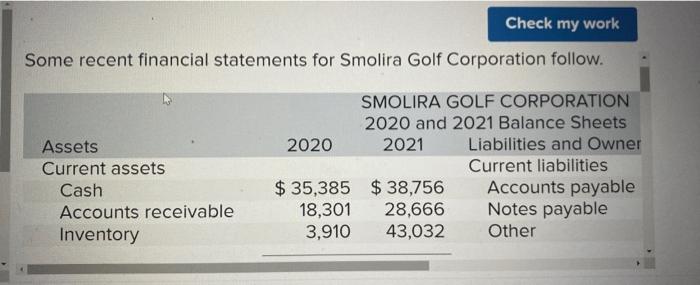

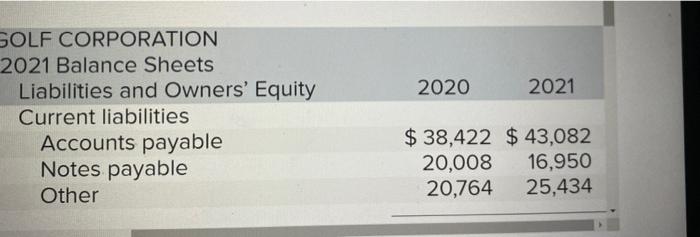

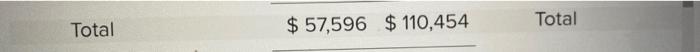

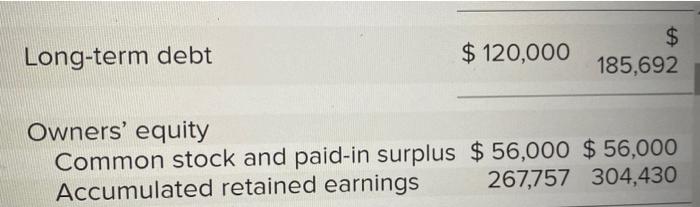

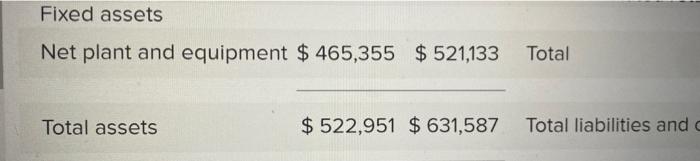

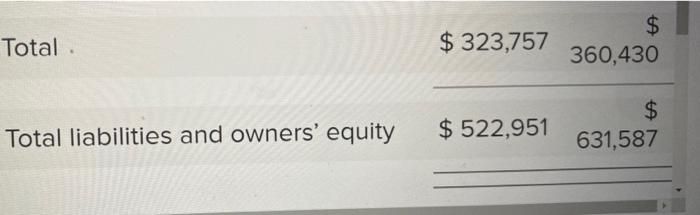

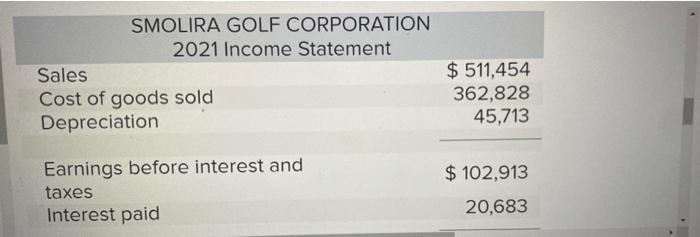

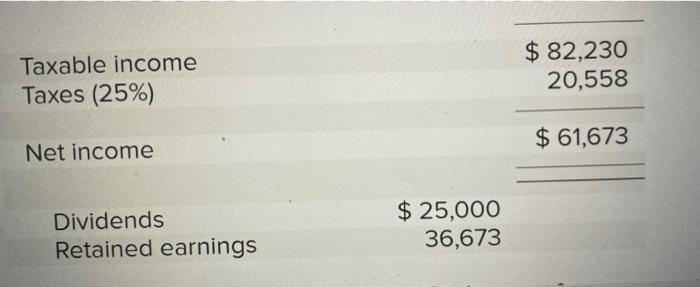

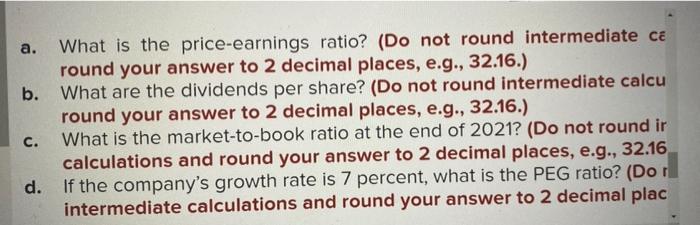

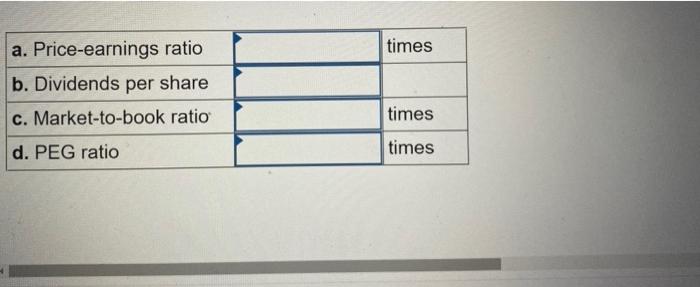

Some recent financial statements for Smolira Golf Corporation follow. SOLF CORPORATION 2021 Balance Sheets \begin{tabular}{lrr} Liabilities and Owners' Equity & 2020 & 2021 \\ \hline Current liabilities & & \\ Accounts payable & $38,422 & $43,082 \\ Notes payable & 20,008 & 16,950 \\ Other & 20,764 & 25,434 \\ \hline \end{tabular} Total $57,596$110,454 Total Total $79,194$85,466 Long-term debt $120,000$185,692 Owners' equity Common stock and paid-in surplus \$56,000 \$56,000 Accumulated retained earnings 267,757304,430 Fixed assets Net plant and equipment \$465,355 \$521,133 Total Total assets $522,951$631,587 Total liabilities and c \begin{tabular}{lrr} Total & $323,757 & $ \\ & & $60,430 \\ \cline { 3 } & & $ \\ Total liabilities and owners' equity & $522,951 & 631,587 \\ \hline \end{tabular} \begin{tabular}{lr} \multicolumn{2}{c}{ SMOLIRA GOLF CORPORATION } \\ \multicolumn{2}{c}{2021 Income Statement } \\ Sales & $511,454 \\ Cost of goods sold & 362,828 \\ Depreciation & 45,713 \\ \hline Earnings before interest and & $102,913 \\ taxes & 20,683 \\ Interest paid & \end{tabular} Smolira Golf Corporation has 50,000 shares of common stock outsta market price for a share of stock at the end of 2021 was $30. a. What is the price-earnings ratio? (Do not round intermediate ce round your answer to 2 decimal places, e.g., 32.16.) b. What are the dividends per share? (Do not round intermediate calcu round your answer to 2 decimal places, e.g., 32.16.) c. What is the market-to-book ratio at the end of 2021? (Do not round ir calculations and round your answer to 2 decimal places, e.g., 32.16 d. If the company's growth rate is 7 percent, what is the PEG ratio? (Do i intermediate calculations and round your answer to 2 decimal plac ice-earnings ratio? (Do not round intermediate calculations and wer to 2 decimal places, e.g., 32.16.) jidends per share? (Do not round intermediate calculations and wer to 2 decimal places, e.g., 32.16.) ket-to-book ratio at the end of 2021 ? (Do not round intermediate d round your answer to 2 decimal places, e.g., 32.16.) 5 growth rate is 7 percent, what is the PEG ratio? (Do not round Ilculations and round your answer to 2 decimal places, e.g., 32.16.) \begin{tabular}{|l|l|l|} \hline a. Price-earnings ratio & & times \\ \hline b. Dividends per share & & \\ \hline c. Market-to-book ratio & & times \\ \hline d. PEG ratio & & times \\ \hline \end{tabular}