Soory about the unclear pictures. I hope these pictures are more clear. The pictures show problems from Chapters 3&4 of accounting 1. Thank you.

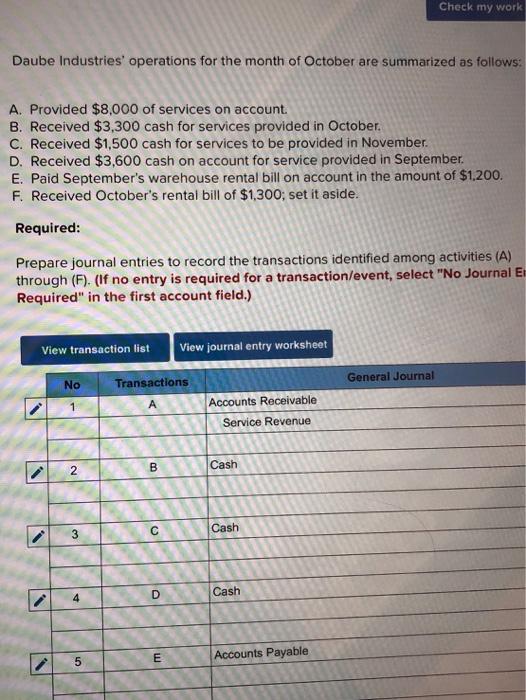

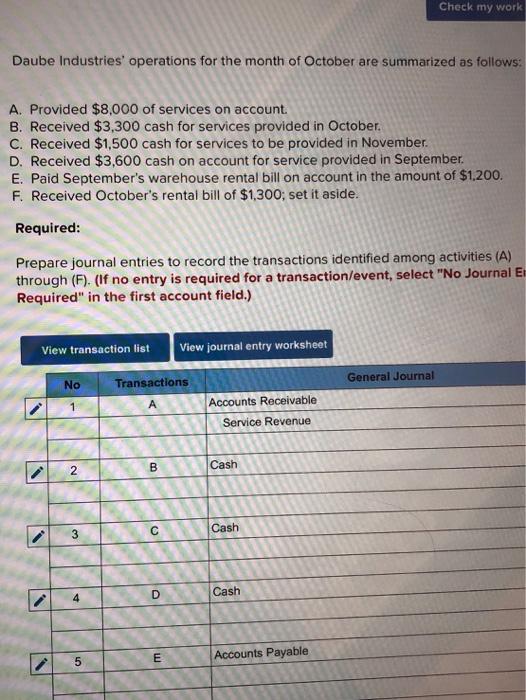

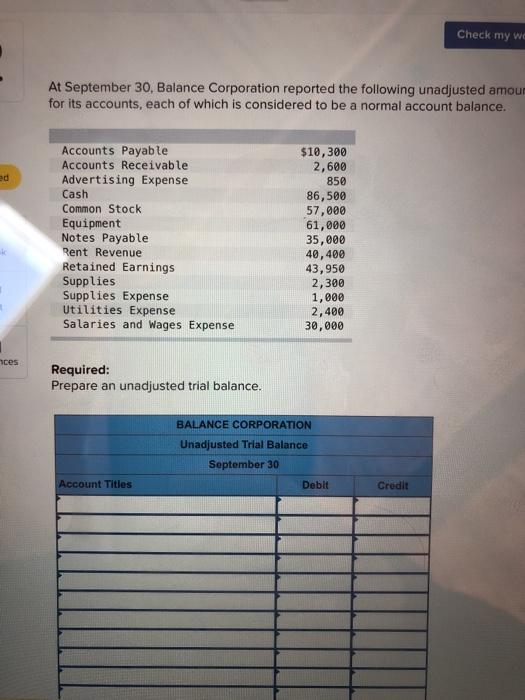

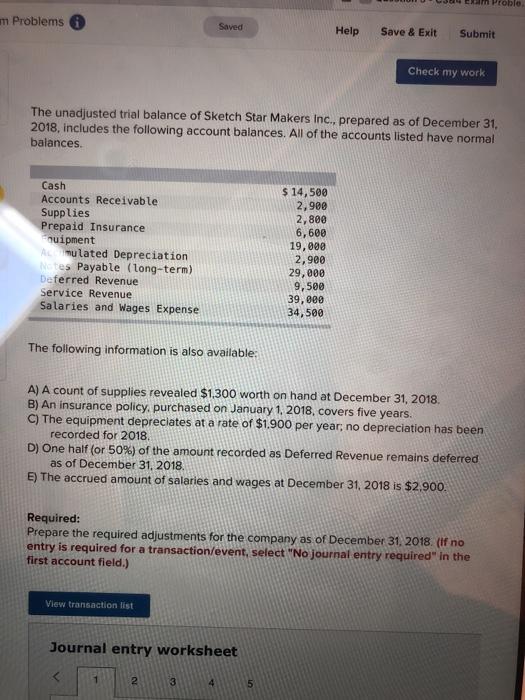

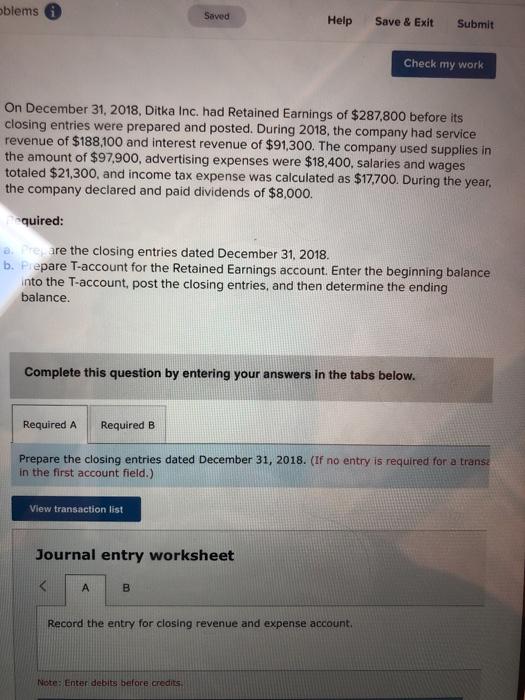

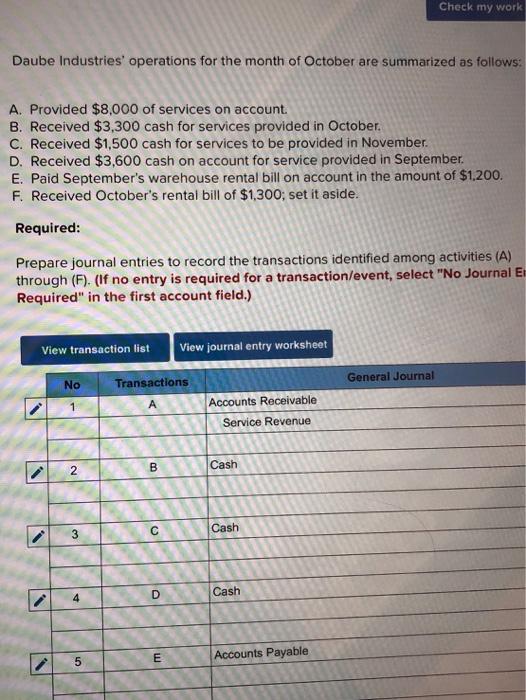

Check my work Daube Industries' operations for the month of October are summarized as follows: A. Provided $8,000 of services on account B. Received $3,300 cash for services provided in October. C. Received $1,500 cash for services to be provided in November D. Received $3,600 cash on account for service provided in September. E. Paid September's warehouse rental bill on account in the amount of $1,200. F. Received October's rental bill of $1,300; set it aside. Required: Prepare journal entries to record the transactions identified among activities (A) through (F). (If no entry is required for a transaction/event, select "No Journal E Required" in the first account field.) View transaction list View journal entry worksheet General Journal No 1 Transactions Accounts Receivable Service Revenue B N Cash 3 Cash 4 Cash D Accounts Payable E LO Check my we At September 30, Balance Corporation reported the following unadjusted amour for its accounts, each of which is considered to be a normal account balance. ed Accounts Payable Accounts Receivable Advertising Expense Cash Common Stock Equipment Notes Payable Rent Revenue Retained Earnings Supplies Supplies Expense Utilities Expense Salaries and Wages Expense $10,300 2,600 850 86,500 57,000 61,000 35,000 40,400 43,950 2,300 1,000 2,400 30,000 ces Required: Prepare an unadjusted trial balance. BALANCE CORPORATION Unadjusted Trial Balance September 30 Account Titles Debit Credit Cm Propio m Problems Saved Help Save & Exit Submit Check my work The unadjusted trial balance of Sketch Star Makers Inc., prepared as of December 31, 2018, includes the