Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sonyias Inc. granted 15,000 stock options to certain sales employees on January 1 , Year 1 . The options vested at the end of three

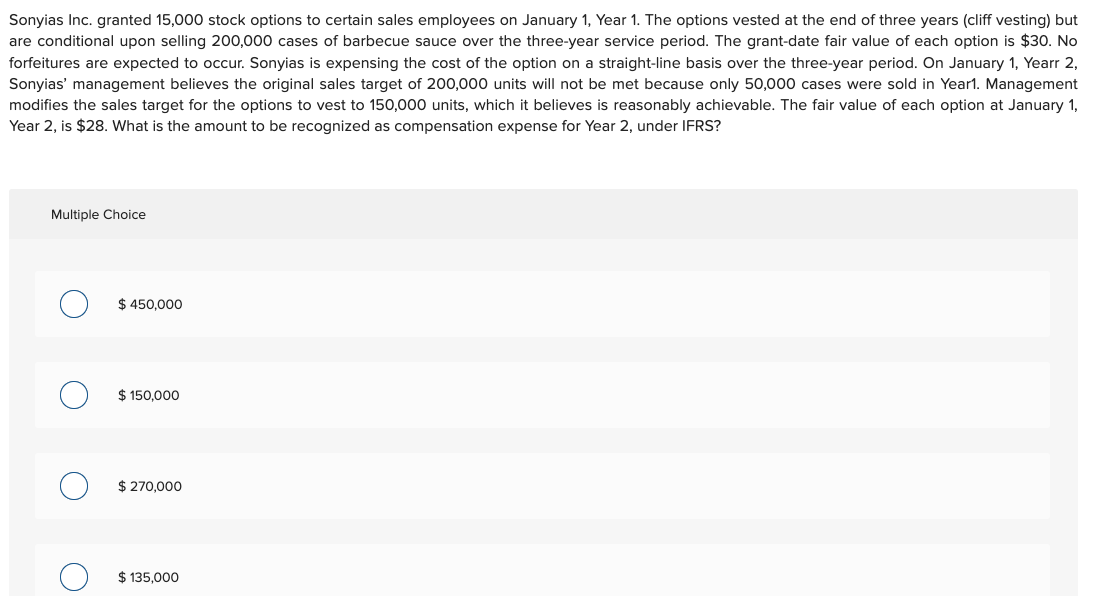

Sonyias Inc. granted 15,000 stock options to certain sales employees on January 1 , Year 1 . The options vested at the end of three years (cliff vesting) but are conditional upon selling 200,000 cases of barbecue sauce over the three-year service period. The grant-date fair value of each option is $30. No forfeitures are expected to occur. Sonyias is expensing the cost of the option on a straight-line basis over the three-year period. On January 1 , Yearr 2 , Sonyias' management believes the original sales target of 200,000 units will not be met because only 50,000 cases were sold in Year1. Management modifies the sales target for the options to vest to 150,000 units, which it believes is reasonably achievable. The fair value of each option at January 1 , Year 2, is $28. What is the amount to be recognized as compensation expense for Year 2, under IFRS? Multiple Choice $450,000 $150,000 $270,000 $135,000 Sonyias Inc. granted 15,000 stock options to certain sales employees on January 1 , Year 1 . The options vested at the end of three years (cliff vesting) but are conditional upon selling 200,000 cases of barbecue sauce over the three-year service period. The grant-date fair value of each option is $30. No forfeitures are expected to occur. Sonyias is expensing the cost of the option on a straight-line basis over the three-year period. On January 1 , Yearr 2 , Sonyias' management believes the original sales target of 200,000 units will not be met because only 50,000 cases were sold in Year1. Management modifies the sales target for the options to vest to 150,000 units, which it believes is reasonably achievable. The fair value of each option at January 1 , Year 2, is $28. What is the amount to be recognized as compensation expense for Year 2, under IFRS? Multiple Choice $450,000 $150,000 $270,000 $135,000

Sonyias Inc. granted 15,000 stock options to certain sales employees on January 1 , Year 1 . The options vested at the end of three years (cliff vesting) but are conditional upon selling 200,000 cases of barbecue sauce over the three-year service period. The grant-date fair value of each option is $30. No forfeitures are expected to occur. Sonyias is expensing the cost of the option on a straight-line basis over the three-year period. On January 1 , Yearr 2 , Sonyias' management believes the original sales target of 200,000 units will not be met because only 50,000 cases were sold in Year1. Management modifies the sales target for the options to vest to 150,000 units, which it believes is reasonably achievable. The fair value of each option at January 1 , Year 2, is $28. What is the amount to be recognized as compensation expense for Year 2, under IFRS? Multiple Choice $450,000 $150,000 $270,000 $135,000 Sonyias Inc. granted 15,000 stock options to certain sales employees on January 1 , Year 1 . The options vested at the end of three years (cliff vesting) but are conditional upon selling 200,000 cases of barbecue sauce over the three-year service period. The grant-date fair value of each option is $30. No forfeitures are expected to occur. Sonyias is expensing the cost of the option on a straight-line basis over the three-year period. On January 1 , Yearr 2 , Sonyias' management believes the original sales target of 200,000 units will not be met because only 50,000 cases were sold in Year1. Management modifies the sales target for the options to vest to 150,000 units, which it believes is reasonably achievable. The fair value of each option at January 1 , Year 2, is $28. What is the amount to be recognized as compensation expense for Year 2, under IFRS? Multiple Choice $450,000 $150,000 $270,000 $135,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started