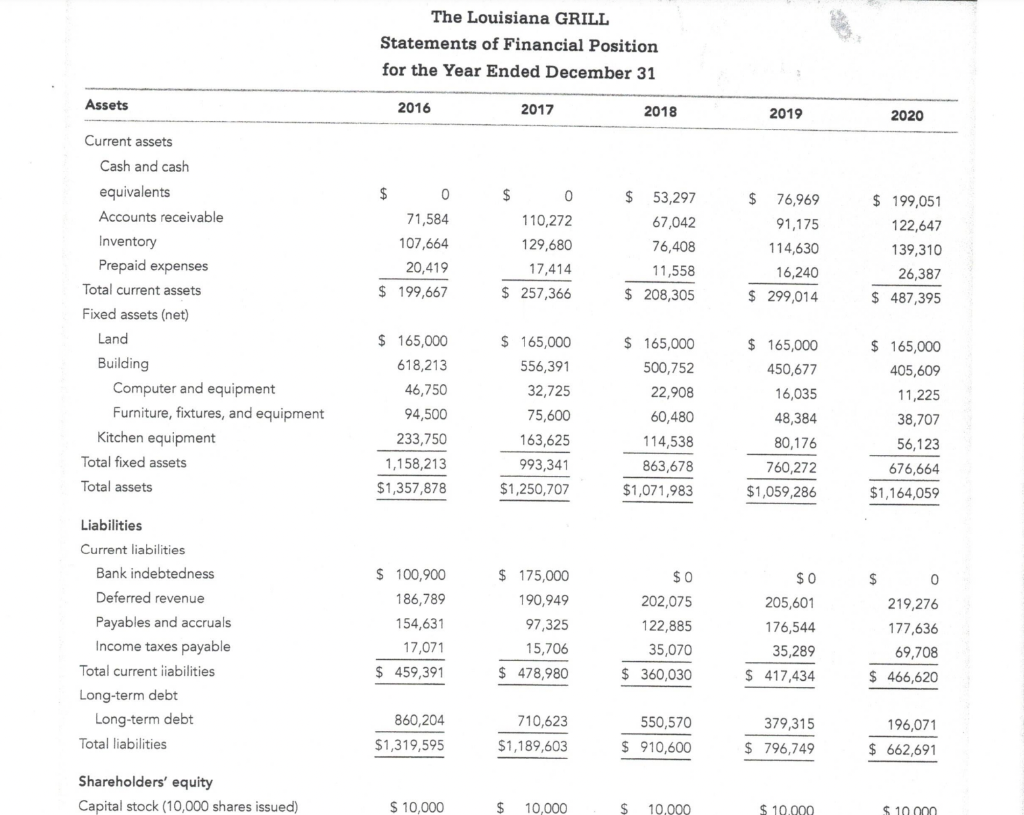

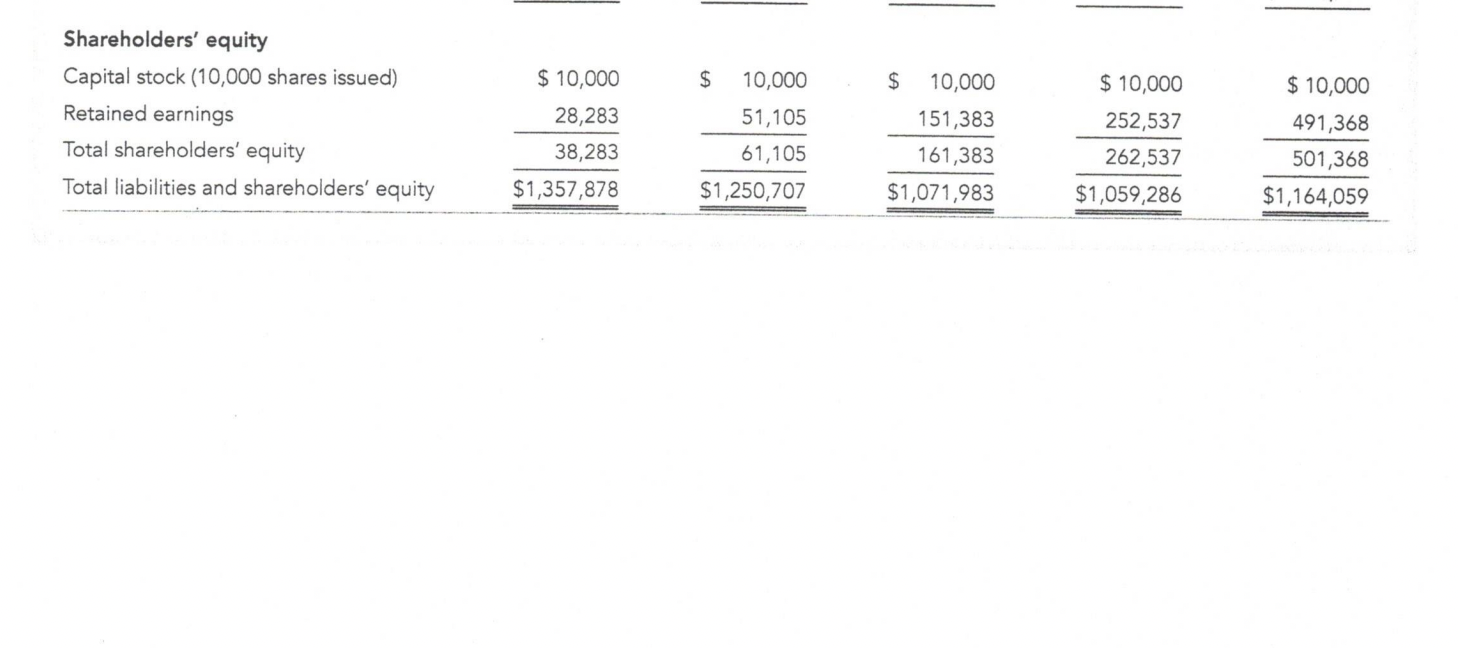

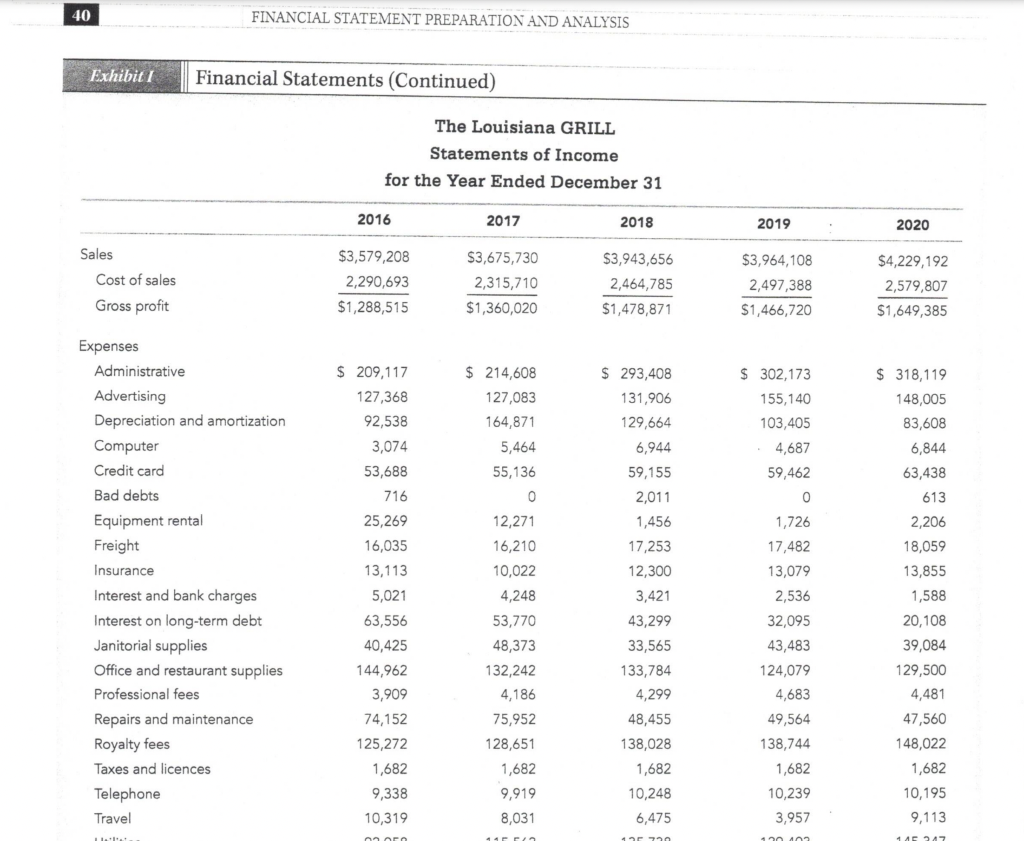

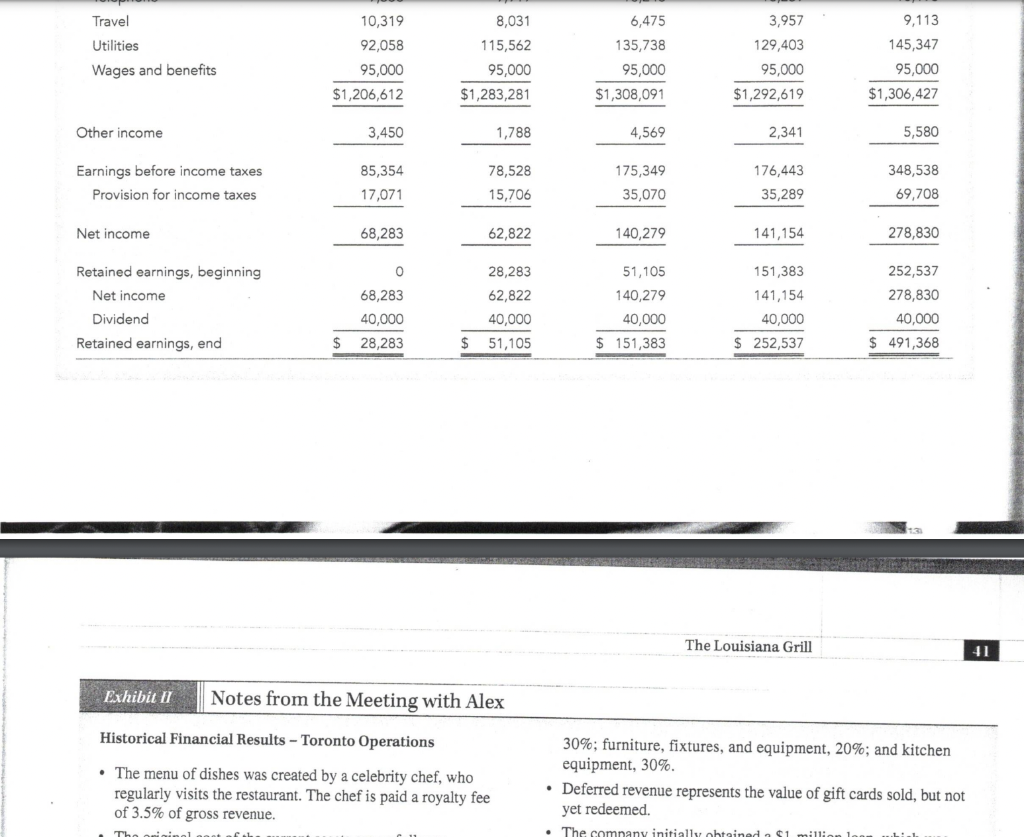

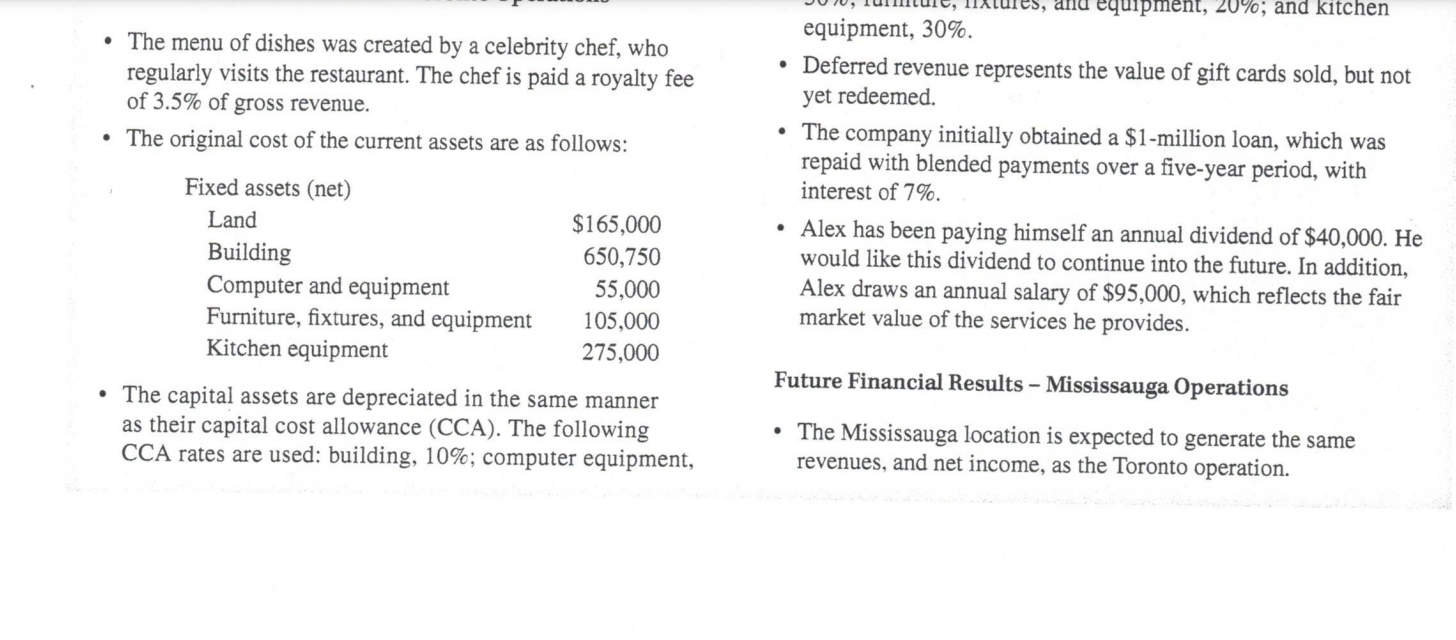

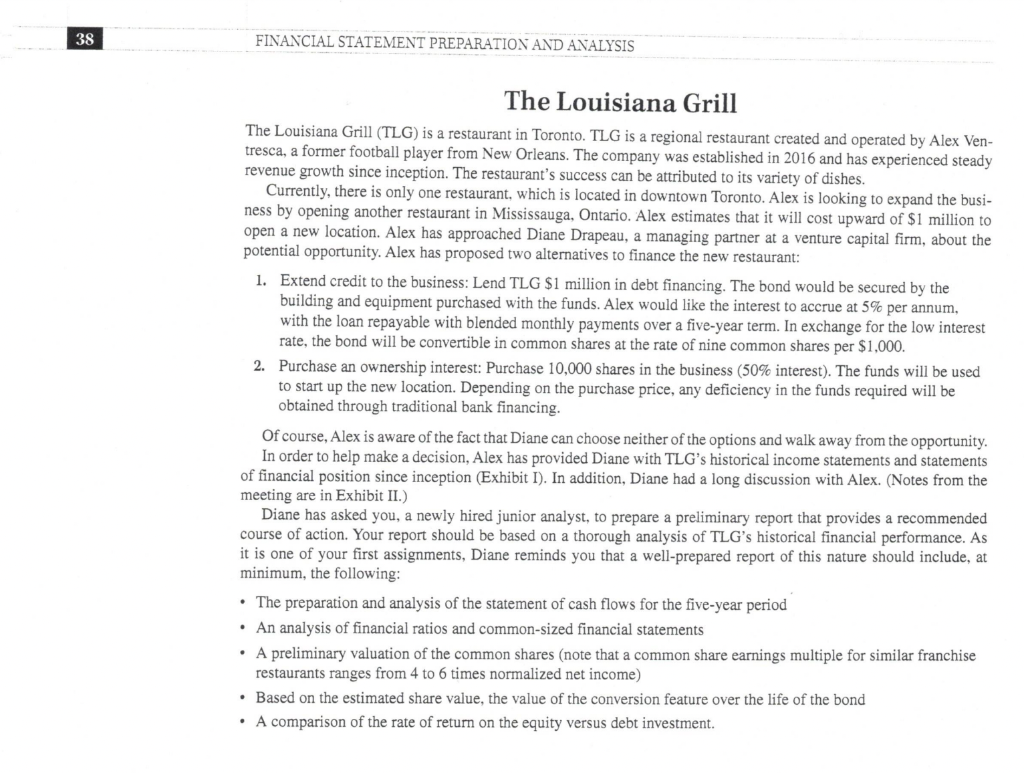

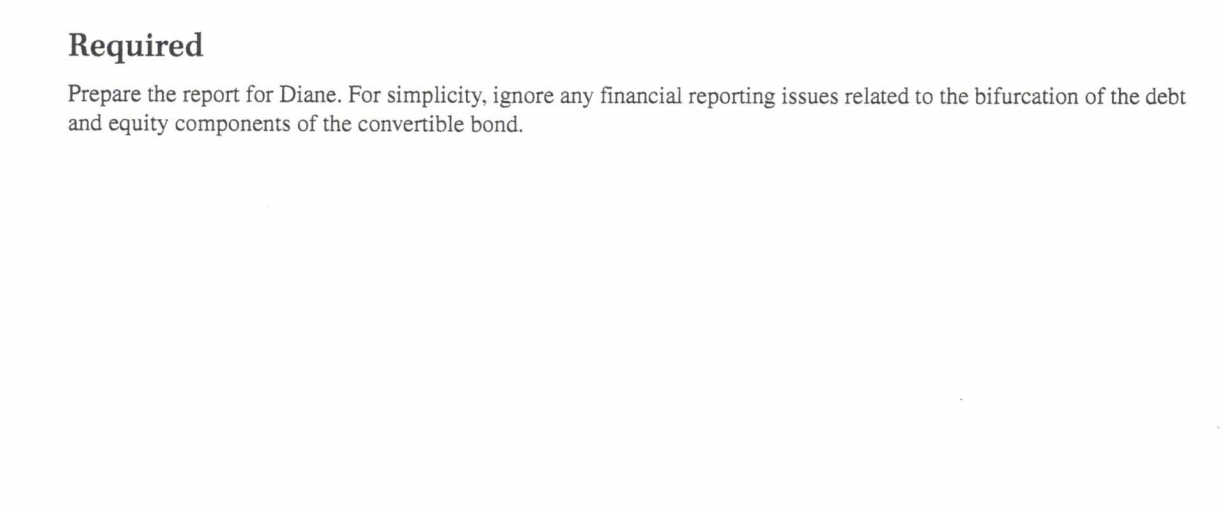

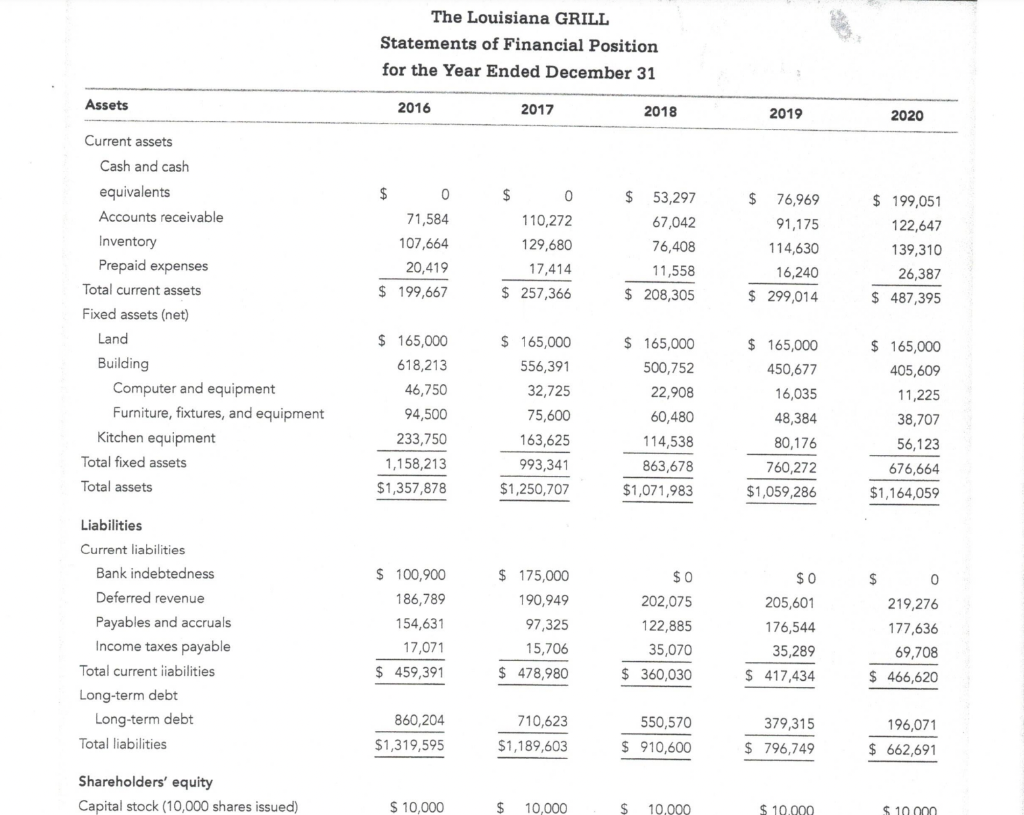

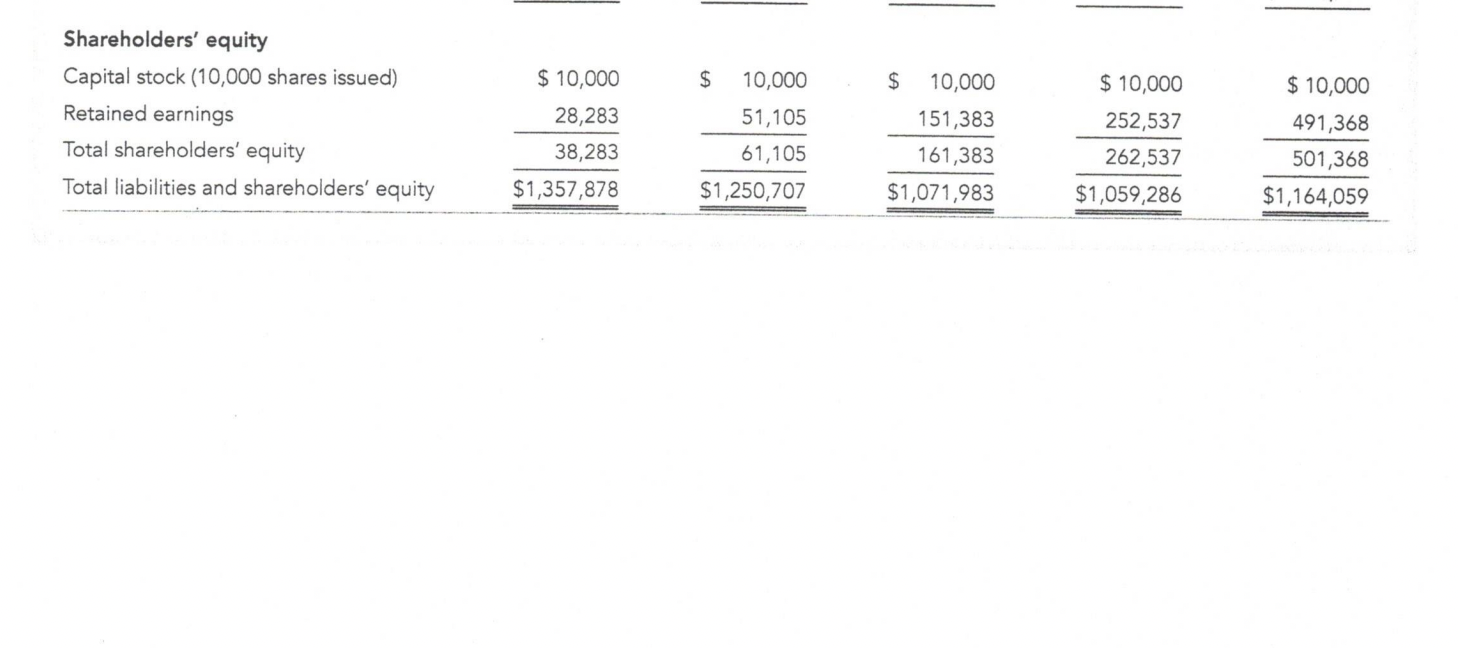

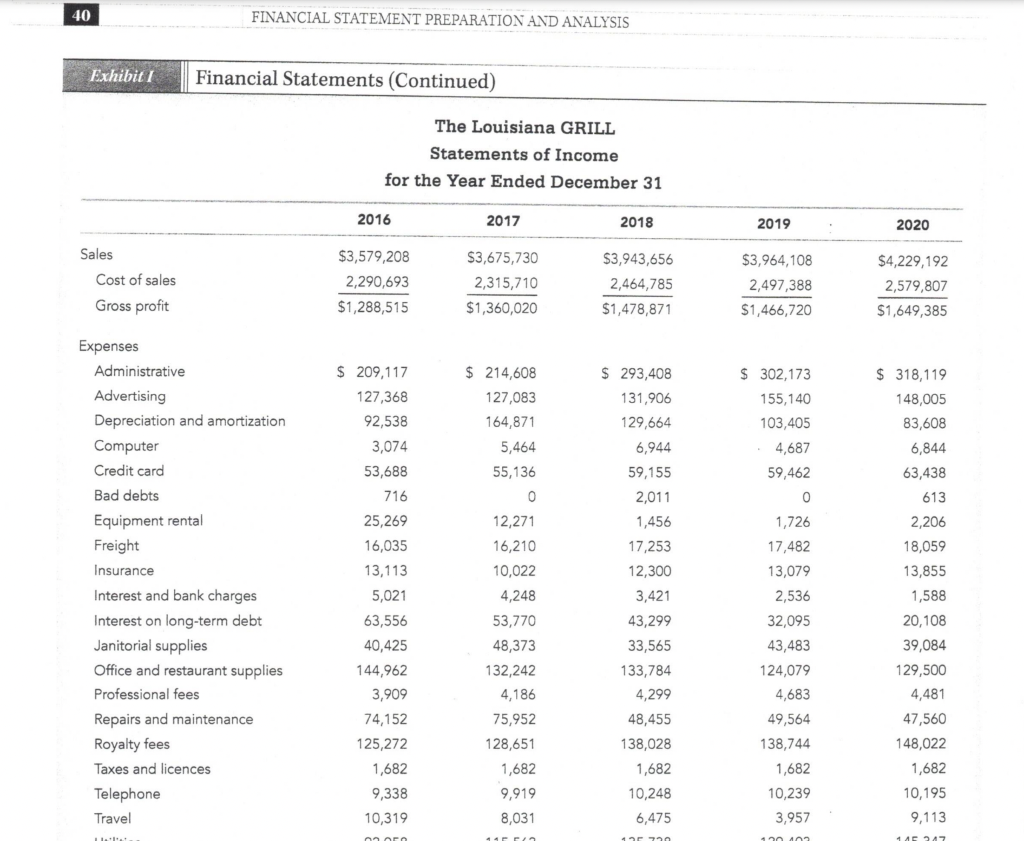

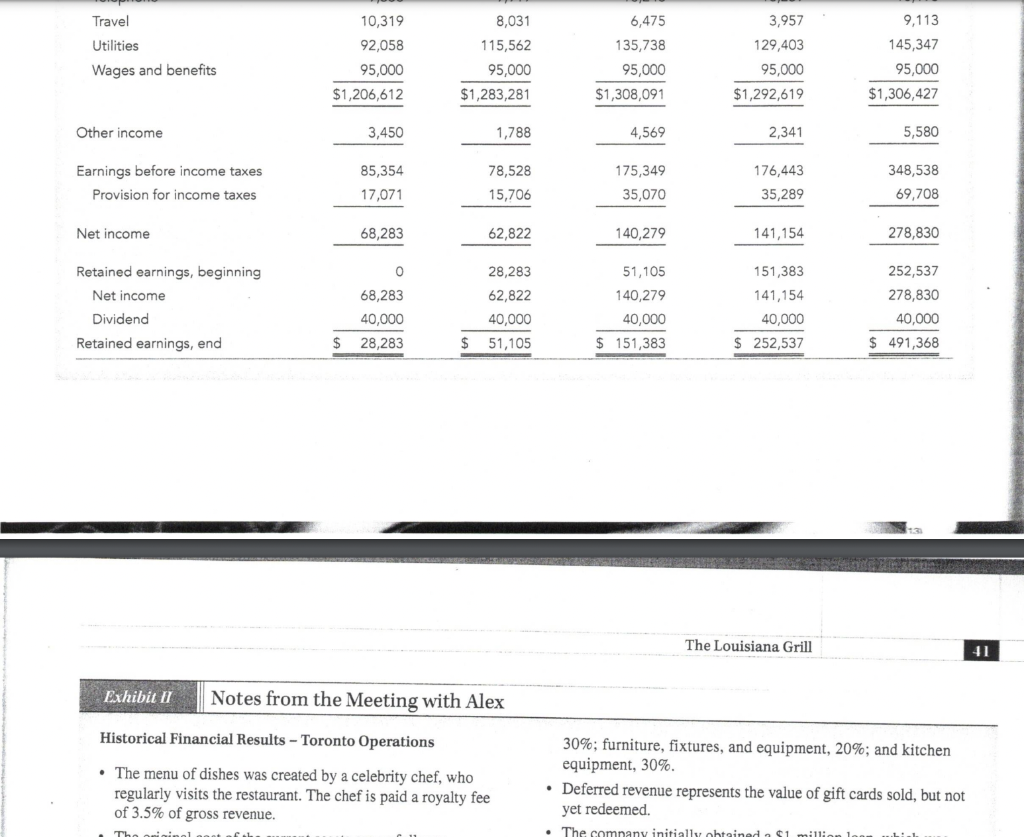

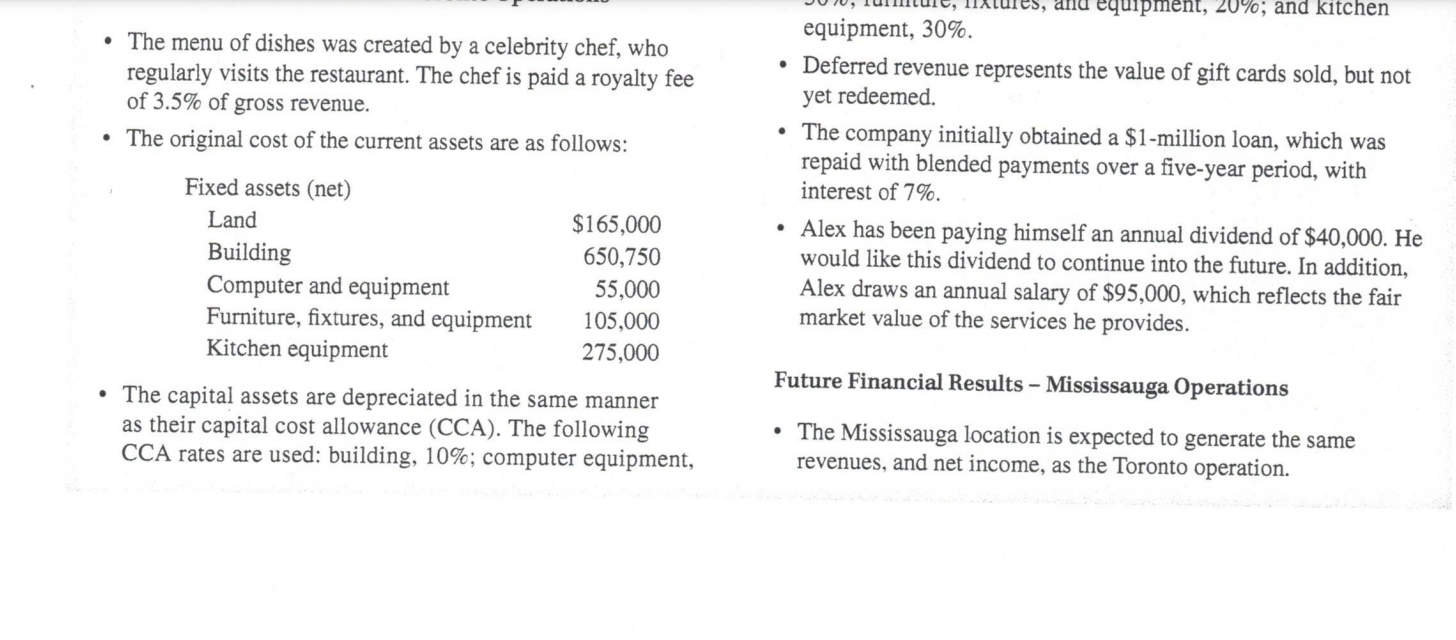

source: Lento and Ryan Canadian Financial Accounting Cases, 3e, Wiley Publishing Ltd., 2020 Required (due by end-of-day April 11) Prepare a report for Diane. For simplicity, ignore any financial reporting issues related to the (bifurication) splitting up/division of the debt and equity components of the convertible bond. Specifically, your report should include 1. Preparation and analysis of the statement of cash flows; 2. Compute and interpret component percentages; 3. Compute and interpret profitability, liquidity, and solvency ratios; 4. Using the financial statements and the results of your work in points 1 to 3 above conclude if strategic plans for Louisiana Grill are consistent with your analysis of the financial statements. Are the plans feasible (why or why not)? Your report should be 12 font and no longer than 10 pages double-spaced including exhibits 38 FINANCIAL STATEMENT PREPARATION AND ANALYSIS The Louisiana Grill The Louisiana Grill (TLG) is a restaurant in Toronto. TLG is a regional restaurant created and operated by Alex Ven- tresca, a former football player from New Orleans. The company was established in 2016 and has experienced steady revenue growth since inception. The restaurant's success can be attributed to its variety of dishes. Currently, there is only one restaurant, which is located in downtown Toronto. Alex is looking to expand the busi- ness by opening another restaurant in Mississauga, Ontario. Alex estimates that it will cost upward of $1 million to open a new location. Alex has approached Diane Drapeau, a managing partner at a venture capital firm, about the potential opportunity. Alex has proposed two alternatives to finance the new restaurant: 1. Extend credit to the business: Lend TLG $1 million in debt financing. The bond would be secured by the building and equipment purchased with the funds. Alex would like the interest to accrue at 5% per annum, with the loan repayable with blended monthly payments over a five-year term. In exchange for the low interest rate, the bond will be convertible in common shares at the rate of nine common shares per $1,000. 