Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sophia Inc. is a car manufacturer that has expected annual earnings before interest and taxes of $80 million per year. Expected annual depreciation is

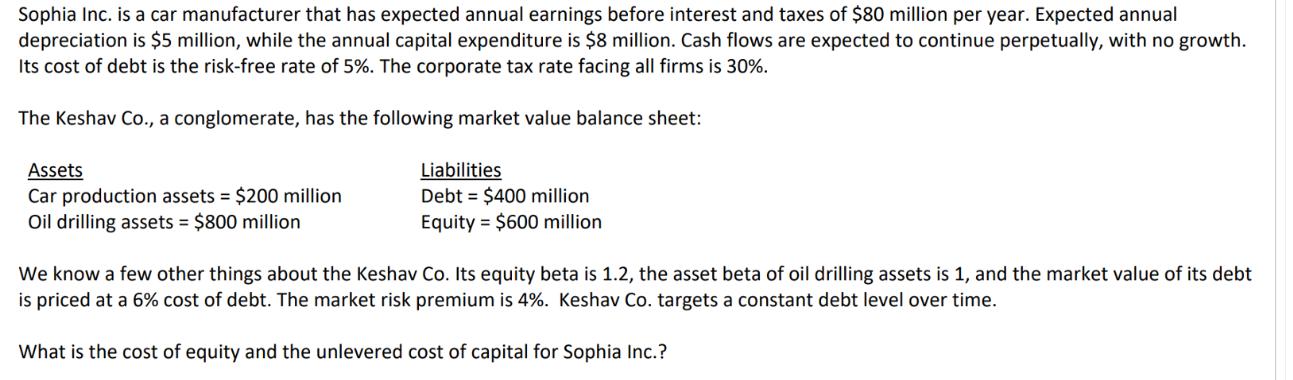

Sophia Inc. is a car manufacturer that has expected annual earnings before interest and taxes of $80 million per year. Expected annual depreciation is $5 million, while the annual capital expenditure is $8 million. Cash flows are expected to continue perpetually, with no growth. Its cost of debt is the risk-free rate of 5%. The corporate tax rate facing all firms is 30%. The Keshav Co., a conglomerate, has the following market value balance sheet: Assets Car production assets $200 million Oil drilling assets = $800 million Liabilities Debt $400 million Equity $600 million We know a few other things about the Keshav Co. Its equity beta is 1.2, the asset beta of oil drilling assets is 1, and the market value of its debt is priced at a 6% cost of debt. The market risk premium is 4%. Keshav Co. targets a constant debt level over time. What is the cost of equity and the unlevered cost of capital for Sophia Inc.?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started