Answered step by step

Verified Expert Solution

Question

1 Approved Answer

someone, please teach me the answers... it's too hard for me(T-T) it's from using sage 50 accounting , and if you need more infomation,i can

someone, please teach me the answers...

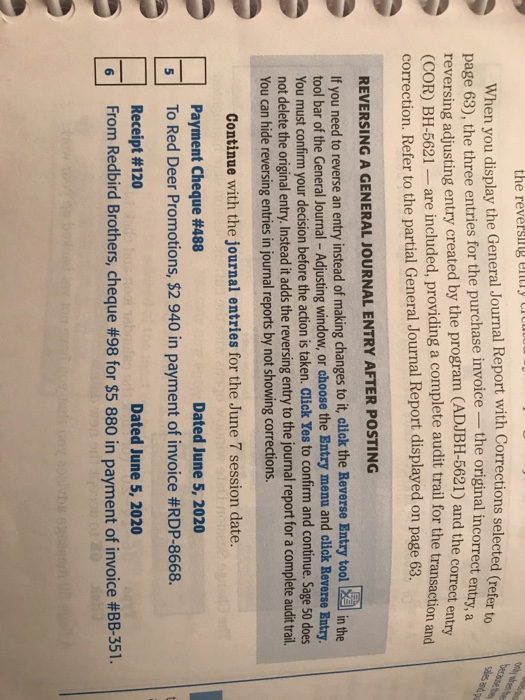

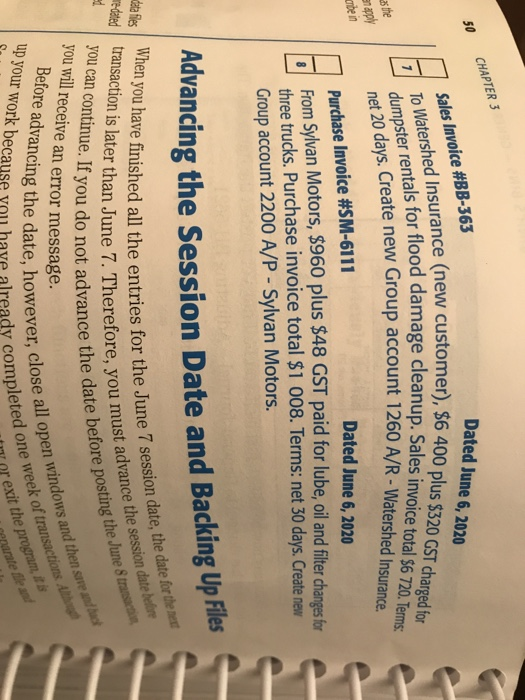

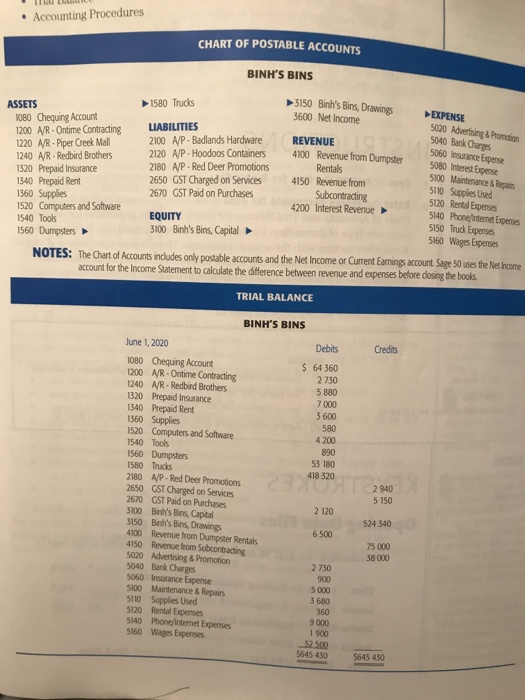

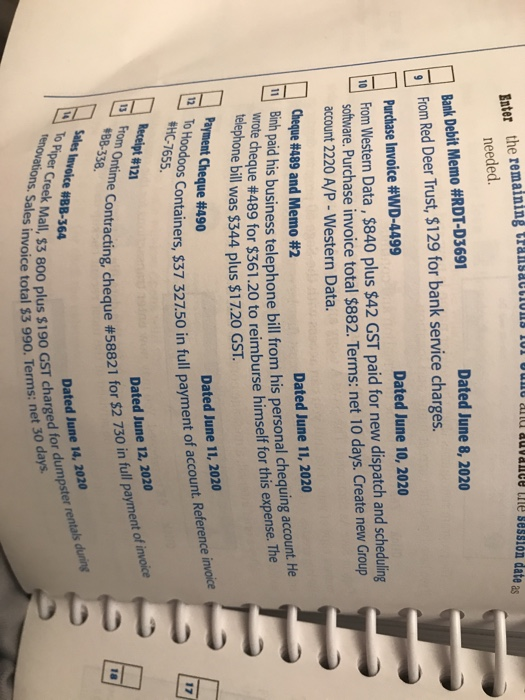

the reversing ently ICU When you display the General Journal Report with Corrections selected (refer to page 63), the three entries for the purchase invoice the original incorrect entry, a reversing adjusting entry created by the program (ADJBH-5621) and the correct entry (COR) BH-5621 - are included, providing a complete audit trail for the transaction and correction. Refer to the partial General Journal Report displayed on page 63. in the REVERSING A GENERAL JOURNAL ENTRY AFTER POSTING If you need to reverse an entry instead of making changes to it, click the Reverse Entry tool tool bar of the General Journal - Adjusting window, or choose the Entry menu and click Reverse Entry You must confirm your decision before the action is taken. Click Yes to confirm and continue. Sage 50 does not delete the original entry. Instead it adds the reversing entry to the journal report for a complete audit trail. You can hide reversing entries in journal reports by not showing corrections. Continue with the journal entries for the June 7 session date. Payment Cheque #488 Dated June 5, 2020 To Red Deer Promotions, $2 940 in payment of invoice #RDP-8668. Receipt #120 Dated June 5, 2020 From Redbird Brothers, cheque #98 for $5 880 in payment of invoice #BB-351. CHAPTER 3 50 Dated June 6, 2020 Sales Invoice #BB-363 #the an apply wie in Purchase Invoice #SM-6111 Dated June 6, 2020 From Sylvan Motors, $960 plus $48 GST paid for lube, oil and filter changes for three trucks. Purchase invoice total $1 008. Terms: net 30 days. Create new Group account 2200 A/P - Sylvan Motors. Advancing the Session Date and Backing Up Files data files ed you will receive an error message. up your work because you hay exit the program, it is To Watershed Insurance (new customer), $6 400 plus $320 GST charged for dumpster rentals for flood damage cleanup. Sales invoice total $6 720. Terms: When you have finished all the entries for the June 7 session date, the date for the next redated transaction is later than June 7. Therefore, you must advance the session date before you can continue. If you do not advance the date before posting the June 8 trans Before advancing the date, however, close all open windows and then sure and fast net 20 days. Create new Group account 1260 A/R - Watershed Insurance. already completed one week of transactions the Accounting Procedures CHART OF POSTABLE ACCOUNTS BINH'S BINS