2. Purchase an ownership interest: Purchase 10,000 shares in the business (50% interest). The funds will be used to start up the new location. Depending on the purchase price, any deficiency in the funds required will be obtained through traditional bank financing. Of course, Alex is aware of the fact that Diane can choose neither of the options and walk away from the opportunity. In order to help make a decision, Alex has provided Diane with TLG's historical income statements and statements of financial position since inception (Exhibit I). In addition, Diane had a long discussion with Alex. (Notes from the meeting are in Exhibit II.) Diane has asked you, a newly hired junior analyst, to prepare a preliminary report that provides a recommended course of action. Your report should be based on a thorough analysis of TLG's historical financial performance. As it is one of your first assignments, Diane reminds you that a well-prepared report of this nature should include, at minimum, the following: The preparation and analysis of the statement of cash flows for the five-year period . An analysis of financial ratios and common-sized financial statements A preliminary valuation of the common shares (note that a common share earnings multiple for similar franchise restaurants ranges from 4 to 6 times normalized net income) Based on the estimated share value, the value of the conversion feature over the life of the bond A comparison of the rate of return on the equity versus debt investment. Required Prepare the report for Diane. For simplicity, ignore any financial reporting issues related to the bifurcation of the debt and equity components of the convertible bond. The Louisiana GRILL Statements of Financial Position for the Year Ended December 31 Assets 2016 2017 2018 2019 2020 Current assets $ 0 $ 0 $ Cash and cash equivalents Accounts receivable Inventory Prepaid expenses Total current assets Fixed assets (net) 53,297 67,042 76,408 71,584 107,664 20,419 $ 199,667 110,272 129,680 17,414 $ 76,969 91,175 114,630 16,240 $ 299,014 $ 199,051 122,647 139,310 26,387 $ 487,395 