Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Someone other than who keeps answering incomplete please 1. Suppose that Bank A is offering the following deposit and mortgage rates to their customers: Maturity

Someone other than who keeps answering incomplete please

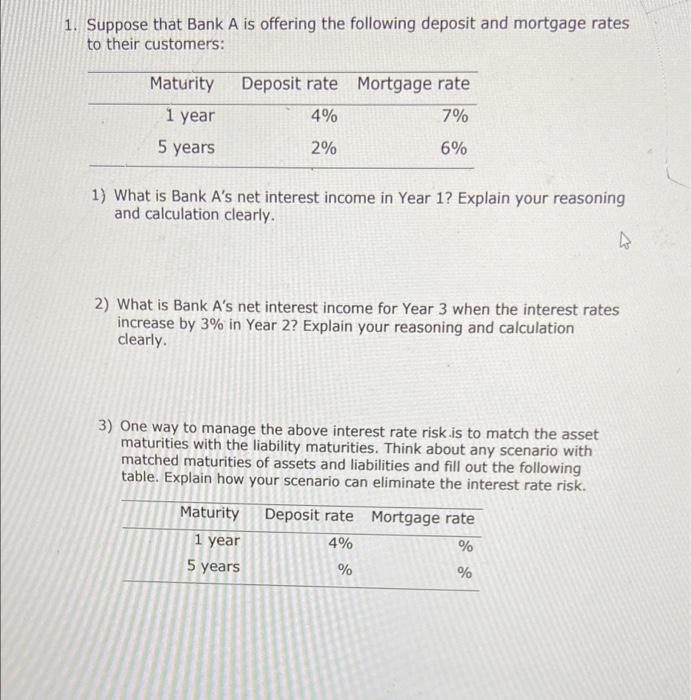

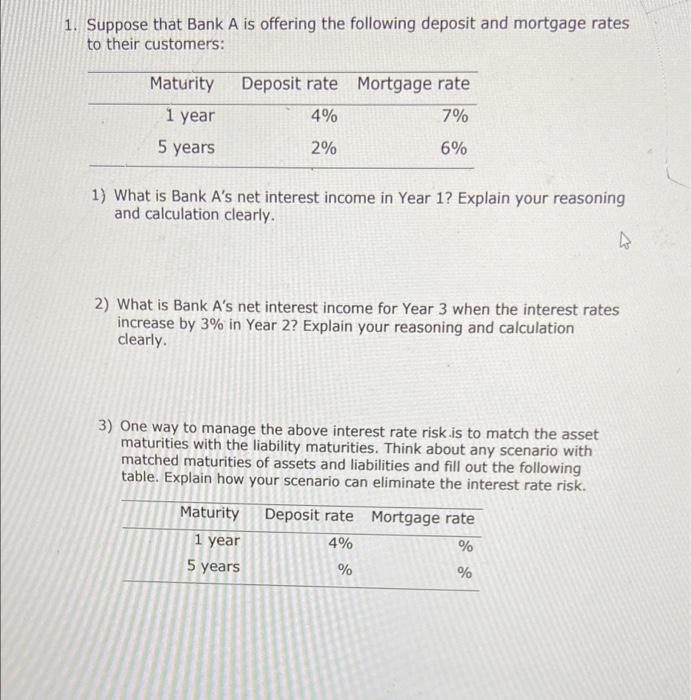

1. Suppose that Bank A is offering the following deposit and mortgage rates to their customers: Maturity Deposit rate Mortgage rate 1 year 4% 7% 5 years 2% 6% 1) What is Bank A's net interest income in Year 1? Explain your reasoning and calculation clearly. 2) What is Bank A's net interest income for Year 3 when the interest rates increase by 3% in Year 2? Explain your reasoning and calculation clearly 3) One way to manage the above interest rate risk is to match the asset maturities with the liability maturities. Think about any scenario with matched maturities of assets and liabilities and fill out the following table. Explain how your scenario can eliminate the interest rate risk. Maturity Deposit rate Mortgage rate 1 year 4% % 5 years % %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started