Im Dumper ASSETS 1580 Trucks 3150 Binh's Bins, Drawings 1080 Chequing Account 3600 Net Income LIABILITIES 1200 AR- Ontime Contracting 1220 AR-Piper Creek Mall 2100 A/P - Badlands Hardware REVENUE 1240 AVR - Redbird Brothers 2120 A/P - Hoodoos Containers 4100 Revenue from Dumpster 1320 Prepaid Insurance 2180 A/P - Red Deer Promotions Rentals 1340 Prepaid Rent 2650 GST Charged on Services 4150 Revenue from 1360 Supplies 2670 GST Paid on Purchases Subcontracting 1520 Computers and Software 4200 Interest Revenue 1540 Tools EQUITY 1560 Dumpsters 3100 Binh's Bins, Capital NOTES: The Chart of Accounts indudes only postable accounts and the Net Income or Current Earnings account Sage 50 uses the Net Income account for the Income Statement to calculate the difference between revenue and expenses before dosing the books. TRIAL BALANCE EXPENSE 5020 Advertising & Promotion 5040 Bank Charges 5060 Insurance Expense 5080 Interest Expense 5100 Maintenance & Repairs 5110 Supplies Used 5120 Rental Expenses 5140 Phone Internet Expenses 5150 Truck Expenses 5160 Wages Expenses BINH'S BINS Debits Credits $ 64 360 2730 5880 7 000 3 600 580 4200 890 53 180 418 320 June 1, 2020 1080 Chequing Account 1200 A/R - Ontime Contracting 1240 A/R - Redbird Brothers 1320 Prepaid Insurance 1340 Prepaid Rent 1360 Supplies 1520 Computers and Software 1540 Tools 1560 Dumpsters 1580 Trucks 2180 A/P - Red Deer Promotions 2650 GST Charged on Services 2670 GST Paid on Purchases 3100 Binh's Bins, Capital 3150 Binh's Bins, Drawings 4100 Revenue from Dumpster Rentals 4150 Revenue from Subcontracting 5020 Advertising & Promotion 5040 Bark Charges 5060 Insurance Expense 5100 Maintenance & Repairs 5110 Supplies Used 5120 Rental Expenses 5140 Phone/Internet Expenses 5160 Wages Expenses 24185202940 5 150 2 120 524 540 6500 75 000 38 000 2730 900 5 000 3 630 360 9000 1 900 $645 450 $645 450 transactions 101 Daltu duvance the session date as Enter the remaining needed. Bank Debit Memo #RDT-D3691 Dated June 8, 2020 From Red Deer Trust, $129 for bank service charges. Purchase Invoice #WD-4499 Dated June 10, 2020 10 From Western Data , $840 plus $42 GST paid for new dispatch and scheduling software. Purchase invoice total $882. Terms: net 10 days. Create new Group account 2220 A/P - Western Data. Cheque #489 and Memo #2 Dated June 11, 2020 telephone bill was $344 plus $17.20 GST. Payment Cheque #490 Dated June 11, 2020 17 *HC-7655. Receipt #121 Dated June 12, 2020 15 *BB-338. Sales invoice #BB-364 Dated June 14, 2020 1 Binh paid his business telephone bill from his personal chequing account. He wrote cheque #489 for $361.20 to reimburse himself for this expense. The To Piper Creek Mall, $3 800 plus $190 GST charged for dumpster rentals during renovations. Sales invoice total $3 990. Terms: net 30 days. 12 To Hoodoos Containers, $37 