11,558 $ 208,305 $ 257,366 Land $ 165,000 405,609 11,225 Building Computer and equipment Furniture, fixtures, and equipment Kitchen equipment Total fixed assets $ 165,000 618,213 46,750 94,500 233,750 1,158,213 $1,357,878 $ 165,000 556,391 32,725 75,600 163,625 993,341 $1,250,707 $ 165,000 500,752 22,908 60,480 114,538 863,678 $1,071,983 $ 165,000 450,677 16,035 48,384 80,176 760,272 $1,059,286 38,707 56,123 676,664 $1,164,059 Total assets $ 0 Liabilities Current liabilities Bank indebtedness Deferred revenue Payables and accruals Income taxes payable Total current liabilities Long-term debt Long-term debt Total liabilities $ 100,900 186,789 154,631 17,071 $ 459,391 $ 175,000 190,949 97,325 15,706 $ 478,980 $0 202,075 122,885 35,070 $360,030 $0 205,601 176,544 35,289 $ 417,434 219,276 177,636 69,708 $ 466,620 860,204 $1,319,595 710,623 $1,189,603 550,570 $ 910,600 379,315 $ 796,749 196,071 $ 662,691 Shareholders' equity Capital stock (10,000 shares issued) $ 10,000 $ 10,000 $ 10,000 $ 10.000 $ 10.000 $ 10,000 Shareholders' equity Capital stock (10,000 shares issued) Retained earnings Total shareholders' equity Total liabilities and shareholders' equity $ 10,000 28,283 38,283 $ 10,000 51,105 61,105 $1,250,707 $ 10,000 151,383 161,383 $1,071,983 $ 10,000 252,537 262,537 $1,059,286 491,368 501,368 $1,357,878 $1,164,059 40 FINANCIAL STATEMENT PREPARATION AND ANALYSIS Exhibiti Financial Statements (Continued) The Louisiana GRILL Statements of Income for the Year Ended December 31 2016 2017 2018 2019 2020 Sales Cost of sales Gross profit $3,579,208 2,290,693 $1,288,515 $3,675,730 2,315,710 $1,360,020 $3,943,656 2,464,785 $1,478,871 $3,964,108 2,497,388 $1,466,720 $4,229,192 2,579,807 $1,649,385 $ 209,117 127,368 92,538 3,074 $ 214,608 127,083 164,871 5,464 55,136 0 $ 302,173 155,140 103,405 4,687 59,462 53,688 716 25,269 16,035 Expenses Administrative Advertising Depreciation and amortization Computer Credit card Bad debts Equipment rental Freight Insurance Interest and bank charges Interest on long-term debt Janitorial supplies Office and restaurant supplies Professional fees Repairs and maintenance Royalty fees Taxes and licences Telephone Travel 13,113 5,021 63,556 40,425 144,962 3,909 74,152 125,272 1,682 9,338 10,319 12,271 16,210 10,022 4,248 53,770 48,373 132,242 4,186 75,952 128,651 1,682 9,919 8,031 $ 293,408 131,906 129,664 