Answered step by step

Verified Expert Solution

Question

1 Approved Answer

someone pls help asap Sylvestor Systems borrows $77,000 cash on May 15 by signing a 60-day, 6%, $77,000 note. 1. On what date does this

someone pls help asap

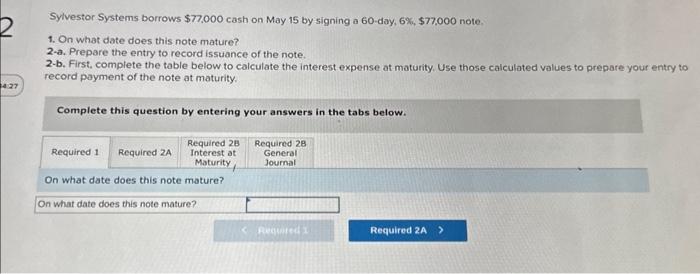

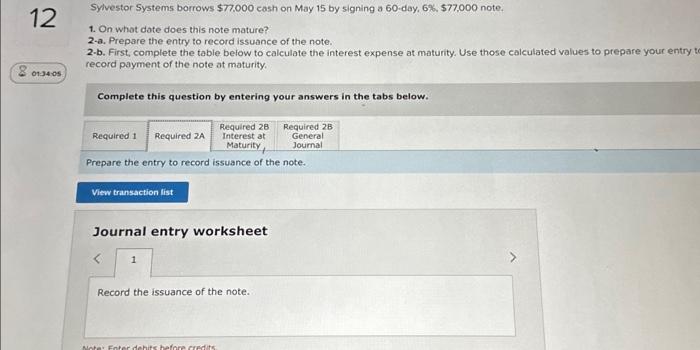

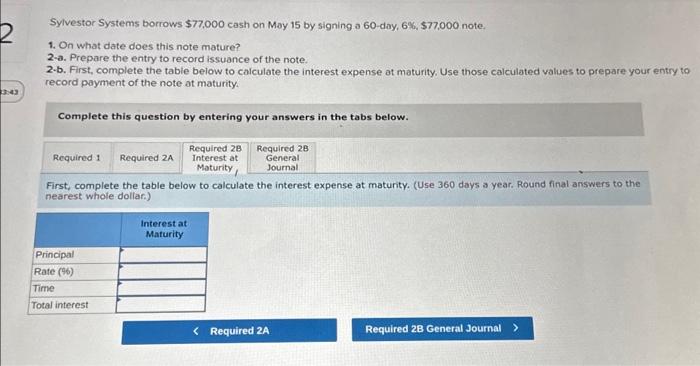

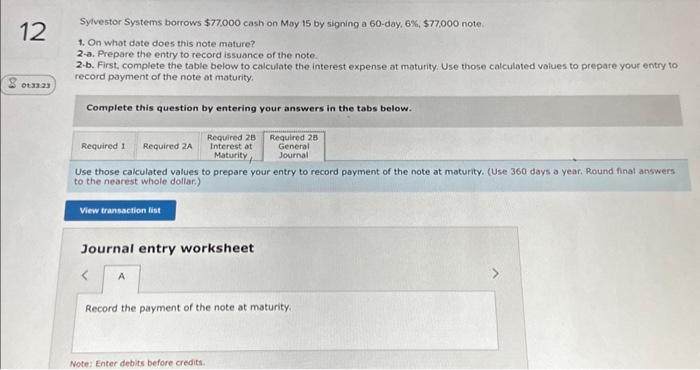

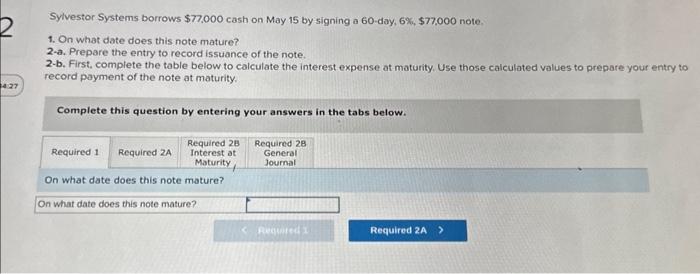

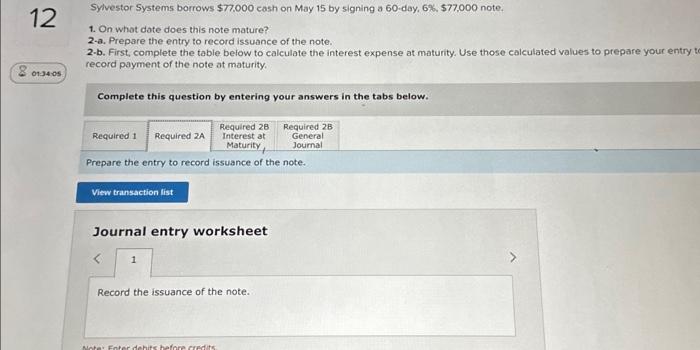

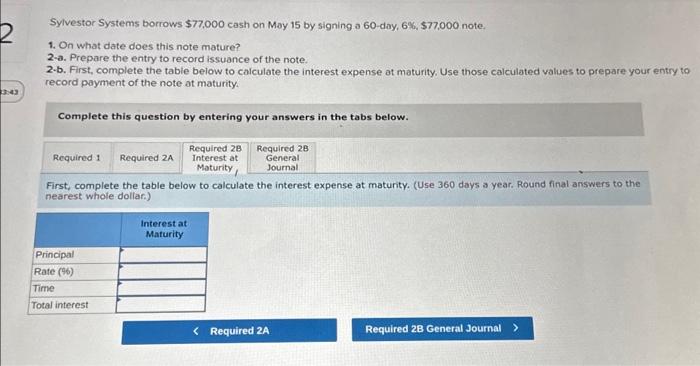

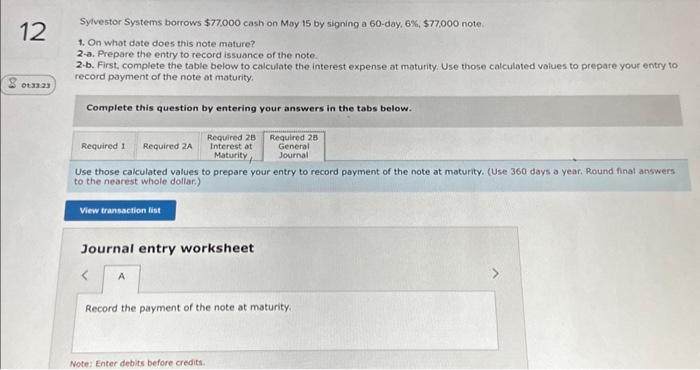

Sylvestor Systems borrows $77,000 cash on May 15 by signing a 60-day, 6\%, $77,000 note. 1. On what date does this note mature? 2-a. Prepare the entry to record issuance of the note. 2-b. First, complete the table below to calculate the interest expense at maturity. Use those calculated values to prepare your entry to record payment of the note at maturity. Complete this question by entering your answers in the tabs below. On what date does this note mature? Sylvestor Systems borrows $77.000 cash on May 15 by signing a 60 -day, 6%,$77.000 note. 1. On what dote does this note mature? 2-a. Prepare the entry to record issuance of the note. 2-b. First, complete the table below to calculate the interest expense at maturity. Use those colculated values to prepare your entry t record payment of the note at maturity. Complete this question by entering your answers in the tabs below. Prepare the entry to record issuance of the note. Sylvestor Systems borrows $77,000 cash on May 15 by signing a 60-day, 6\%, $77,000 note. 1. On what date does this note mature? 2-a. Prepare the entry to record issuance of the note. 2-b. First, complete the table below to calculate the interest expense at maturity. Use those calculated values to prepare your entry record payment of the note at maturity. Complete this question by entering your answers in the tabs below. First, complete the table below to calculate the interest expense at maturity. (Use 360 days a year. Round final answers to the nearest whole dollar.) Syivestor Systems borrows \$77,000 cash on May 15 by signing a 60-day, 6\%, $77,000 note. 1. On whot date does this note mature? 2-a. Prepare the entry to record issuance of the note. 2-b. First, complete the table below to calculate the interest expense at maturity. Use those calculated values to prepare your entry to record payment of the note at maturity. Complete this question by entering your answers in the tabs below. Use those cakulated values to prepare your entry to record payment of the note at maturity. (Use 360 days a year. Round final answers to the nearest whole dollar.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started