327.50 in full payment of account. Reference invoice From Ontime Contracting, cheque #58821 for $2 730 in full payment of invoice the reversing ently ICU When you display the General Journal Report with Corrections selected (refer to page 63), the three entries for the purchase invoice the original incorrect entry, a reversing adjusting entry created by the program (ADJBH-5621) and the correct entry (COR) BH-5621 - are included, providing a complete audit trail for the transaction and correction. Refer to the partial General Journal Report displayed on page 63. in the REVERSING A GENERAL JOURNAL ENTRY AFTER POSTING If you need to reverse an entry instead of making changes to it, click the Reverse Entry tool tool bar of the General Journal - Adjusting window, or choose the Entry menu and click Reverse Entry You must confirm your decision before the action is taken. Click Yes to confirm and continue. Sage 50 does not delete the original entry. Instead it adds the reversing entry to the journal report for a complete audit trail. You can hide reversing entries in journal reports by not showing corrections. Continue with the journal entries for the June 7 session date. Payment Cheque #488 Dated June 5, 2020 To Red Deer Promotions, $2 940 in payment of invoice #RDP-8668. Receipt #120 Dated June 5, 2020 From Redbird Brothers, cheque #98 for $5 880 in payment of invoice #BB-351. CHAPTER 3 50 Dated June 6, 2020 Sales Invoice #BB-363 #the an apply wie in Purchase Invoice #SM-6111 Dated June 6, 2020 From Sylvan Motors, $960 plus $48 GST paid for lube, oil and filter changes for three trucks. Purchase invoice total $1 008. Terms: net 30 days. Create new Group account 2200 A/P - Sylvan Motors. Advancing the Session Date and Backing Up Files data files ed you will receive an error message. up your work because you hay exit the program, it is To Watershed Insurance (new customer), $6 400 plus $320 GST charged for dumpster rentals for flood damage cleanup. Sales invoice total $6 720. Terms: When you have finished all the entries for the June 7 session date, the date for the next redated transaction is later than June 7. Therefore, you must advance the session date before you can continue. If you do not advance the date before posting the June 8 trans Before advancing the date, however, close all open windows and then sure and fast net 20 days. Create new Group account 1260 A/R - Watershed Insurance. already completed one week of transactions the Accounting Procedures CHART OF POSTABLE ACCOUNTS BINH'S BINS Im Dumper ASSETS 1580 Trucks 3150 Binh's Bins, Drawings 1080 Chequing Account 3600 Net Income LIABILITIES 1200 AR- Ontime Contracting 1220 AR-Piper Creek Mall 2100 A/P - Badlands Hardware REVENUE 1240 AVR - Redbird Brothers 2120 A/P - Hoodoos Containers 4100 Revenue from Dumpster 1320 Prepaid