Answered step by step

Verified Expert Solution

Question

1 Approved Answer

( Solving a comprehensive problem ) Use the end - of - year stock price data in the popup window, , to answer the following

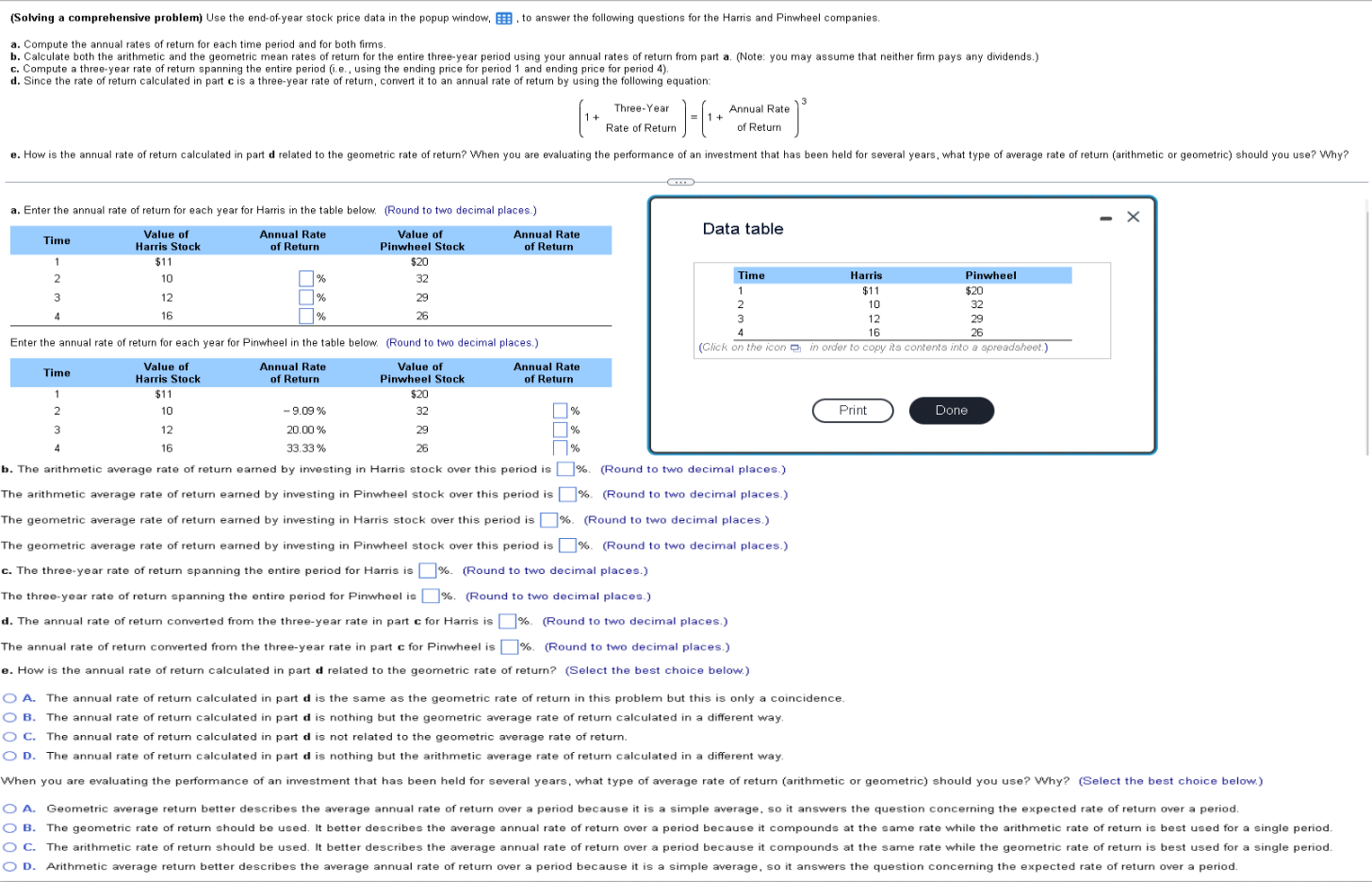

Solving a comprehensive problem Use the endofyear stock price data in the popup window, to answer the following questions for the Harris and Pinwheel companies.

a Compute the annual rates of return for each time period and for both firms.

b Calculate both the arithmetic and the geometric mean rates of return for the entire threeyear period using your annual rates of return from part aNote: you may assume that neither firm pays any dividends.

c Compute a threeyear rate of return spanning the entire period ie using the ending price for period and ending price for period

d Since the rate of retum calculated in part is a threeyear rate of return, convert it to an annual rate of retum by using the following equation:

ThreeYear Rate Return Annual Rate Return

a Enter the annual rate of retum for each year for Harris in the table below. Round to two decimal places.

Enter the annual rate of return for each year for Pinwheel in the table below. Round to two decimal places.

Data table

b The arithmetic average rate of return eamed by investing in Harris stock over this period is

The arithmetic average rate of return earned by investing in Pinwheel stock over this period is

Round to two decimal places.

The geometric average rate of return earned by investing in Harris stock over this period is

Round to two decimal places.

The geometric average rate of return earned by investing in Pinwheel stock over this period is

Round to two decimal places.

c The threeyear rate of return spanning the entire period for Harris is

Round to two decimal places.

The threeyear rate of return spanning the entire period for Pinwheel is

d The annual rate of return converted from the threeyear rate in part for Harris is

The annual rate of return converted from the threeyear rate in part for Pinwheel is

Round to two decimal places.

e How is the annual rate of return calculated in part d related to the geometric rate of return? Select the best choice below.

A The annual rate of return calculated in part is the same as the geometric rate of return in this problem but this is only a coincidence.

B The annual rate of return calculated in part is nothing but the geometric average rate of return calculated in a different way.

C The annual rate of return calculated in part is not related to the geometric average rate of return.

D The annual rate of return calculated in part is nothing but the arithmetic average rate of return calculated in a different way.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started