following account balances. All of the accounts listed have normal balances Cash Accounts Receivable Supplies Prepaid Insurance huipment Amulated Depreciation Notes Payable (long-term) Deferred Revenue Service Revenue Salaries and Wages Expense $ 14,500 2,900 2,800 6,600 19,000 2,900 29,000 9,500 39,000 34,500 The following information is also available: A) A count of supplies revealed $1.300 worth on hand at December 31, 2018 B) An insurance policy, purchased on January 1, 2018, covers five years. C) The equipment depreciates at a rate of $1,900 per year, no depreciation has been recorded for 2018 D) One half (or 50%) of the amount recorded as Deferred Revenue remains deferred as of December 31, 2018 E) The accrued amount of salaries and wages at December 31, 2018 is $2.900. Required: Prepare the required adjustments for the company as of December 31, 2018. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 2 3 5 oblems Saved Help Save & Exit Submit Check my work On December 31, 2018, Ditka Inc. had Retained Earnings of $287,800 before its closing entries were prepared and posted. During 2018, the company had service revenue of $188,100 and interest revenue of $91,300. The company used supplies in the amount of $97.900, advertising expenses were $18,400, salaries and wages totaled $21,300, and income tax expense was calculated as $17,700. During the year, the company declared and paid dividends of $8,000. quired: are are the closing entries dated December 31, 2018. b. Prepare T-account for the Retained Earnings account. Enter the beginning balance into the T-account, post the closing entries, and then determine the ending balance. Complete this question by entering your answers in the tabs below. Required A Required B Prepare the closing entries dated December 31, 2018. (If no entry is required for a transi in the first account field.) View transaction list Journal entry worksheet A B Record the entry for closing revenue and expense account Note: Enter debits before credits