Insurance 2180 A/P - Red Deer Promotions Rentals 1340 Prepaid Rent 2650 GST Charged on Services 4150 Revenue from 1360 Supplies 2670 GST Paid on Purchases Subcontracting 1520 Computers and Software 4200 Interest Revenue 1540 Tools EQUITY 1560 Dumpsters 3100 Binh's Bins, Capital NOTES: The Chart of Accounts indudes only postable accounts and the Net Income or Current Earnings account Sage 50 uses the Net Income account for the Income Statement to calculate the difference between revenue and expenses before dosing the books. TRIAL BALANCE EXPENSE 5020 Advertising & Promotion 5040 Bank Charges 5060 Insurance Expense 5080 Interest Expense 5100 Maintenance & Repairs 5110 Supplies Used 5120 Rental Expenses 5140 Phone Internet Expenses 5150 Truck Expenses 5160 Wages Expenses BINH'S BINS Debits Credits $ 64 360 2730 5880 7 000 3 600 580 4200 890 53 180 418 320 June 1, 2020 1080 Chequing Account 1200 A/R - Ontime Contracting 1240 A/R - Redbird Brothers 1320 Prepaid Insurance 1340 Prepaid Rent 1360 Supplies 1520 Computers and Software 1540 Tools 1560 Dumpsters 1580 Trucks 2180 A/P - Red Deer Promotions 2650 GST Charged on Services 2670 GST Paid on Purchases 3100 Binh's Bins, Capital 3150 Binh's Bins, Drawings 4100 Revenue from Dumpster Rentals 4150 Revenue from Subcontracting 5020 Advertising & Promotion 5040 Bark Charges 5060 Insurance Expense 5100 Maintenance & Repairs 5110 Supplies Used 5120 Rental Expenses 5140 Phone/Internet Expenses 5160 Wages Expenses 24185202940 5 150 2 120 524 540 6500 75 000 38 000 2730 900 5 000 3 630 360 9000 1 900 $645 450 $645 450 transactions 101 Daltu duvance the session date as Enter the remaining needed. Bank Debit Memo #RDT-D3691 Dated June 8, 2020 From Red Deer Trust, $129 for bank service charges. Purchase Invoice #WD-4499 Dated June 10, 2020 10 From Western Data , $840 plus $42 GST paid for new dispatch and scheduling software. Purchase invoice total $882. Terms: net 10 days. Create new Group account 2220 A/P - Western Data. Cheque #489 and Memo #2 Dated June 11, 2020 telephone bill was $344 plus $17.20 GST. Payment Cheque #490 Dated June 11, 2020 17 *HC-7655. Receipt #121 Dated June 12, 2020 15 *BB-338. Sales invoice #BB-364 Dated June 14, 2020 1 Binh paid his business telephone bill from his personal chequing account. He wrote cheque #489 for $361.20 to reimburse himself for this expense. The To Piper Creek Mall, $3 800 plus $190 GST charged for dumpster rentals during renovations. Sales invoice total $3 990. Terms: net 30 days. 12 To Hoodoos Containers, $37 327.50 in full payment of account. Reference invoice From Ontime Contracting, cheque #58821 for $2 730 in full payment of invoice it's too hard for me(T-T)

it's from using sage 50 accounting , and if you need more infomation,i can upload it:)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started