Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Solving the following questions below for the attach cased study: Questions: Briefly discuss the key drivers of the growth in green bonds. (4 marks) Recently,

Solving the following questions below for the attach cased study:

Questions:

- Briefly discuss the key drivers of the growth in green bonds. (4 marks)

- Recently, the green bond index has been well-established. The introduction of an index will deepen the investor base. Do you agree? Justify your answer.

- Bond quotes have become more available with the rise of the internet. We got the above information about the bond issued by Microsoft Corp from finra-markets.morningstar.com. Microsoft Corp has a coupon rate of 5.2% and matures on 06.01.2039. the last sale on this bond was at a price of $128.79. Briefly discuss why Microsoft Corp sold this bond at a premium.

- Discuss the implications of an expected increase in yield to maturity on Microsoft Corp bond pricing.

- Taking the two scenarios in C and D above, calculate the interest rate risk and explain why companies like Microsoft Corp issue bonds with longer maturity.

- Briefly discuss the importance of credit and rating element information of Microsoft Corp above and the implication of lowering the company's bond rating?

- State clearly any assumptions that you made in your calculation

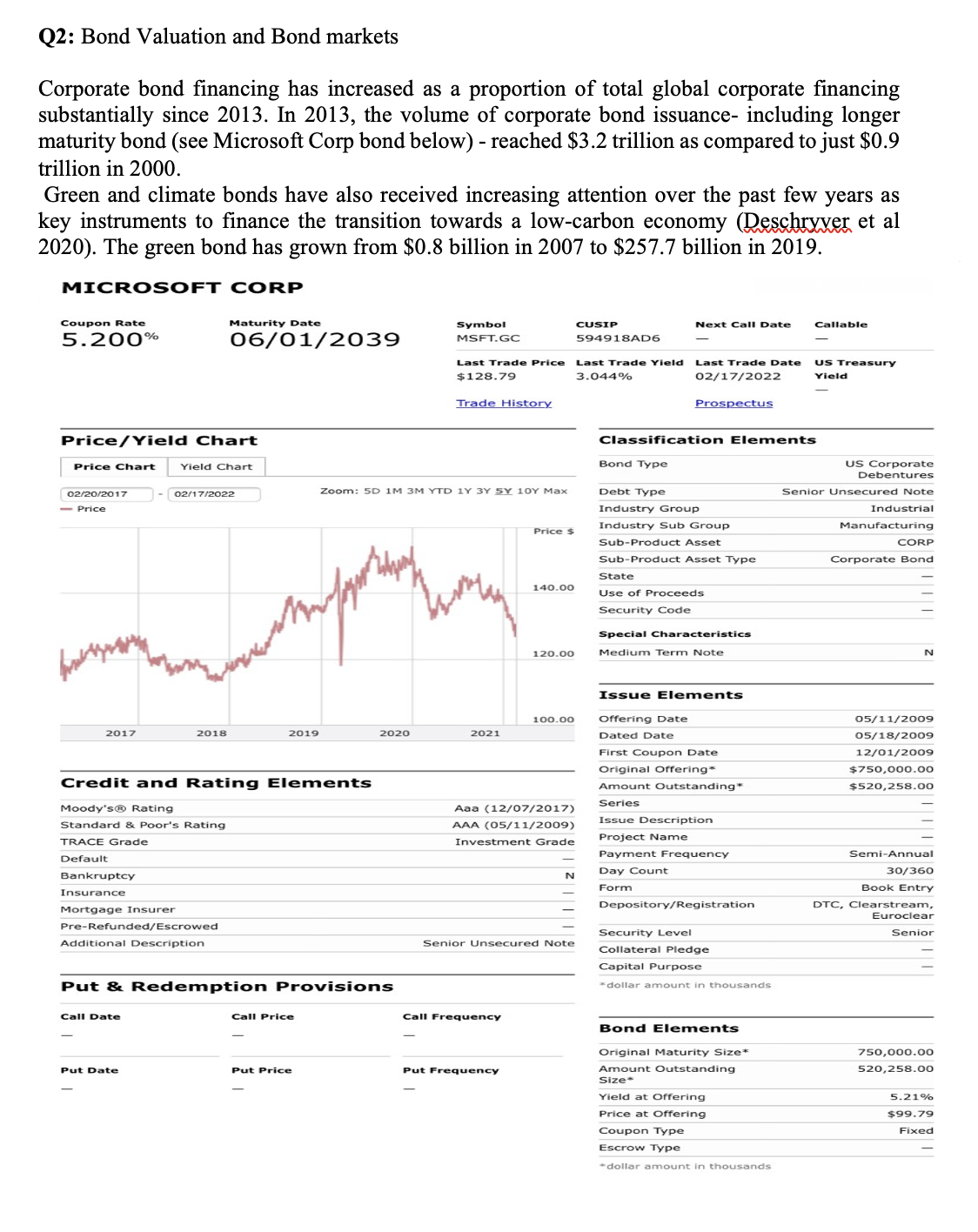

Q2: Bond Valuation and Bond markets Corporate bond financing has increased as a proportion of total global corporate financing substantially since 2013. In 2013, the volume of corporate bond issuance- including longer maturity bond (see Microsoft Corp bond below) - reached $3.2 trillion as compared to just $0.9 trillion in 2000. Green and climate bonds have also received increasing attention over the past few years as key instruments to finance the transition towards a low-carbon economy (Deschryver et al 2020). The green bond has grown from $0.8 billion in 2007 to $257.7 billion in 2019. MICROSOFT CORP Coupon Rate 5.200% Price/Yield Chart Price Chart 02/20/2017 -Price 2017 - Yield Chart Bankruptcy Insurance Mortgage Insurer Pre-Refunded/Escrowed Call Date Maturity Date 06/01/2039 02/17/2022 2018 Additional Description Credit and Rating Elements Moody's Rating Standard & Poor's Rating TRACE Grade Default Put Date 2019 Put & Redemption Provisions Call Price Put Price 2020 Symbol MSFT.GC Last Trade Price Zoom: 5D 1M 3M YTD 1Y 3Y SY 10Y Max $128.79 Trade History 2021 Price $ 140.00 Call Frequency 120.00 Aaa (12/07/2017) AAA (05/11/2009) Put Frequency 100.00 Investment Grade Senior Unsecured Note N CUSIP Last Trade Yield 3.044% 594918AD6 Bond Type Next Call Date Last Trade Date 02/17/2022 Prospectus Classification Elements Debt Type Industry Group Industry Sub Group Sub-Product Asset Sub-Product Asset Type State Use of Proceeds Security Code Special Characteristics Medium Term Note Issue Elements Offering Date Dated Date First Coupon Date Day Count Form Original Offering* Amount Outstanding* Series Issue Description Project Name Payment Frequency Depository/Registration Security Level Collateral Pledge Capital Purpose *dollar amount in thousands Bond Elements Original Maturity Size* Amount Outstanding Size* Yield at Offering Price at Offering Callable Coupon Type Escrow Type *dollar amount in thousands US Treasury Yield US Corporate Debentures Senior Unsecured Note Industrial Manufacturing CORP Corporate Bond N 05/11/2009 05/18/2009 12/01/2009 $750,000.00 $520,258.00 Semi-Annual 30/360 Book Entry DTC, Clearstream, Euroclear Senior 750,000.00 520,258.00 5.21% $99.79 Fixed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION Q1 Briefly discuss the key drivers of the growth in green bonds 4 marks The growth in green bonds can be attributed to several key drivers including 1 Increased investor demand for sustainabl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started