Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Source Sandals is a subsidiary of Pony Industries. In 2019, Pony purchased land from Source for $10,000,000. Source had carried the land at $12,500,000

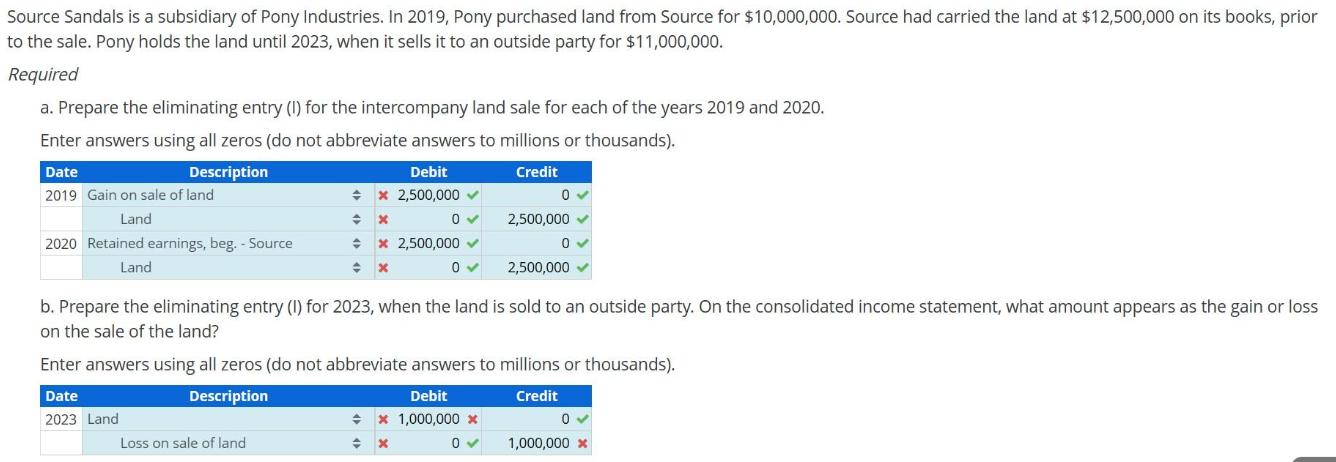

Source Sandals is a subsidiary of Pony Industries. In 2019, Pony purchased land from Source for $10,000,000. Source had carried the land at $12,500,000 on its books, prior to the sale. Pony holds the land until 2023, when it sells it to an outside party for $11,000,000. Required a. Prepare the eliminating entry (1) for the intercompany land sale for each of the years 2019 and 2020. Enter answers using all zeros (do not abbreviate answers to millions or thousands). Description Credit Date 2019 Gain on sale of land Land 2020 Retained earnings, beg. - Source Land Debit * * x 2,500,000 + x 0 x 2,500,000 x 0 Loss on sale of land 0 2,500,000 0 b. Prepare the eliminating entry (I) for 2023, when the land is sold to an outside party. On the consolidated income statement, what amount appears as the gain or loss on the sale of the land? 2,500,000 Enter answers using all zeros (do not abbreviate answers to millions or thousands). Date Description Credit 2023 Land Debit * 1,000,000 * 0 0 1,000,000 *

Step by Step Solution

★★★★★

3.41 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Polution 2 Elimination Entry in Consolidation 2019 Note 1 2020 Note ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started