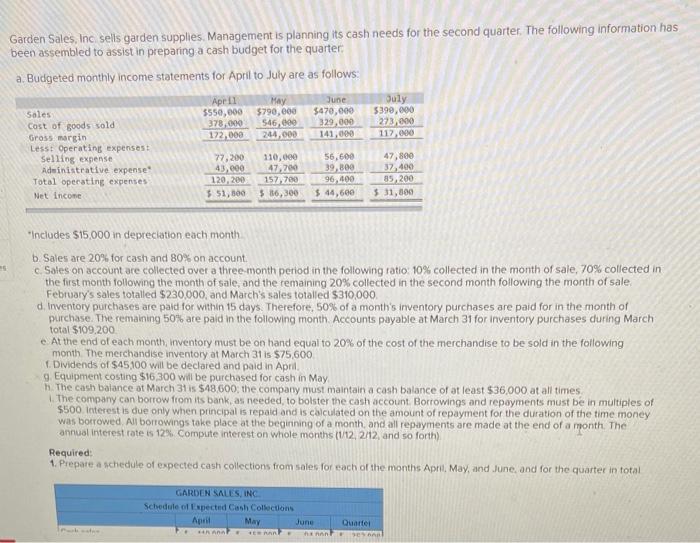

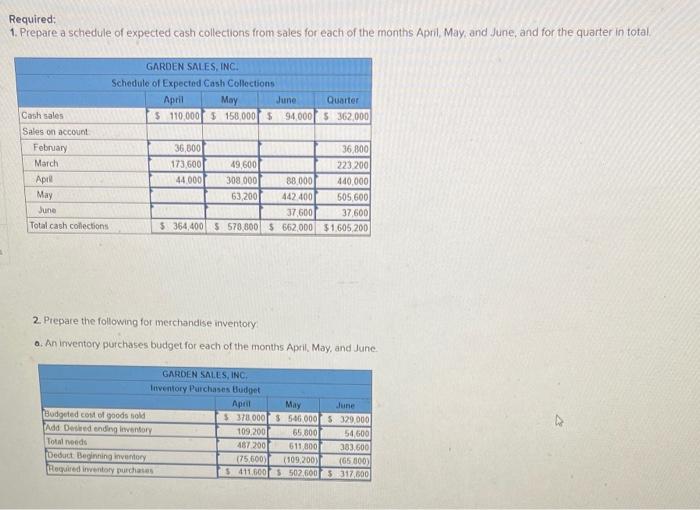

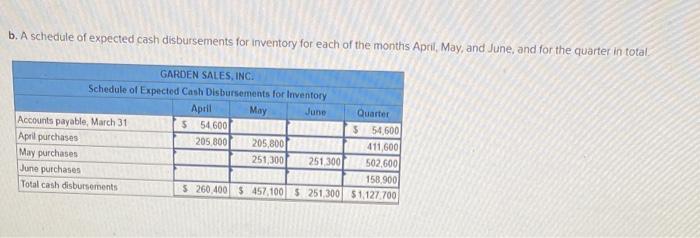

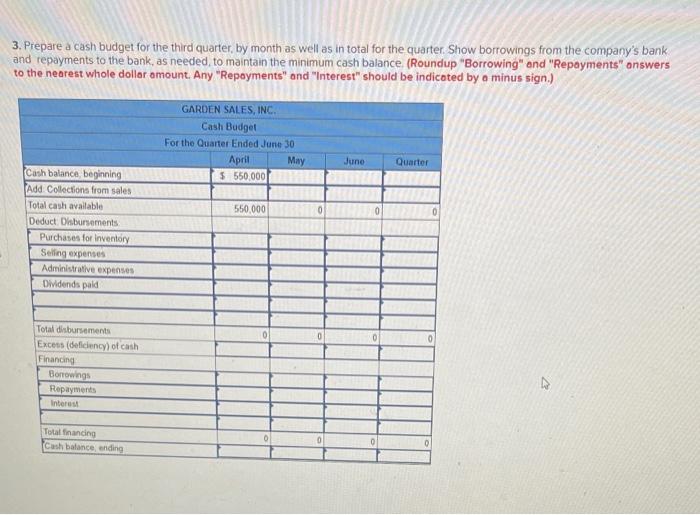

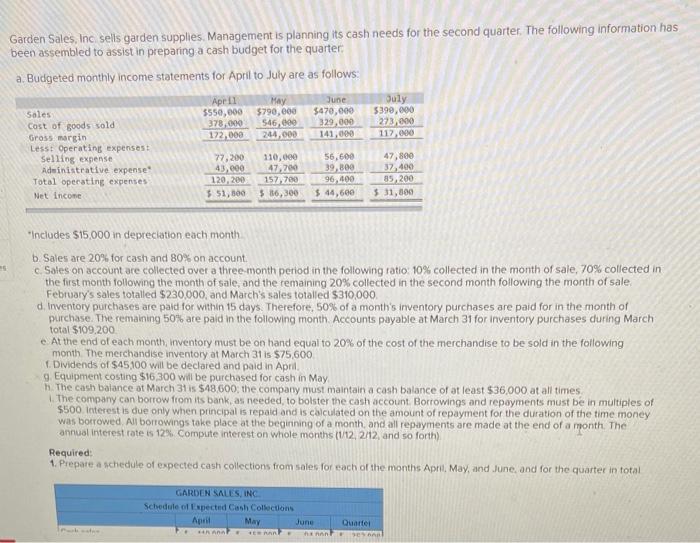

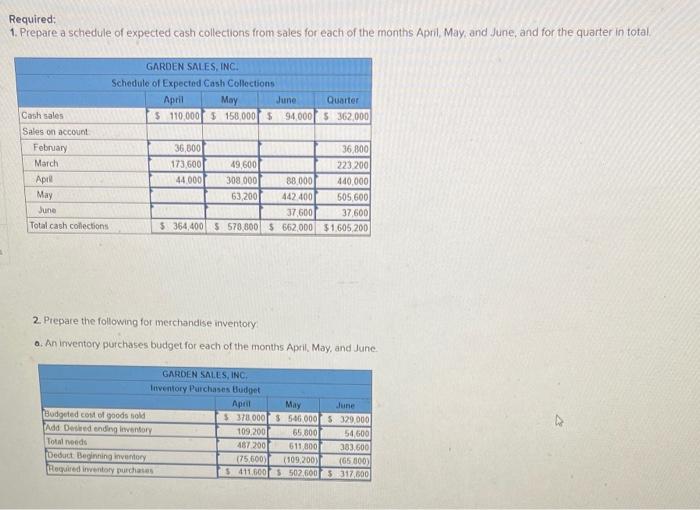

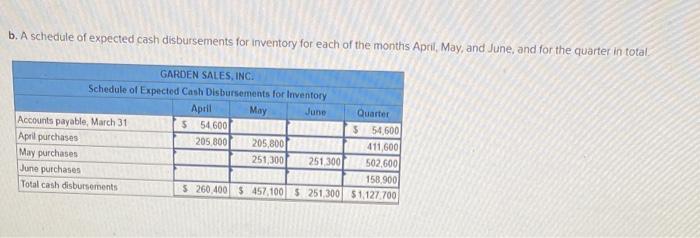

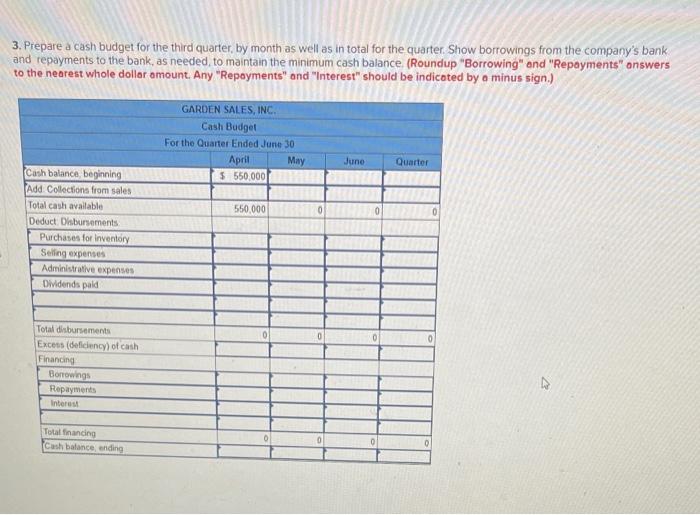

Garden Sales, Inc sells garden supplies. Management is planning its cash needs for the second quarter. The following information has been assembled to assist in preparing a cash budget for the quarter a. Budgeted monthly income statements for April to July are as follows: April May 3550,000 $790,000 378,000 546,200 172,000 244,000 June $470,000 329,000 141,000 July 5390,000 273,000 117,000 Soles Cost of goods sold Gross margin Lesst Operating expenses Selling expense Administrative expense" Total operating expenses Net Income 77,200 43,000 120200 $ 51,800 110,000 47,200 157.700 $ 16,300 56,600 39,800 96,400 $44,600 47,800 37,400 85,200 $ 31,800 Includes $15,000 in depreciation each month b. Sales are 20% for cash and 80% on account c Sales on account are collected over a three-month period in the following ratio: 10% collected in the month of sale, 70% collected in the first month following the month of sale, and the remaining 20% collected in the second month following the month of sale February's sales totalled $230,000, and March's sales totalled $310,000 d. Inventory purchases are paid for within 15 days. Therefore, 50% of a month's inventory purchases are paid for in the month of purchase. The remaining 50% are paid in the following month Accounts payable at March 31 for inventory purchases during March