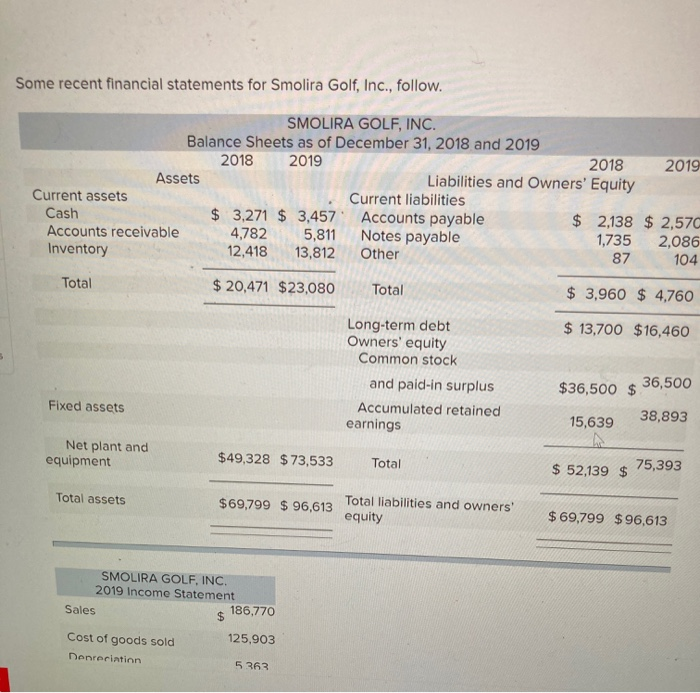

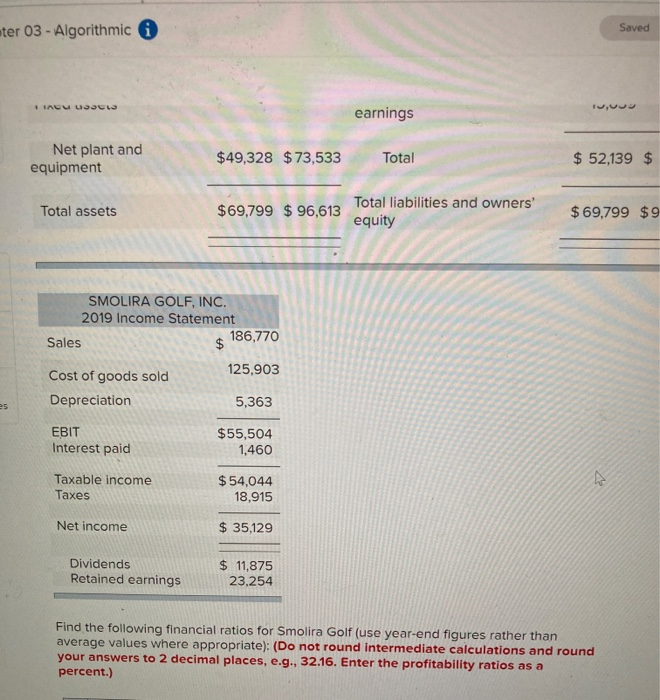

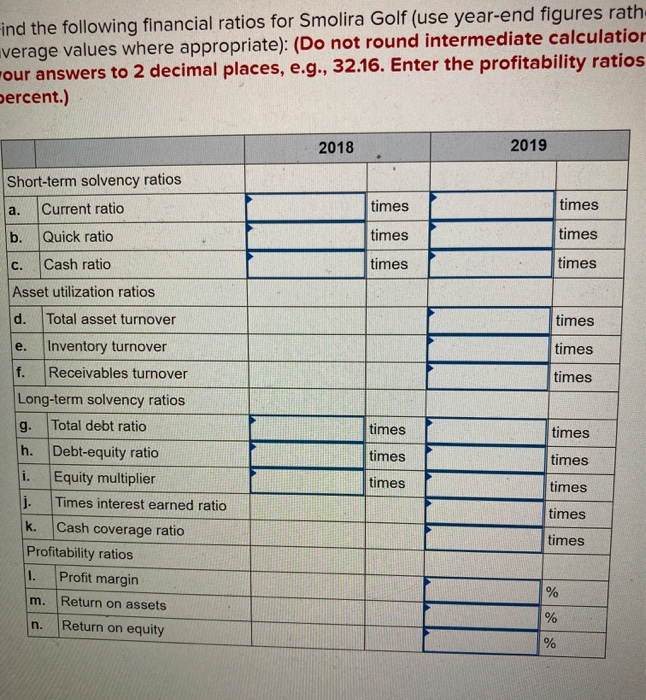

Some recent financial statements for Smolira Golf, Inc., follow. SMOLIRA GOLF, INC. Balance Sheets as of December 31, 2018 and 2019 2018 2019 2018 2019 Assets Liabilities and Owners' Equity Current assets Current liabilities Cash $ 3,271 $ 3,457 Accounts payable $ 2,138 $ 2,57C Accounts receivable 4,782 5,811 Notes payable 1,735 2,086 Inventory 12,418 13,812 Other 87 104 Total $ 20,471 $23,080 Total $ 3,960 $ 4,760 $ 13,700 $16,460 Long-term debt Owners' equity Common stock and paid-in surplus Accumulated retained earnings $36,500 $ 36,500 Fixed assets 15,639 38,893 Net plant and equipment $49,328 $ 73,533 Total $ 52,139 $ 75,393 Total assets $69,799 $ 96,613 Total liabilities and owners' equity $69,799 $ 96,613 SMOLIRA GOLF, INC. 2019 Income Statement Sales 186,770 $ 125,903 Cost of goods sold Depreciation 5 363 ter 03 - Algorithmic i Saved IACUUSSELS earnings Net plant and equipment $49,328 $ 73,533 Total $ 52,139 $ Total assets $69,799 $ 96,613 Total liabilities and owners' equity $ 69,799 $9 SMOLIRA GOLF, INC. 2019 Income Statement Sales $ 186,770 Cost of goods sold 125,903 Depreciation 5,363 es EBIT Interest paid $55,504 1,460 Taxable income Taxes $ 54,044 18,915 Net income $ 35,129 Dividends Retained earnings $ 11,875 23,254 Find the following financial ratios for Smolira Golf (use year-end figures rather than average values where appropriate): (Do not round Intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. Enter the profitability ratios as a percent.) Find the following financial ratios for Smolira Golf (use year-end figures rath verage values where appropriate): (Do not round intermediate calculatior Four answers to 2 decimal places, e.g., 32.16. Enter the profitability ratios percent.) 2018 2019 Short-term solvency ratios a. Current ratio times times b. Quick ratio times times C. Cash ratio times times Asset utilization ratios times times times times times times times d. Total asset turnover e. Inventory turnover f. Receivables turnover Long-term solvency ratios g. Total debt ratio h. Debt-equity ratio i. Equity multiplier j. Times interest earned ratio k. Cash coverage ratio Profitability ratios 1. Profit margin m. Return on assets Return on equity times times times times % %