Answered step by step

Verified Expert Solution

Question

1 Approved Answer

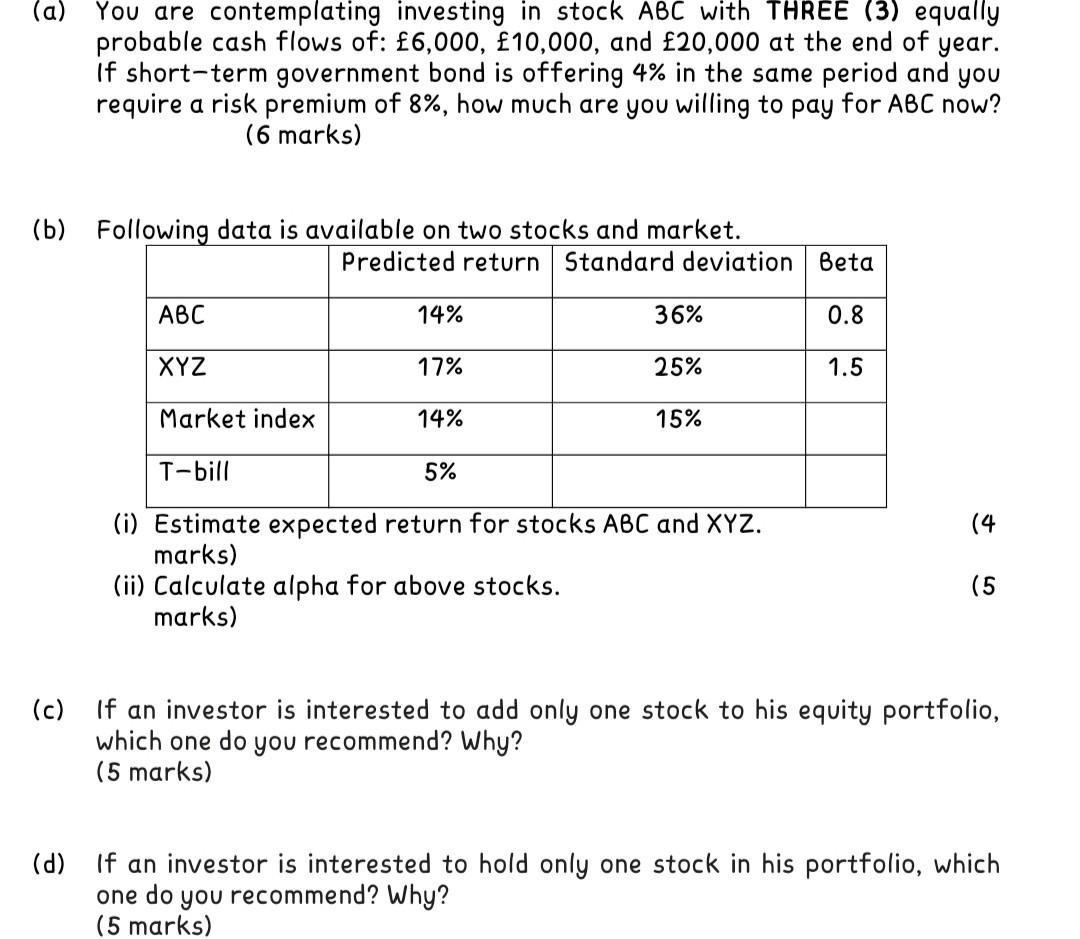

some plz answer this one (a) You are contemplating investing in stock ABC with THREE (3) equally probable cash flows of: 6,000, 10,000, and 20,000

some plz answer this one

(a) You are contemplating investing in stock ABC with THREE (3) equally probable cash flows of: 6,000, 10,000, and 20,000 at the end of year. If short-term government bond is offering 4% in the same period and you require a risk premium of 8%, how much are you willing to pay for ABC now? (6 marks) (b) Following data is available on two stocks and market. Predicted return Standard deviation Beta ABC 14% 36% 0.8 XYZ 17% 25% 1.5 Market index 14% 15% T-bill 5% (4 (i) Estimate expected return for stocks ABC and XYZ. marks) (ii) Calculate alpha for above stocks. marks) (5 (c) If an investor is interested to add only one stock to his equity portfolio, which one do you recommend? Why? (5 marks) (d) If an investor is interested to hold only one stock in his portfolio, which one do you recommend? WhyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started