6,944 59,155 2,011 1,456 17,253 12,300 3,421 43,299 33,565 133,784 4,299 48,455 138,028 1,682 10,248 6,475 0 1,726 17,482 13,079 2,536 32,095 43,483 124,079 4,683 49,564 138,744 1,682 10,239 3,957 $ 318,119 148,005 83,608 6,844 63,438 613 2,206 18,059 13,855 1,588 20,108 39,084 129,500 4,481 47,560 148,022 1,682 10,195 9,113 narn 11 1 17010 HASA Travel Utilities 10,319 92,058 95,000 $1,206,612 8,031 115,562 95,000 $1,283,281 6,475 135,738 95,000 $1,308,091 3,957 129,403 95,000 $1,292,619 9,113 145,347 95,000 $1,306,427 Wages and benefits Other income 3,450 1,788 4,569 2,341 5,580 Earnings before income taxes Provision for income taxes 85,354 17,071 78,528 15,706 175,349 35,070 176,443 35,289 348,538 69,708 Net income 68,283 62,822 140,279 141,154 278,830 0 28,283 51,105 151,383 Retained earnings, beginning Net income Dividend Retained earnings, end 68,283 40,000 28,283 62,822 40,000 51,105 140,279 40,000 $ 151,383 141,154 40,000 $ 252,537 252,537 278,830 40,000 $ $ $ 491,368 The Louisiana Grill 41 Exhibit II Notes from the Meeting with Alex Historical Financial Results - Toronto Operations The menu of dishes was created by a celebrity chef, who regularly visits the restaurant. The chef is paid a royalty fee of 3.5% of gross revenue. 30%; furniture, fixtures, and equipment, 20%; and kitchen equipment, 30%. Deferred revenue represents the value of gift cards sold, but not yet redeemed. The comnany initially obtained $1 The menu of dishes was created by a celebrity chef, who regularly visits the restaurant. The chef is paid a royalty fee of 3.5% of gross revenue. The original cost of the current assets are as follows: Fixed assets (net) Land $165,000 Building 650,750 Computer and equipment 55,000 Furniture, fixtures, and equipment 105,000 Kitchen equipment 275,000 The capital assets are depreciated in the same manner as their capital cost allowance (CCA). The following CCA rates are used: building, 10%; computer equipment, ses, and equipment, 20%; and kitchen equipment, 30%. Deferred revenue represents the value of gift cards sold, but not yet redeemed. The company initially obtained a $1-million loan, which was repaid with blended payments over a five-year period, with interest of 7%. Alex has been paying himself an annual dividend of $40,000. He would like this dividend to continue into the future. In addition, Alex draws an