total $109,200 At the end of each month. Inventory must be on hand equal to 20% of the cost of the merchandise to be sold in the following month The merchandise inventory at March 31 is $75,600 Dividends of $45100 will be declared and paid in April 9 Equipment costing $16,300 will be purchased for cash in May n. The cash balance at March 31 is $48,600; the company must maintain a cash balance of at least $36,000 at all times The company can borrow from its bank, as needed to bolster the cash account Borrowings and repayments must be in multiples of $500 Interest is due only when principal is repaid and is calculated on the amount of repayment for the duration of the time money was borrowed All borrowings take place at the beginning of a month and all repayments are made at the end of a month. The annual interest rate is 12%. Compute interest on whole months (112. 2/12, and so forth) Required: 1. Prepare a schedule of expected cash collections from sales for each of the months April May, and June, and for the quarter in total GARDEN SALES, INC Schedule of Expected Cash Collections May June Ann **RARE nant Quarter sen Required: 1. Prepare a schedule of expected cash collections from sales for each of the months April May and June, and for the quarter in total, GARDEN SALES, INC. Schedule of Expected Cash Collections April May June Quarter Cash sales $ 110,000 $ 158,000 94.000 5 362.000 Sales on account February 36,800 36,800 March 173,600 49,600 223 200 April 44.000 308 000 88.000 440.000 May 63.200 442 400 505,600 June 37 6001 37 600 Total cash collections 5 364,400 5 578,800 $ 662.000 $1.605 200 2. Prepare the following for merchandise