Someone got this?

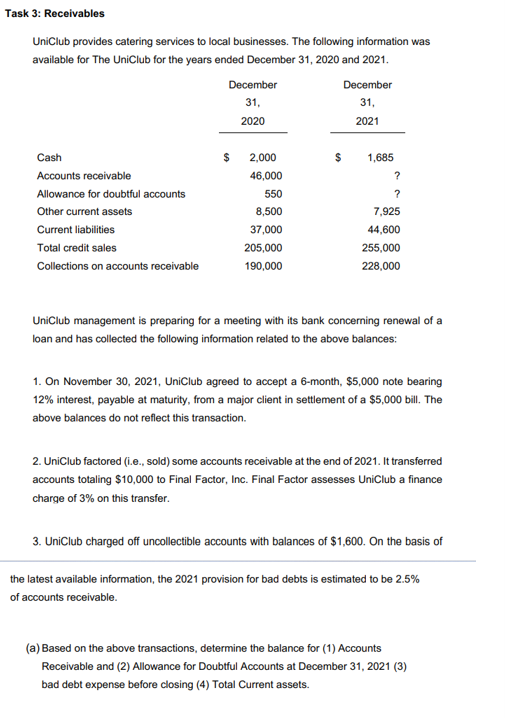

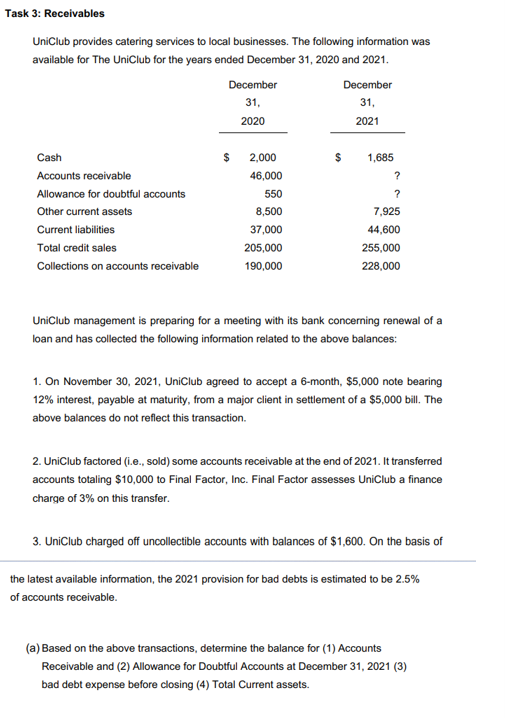

ask 3: Receivables UniClub provides catering services to local businesses. The following information was available for The UniClub for the years ended December 31, 2020 and 2021. UniClub management is preparing for a meeting with its bank concerning renewal of a loan and has collected the following information related to the above balances: 1. On November 30, 2021, UniClub agreed to accept a 6-month, $5,000 note bearing 12% interest, payable at maturity, from a major client in settlement of a $5,000 bill. The above balances do not reflect this transaction. 2. UniClub factored (i.e., sold) some accounts receivable at the end of 2021. It transferred accounts totaling $10,000 to Final Factor, Inc. Final Factor assesses UniClub a finance charge of 3% on this transfer. 3. UniClub charged off uncollectible accounts with balances of $1,600. On the basis of the latest available information, the 2021 provision for bad debts is estimated to be 2.5% of accounts receivable. (a) Based on the above transactions, determine the balance for (1) Accounts Receivable and (2) Allowance for Doubtful Accounts at December 31, 2021 (3) bad debt expense before closing (4) Total Current assets. ask 3: Receivables UniClub provides catering services to local businesses. The following information was available for The UniClub for the years ended December 31, 2020 and 2021. UniClub management is preparing for a meeting with its bank concerning renewal of a loan and has collected the following information related to the above balances: 1. On November 30, 2021, UniClub agreed to accept a 6-month, $5,000 note bearing 12% interest, payable at maturity, from a major client in settlement of a $5,000 bill. The above balances do not reflect this transaction. 2. UniClub factored (i.e., sold) some accounts receivable at the end of 2021. It transferred accounts totaling $10,000 to Final Factor, Inc. Final Factor assesses UniClub a finance charge of 3% on this transfer. 3. UniClub charged off uncollectible accounts with balances of $1,600. On the basis of the latest available information, the 2021 provision for bad debts is estimated to be 2.5% of accounts receivable. (a) Based on the above transactions, determine the balance for (1) Accounts Receivable and (2) Allowance for Doubtful Accounts at December 31, 2021 (3) bad debt expense before closing (4) Total Current assets