annual salary of $95,000, which reflects the fair market value of the services he provides. Future Financial Results - Mississauga Operations . The Mississauga location is expected to generate the same revenues, and net income, as the Toronto operation. source: Lento and Ryan Canadian Financial Accounting Cases, 3e, Wiley Publishing Ltd., 2020 Required (due by end-of-day April 11) Prepare a report for Diane. For simplicity, ignore any financial reporting issues related to the (bifurication) splitting up/division of the debt and equity components of the convertible bond. Specifically, your report should include 1. Preparation and analysis of the statement of cash flows; 2. Compute and interpret component percentages; 3. Compute and interpret profitability, liquidity, and solvency ratios; 4. Using the financial statements and the results of your work in points 1 to 3 above conclude if strategic plans for Louisiana Grill are consistent with your analysis of the financial statements. Are the plans feasible (why or why not)? Your report should be 12 font and no longer than 10 pages double-spaced including exhibits 38 FINANCIAL STATEMENT PREPARATION AND ANALYSIS The Louisiana Grill The Louisiana Grill (TLG) is a restaurant in Toronto. TLG is a regional restaurant created and operated by Alex Ven- tresca, a former football player from New Orleans. The company was established in 2016 and has experienced steady revenue growth since inception. The restaurant's success can be attributed to its variety of dishes. Currently, there is only one restaurant, which is located in downtown Toronto. Alex is looking to expand the busi- ness by opening another restaurant in Mississauga, Ontario. Alex estimates that it will cost upward of $1 million to open a new location. Alex has approached Diane Drapeau, a managing partner at a venture capital firm, about the potential opportunity. Alex has proposed two alternatives to finance the new restaurant: 1. Extend credit to the business: Lend TLG $1 million in debt financing. The bond would be secured by the building and equipment purchased with the funds. Alex would like the interest to accrue at 5% per annum, with the loan repayable with blended monthly payments over a five-year term. In exchange for the low interest rate, the bond will be convertible in common shares at the rate of nine common shares per $1,000. 