Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Solve various time value of maney scenanoa (Click the icon to view the sctrarios) (Cick the icon to view the prosent value of 51 tabie)

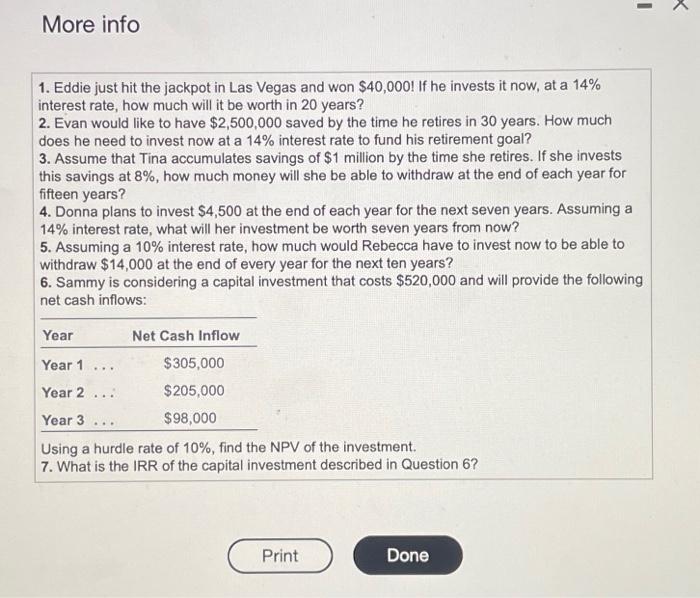

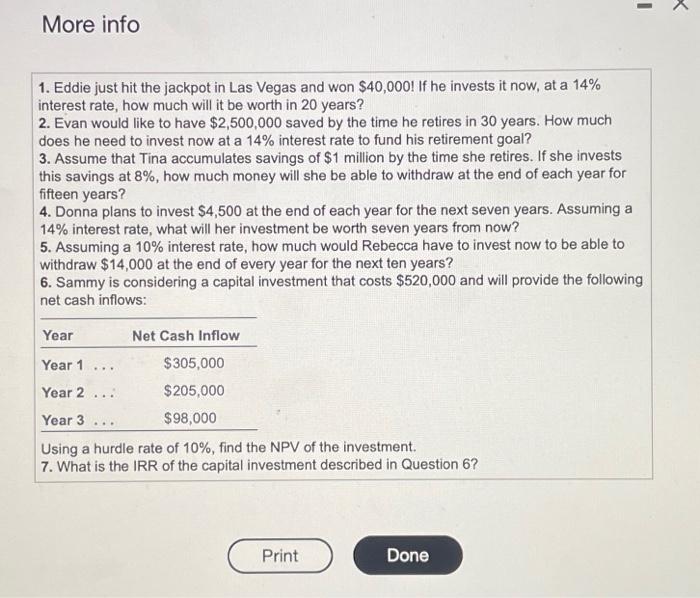

Solve various time value of maney scenanoa (Click the icon to view the sctrarios) (Cick the icon to view the prosent value of 51 tabie) (Cick the icon to view the present value of annuly of $1 table.) (Cick the icon to view the future value of \$1 thible.) (Cick the icon to view the fulure vialue of annulty of $1 table.) Scenarie 1. Edde just ht the jackpot in Las Vegas and won $40,000 it he invett a now, at a 14% interost rato, how much wil it be worth in 20 years? (Round your anawer to the nearest whole dollat) Fiture valuo = More info 1. Eddie just hit the jackpot in Las Vegas and won $40,000 I If he invests it now, at a 14% interest rate, how much will it be worth in 20 years? 2. Evan would like to have $2,500,000 saved by the time he retires in 30 years. How much does he need to invest now at a 14% interest rate to fund his retirement goal? 3. Assume that Tina accumulates savings of $1 million by the time she retires. If she invests this savings at 8%, how much money will she be able to withdraw at the end of each year for fifteen years? 4. Donna plans to invest $4,500 at the end of each year for the next seven years. Assuming a 14% interest rate, what will her investment be worth seven years from now? 5. Assuming a 10% interest rate, how much would Rebecca have to invest now to be able to withdraw $14,000 at the end of every year for the next ten years? 6. Sammy is considering a capital investment that costs $520,000 and will provide the following net cash inflows: Using a hurdle rate of 10%, find the NPV of the investment. 7. What is the IRR of the capital investment described in Question 6

Solve various time value of maney scenanoa (Click the icon to view the sctrarios) (Cick the icon to view the prosent value of 51 tabie) (Cick the icon to view the present value of annuly of $1 table.) (Cick the icon to view the future value of \$1 thible.) (Cick the icon to view the fulure vialue of annulty of $1 table.) Scenarie 1. Edde just ht the jackpot in Las Vegas and won $40,000 it he invett a now, at a 14% interost rato, how much wil it be worth in 20 years? (Round your anawer to the nearest whole dollat) Fiture valuo = More info 1. Eddie just hit the jackpot in Las Vegas and won $40,000 I If he invests it now, at a 14% interest rate, how much will it be worth in 20 years? 2. Evan would like to have $2,500,000 saved by the time he retires in 30 years. How much does he need to invest now at a 14% interest rate to fund his retirement goal? 3. Assume that Tina accumulates savings of $1 million by the time she retires. If she invests this savings at 8%, how much money will she be able to withdraw at the end of each year for fifteen years? 4. Donna plans to invest $4,500 at the end of each year for the next seven years. Assuming a 14% interest rate, what will her investment be worth seven years from now? 5. Assuming a 10% interest rate, how much would Rebecca have to invest now to be able to withdraw $14,000 at the end of every year for the next ten years? 6. Sammy is considering a capital investment that costs $520,000 and will provide the following net cash inflows: Using a hurdle rate of 10%, find the NPV of the investment. 7. What is the IRR of the capital investment described in Question 6

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started