Answered step by step

Verified Expert Solution

Question

1 Approved Answer

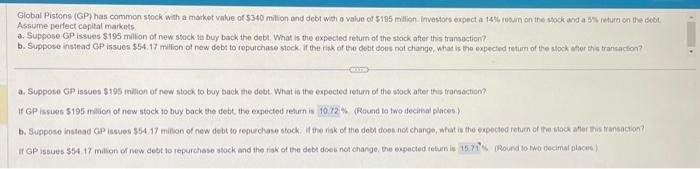

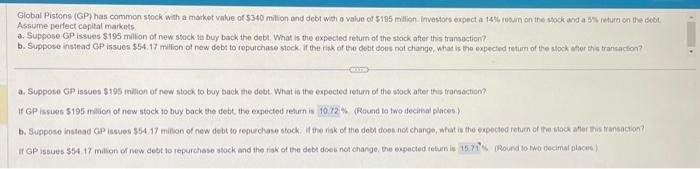

solve w work please Assume perfect copital markets. a. Suppose GP issues $195 million of new stock lo buy back the debt What is the

solve w work please

Assume perfect copital markets. a. Suppose GP issues $195 million of new stock lo buy back the debt What is the expected return of the stock after this transaction? b. Suppose instead GP issues $54,17 milion of new debt to repurchase stock. if the rikk of the dobt does not change, what is the expected return of the slock efier this transacton? a. Suppose GP issues $195 milion of new stock to buy back the debt. What is the expected refurn of thie wook after this fransaction? If GP issues 5195 milion of new stock to buy back the debt, the expected rehurn is 10.72% (Reund bo two decimal places.) If GP issues $54,17 milion of new debt to repurchese sfock and the risk of the debt does not change. Dhe expacted tetum in 4. QRound to the decimal placee)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started