2. Purchase an ownership interest: Purchase 10,000 shares in the business (50% interest). The funds will be used to start up the new location. Depending on the purchase price, any deficiency in the funds required will be obtained through traditional bank financing. Of course, Alex is aware of the fact that Diane can choose neither of the options and walk away from the opportunity. In order to help make a decision, Alex has provided Diane with TLG's historical income statements and statements of financial position since inception (Exhibit I). In addition, Diane had a long discussion with Alex. (Notes from the meeting are in Exhibit II.) Diane has asked you, a newly hired junior analyst, to prepare a preliminary report that provides a recommended course of action. Your report should be based on a thorough analysis of TLG's historical financial performance. As it is one of your first assignments, Diane reminds you that a well-prepared report of this nature should include, at minimum, the following: The preparation and analysis of the statement of cash flows for the five-year period . An analysis of financial ratios and common-sized financial statements A preliminary valuation of the common shares (note that a common share earnings multiple for similar franchise restaurants ranges from 4 to 6 times normalized net income) Based on the estimated share value, the value of the conversion feature over the life of the bond A comparison of the rate of return on the equity versus debt investment. Required Prepare the report for Diane. For simplicity, ignore any financial reporting issues related to the bifurcation of the debt and equity components of the convertible bond. The Louisiana GRILL Statements of Financial Position for the Year Ended December 31 Assets 2016 2017 2018 2019 2020 Current assets $ 0 $ 0 $ Cash and cash equivalents Accounts receivable Inventory Prepaid expenses Total current assets Fixed assets (net) 53,297 67,042 76,408 71,584 107,664 20,419 $ 199,667 110,272 129,680 17,414 $ 76,969 91,175 114,630 16,240 $ 299,014 $ 199,051 122,647 139,310 26,387 $ 487,395 11,558 $ 208,305 $ 257,366 Land $ 165,000 405,609 11,225 Building Computer and equipment Furniture, fixtures, and equipment Kitchen equipment Total fixed assets $ 165,000 618,213 46,750 94,500 233,750 1,158,213 $1,357,878 $ 165,000 556,391 32,725 75,600 