Question

Some financial information about Retail Inc. and Store Inc. is given below: You are asked to analyze these companies and specifically analyze the impact of

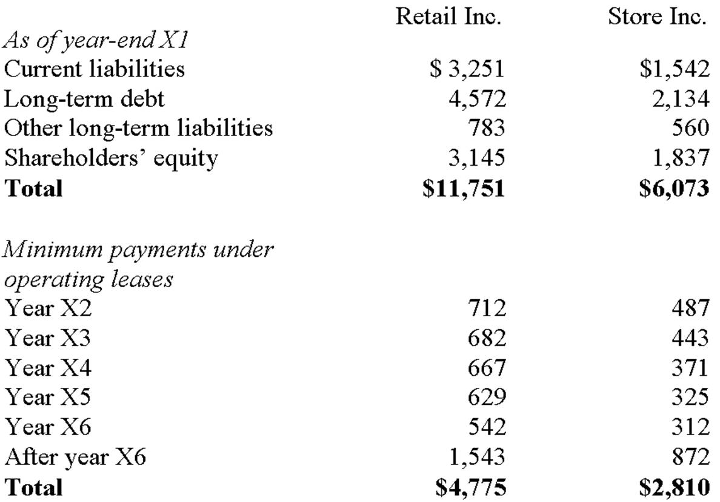

Some financial information about Retail Inc. and Store Inc. is given below: You are asked to analyze these companies and specifically analyze the impact of the leases on different financial ratios. a. Compute the present value of the lease obligations for Retail Inc. using an annual interest rate of 8%. You should assume all payments are made at the end of the year, and all payments after year X6 are equal to the payment in year X6. b. Compute the present value of the lease obligations for Stores Inc. using an annual interest rate of 8%. You should assume all payments are made at the end of the year, and all payments after year X6 are equal to the payment in year X6. c. Compute the total liabilities to asset ratio and the long-term debt to assets ratio for Retail Inc. for the end of year X1. d. Compute the total liabilities to asset ratio and the long-term debt to assets ratio for Stores Inc. for the end of year X1. e. Repeat c and d and compute the total liabilities to asset ratio and the long-term debt to assets ratio for both companies for the end of year X1 assuming the companies capitalize the leases.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started