inventory o. An inventory purchases budget for each of the months April May, and June GARDEN SALES, INC Inventory Purchases Budget April May June Bodouted cost of goods told $ 378000 $ 546 0001 5 329.000 Add Desired ending inventory 109.2001 65,800 54,6001 Total needs 487 200 611 800 383.600 Deduct Beginning inventory (75.600) (109,200) (65 800) Required inventory purchases 5411600s 502.600 s 117.500 b. A schedule of expected cash disbursements for inventory for each of the months April May, and June, and for the quarter in total GARDEN SALES, INC. Schedule of Expected Cash Disbursements for Inventory April May June Quarter Accounts payable, March 31 5 54.600 5 54600 April purchases 205 8001 205,800 411,600 May purchases 251,300 251 300 502,600 June purchases 158.900 Total cash disbursements 5260.400 $ 457,100 $ 251 300 51,127 700 3. Prepare a cash budget for the third quarter, by month as well as in total for the quarter Show borrowings from the company's bank and repayments to the bank, as needed to maintain the minimum cash balance (Roundup "Borrowing" and "Repayments" answers to the nearest whole dollar amount. Any "Repayments" and "Interest" should be indicated by a minus sign.) GARDEN SALES, INC Cash Budget For the Quarter Ended June 30 April May $ 550.000 June Quarter 550.000 0 Canh balance beginning Add Collections from sales Total cash available Deduct Disbursements Purchases for inventory Selling expenses Administrative expenses Didends paid 0 0 Total disbursements Excess (deficiency of cash Financing Borrowings Repayments Interest Total financing Cash balance, ending 0 0 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started