163,625 993,341 $1,250,707 $ 165,000 500,752 22,908 60,480 114,538 863,678 $1,071,983 $ 165,000 450,677 16,035 48,384 80,176 760,272 $1,059,286 38,707 56,123 676,664 $1,164,059 Total assets $ 0 Liabilities Current liabilities Bank indebtedness Deferred revenue Payables and accruals Income taxes payable Total current liabilities Long-term debt Long-term debt Total liabilities $ 100,900 186,789 154,631 17,071 $ 459,391 $ 175,000 190,949 97,325 15,706 $ 478,980 $0 202,075 122,885 35,070 $360,030 $0 205,601 176,544 35,289 $ 417,434 219,276 177,636 69,708 $ 466,620 860,204 $1,319,595 710,623 $1,189,603 550,570 $ 910,600 379,315 $ 796,749 196,071 $ 662,691 Shareholders' equity Capital stock (10,000 shares issued) $ 10,000 $ 10,000 $ 10,000 $ 10.000 $ 10.000 $ 10,000 Shareholders' equity Capital stock (10,000 shares issued) Retained earnings Total shareholders' equity Total liabilities and shareholders' equity $ 10,000 28,283 38,283 $ 10,000 51,105 61,105 $1,250,707 $ 10,000 151,383 161,383 $1,071,983 $ 10,000 252,537 262,537 $1,059,286 491,368 501,368 $1,357,878 $1,164,059 40 FINANCIAL STATEMENT PREPARATION AND ANALYSIS Exhibiti Financial Statements (Continued) The Louisiana GRILL Statements of Income for the Year Ended December 31 2016 2017 2018 2019 2020 Sales Cost of sales Gross profit $3,579,208 2,290,693 $1,288,515 $3,675,730 2,315,710 $1,360,020 $3,943,656 2,464,785 $1,478,871 $3,964,108 2,497,388 $1,466,720 $4,229,192 2,579,807 $1,649,385 $ 209,117 127,368 92,538 3,074 $ 214,608 127,083 164,871 5,464 55,136 0 $ 302,173 155,140 103,405 4,687 59,462 53,688 716 25,269 16,035 Expenses Administrative Advertising Depreciation and amortization Computer Credit card Bad debts Equipment rental Freight Insurance Interest and bank charges Interest on long-term debt Janitorial supplies Office and restaurant supplies Professional fees Repairs and maintenance Royalty fees Taxes and licences Telephone Travel 13,113 5,021 63,556 40,425 144,962 3,909 74,152 125,272 1,682 9,338 10,319 12,271 16,210 10,022 4,248 53,770 48,373 132,242 4,186 75,952 128,651 1,682 9,919 8,031 $ 293,408 131,906 129,664 6,944 59,155 2,011 1,456 17,253 12,300 3,421 43,299 33,565 133,784 4,299 48,455 138,028 1,682 10,248 6,475 0 1,726 17,482 13,079 2,536 32,095 43,483 124,079 4,683 49,564 138,744 1,682 10,239 3,957 $ 318,119 148,005 83,608 6,844 63,438 613 2,206 18,059 13,855 1,588 20,108 39,084 129,500 4,481 47,560 148,022 1,682 10,195 9,113 narn 11 1 17010 HASA Travel Utilities 10,319 92,058 95,000 $1,206,612 8,031 115,562 95,000 $1,283,281 6,475 135,738 95,000 $1,308,091 3,957 129,403 95,000 $1,292,619 9,113 145,347 95,000 $1,306,427 Wages and benefits Other income 3,450 1,788 4,569 2,341 5,580 Earnings before income taxes Provision for income taxes 85,354 17,071 78,528 15,706 175,349 35,070 176,443 35,289 348,538 69,708 Net income 68,283 62,822 140,279 141,154 278,830 0 28,283 51,105 151,383 Retained earnings, beginning Net income Dividend Retained earnings, end 68,283 40,000 28,283 62,822 40,000 51,105 140,279 40,000 $ 151,383 141,154 40,000 $ 252,537 252,537 278,830 40,000 $ $ $ 491,368 The Louisiana Grill 41 Exhibit II Notes from the Meeting with Alex Historical Financial Results - Toronto Operations The menu of dishes was created by a celebrity chef, who regularly visits the restaurant. The chef is paid a royalty fee of 3.5% of gross revenue. 30%; furniture, fixtures, and equipment, 20%; and kitchen equipment, 30%. Deferred revenue represents the value of gift cards sold, but not yet redeemed. The comnany initially obtained $1 The menu of dishes was created by a celebrity chef, who regularly visits the restaurant. The chef is paid a royalty fee of 3.5% of gross revenue. The original cost of the current assets are as follows: Fixed assets (net) Land $165,000 Building 650,750 Computer and equipment 55,000 Furniture, fixtures, and equipment 105,000 Kitchen equipment 275,000 The capital assets are depreciated in the same manner as their capital cost allowance (CCA). The following CCA rates are used: building, 10%; computer equipment, ses, and equipment, 20%; and kitchen equipment, 30%. Deferred revenue represents the value of gift cards sold, but not yet redeemed. The company initially obtained a $1-million loan, which was repaid with blended payments over a five-year period, with interest of 7%. Alex has been paying himself an annual dividend of $40,000. He would like this dividend to continue into the future. In addition, Alex draws an annual salary of $95,000, which reflects the fair market value of the services he provides. Future Financial Results - Mississauga Operations . The Mississauga location is expected to generate the same revenues, and net income, as the Toronto operation