Answered step by step

Verified Expert Solution

Question

1 Approved Answer

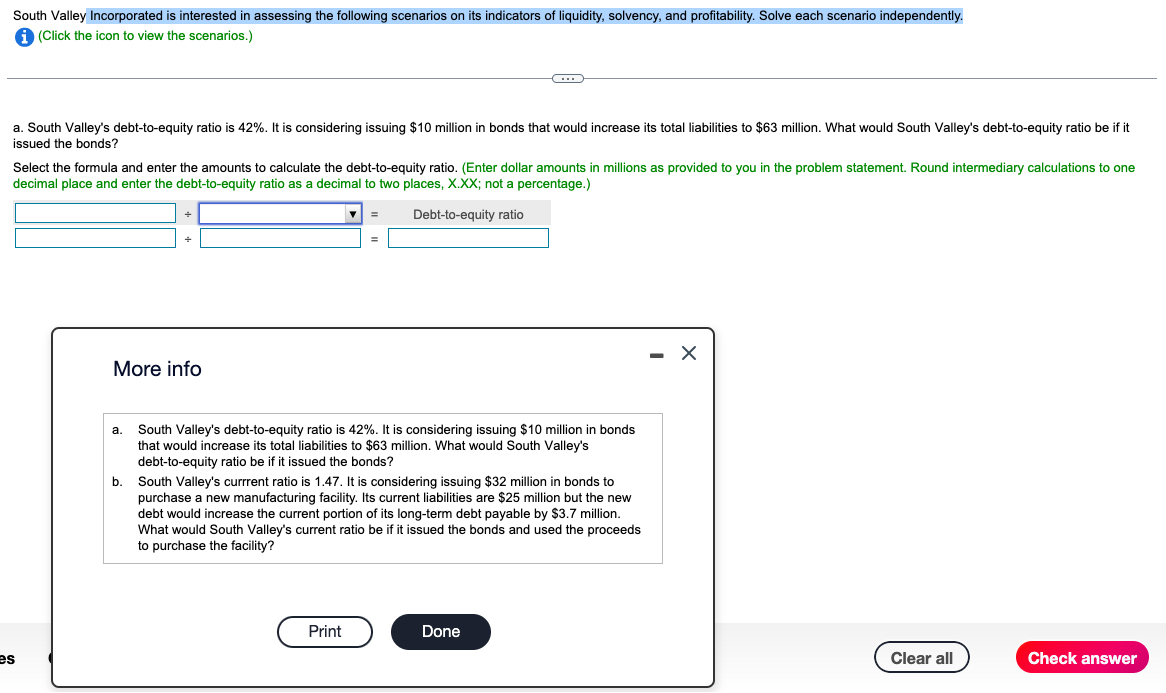

South valley Incorporated is interested in assessing the following scenarios on its indicators of liquidity, solvency, and profitability. Solve each scenario independently.issued the bonds? decimal

South valley Incorporated is interested in assessing the following scenarios on its indicators of liquidity, solvency, and profitability. Solve each scenario independently.issued the bonds?

decimal place and enter the debttoequity ratio as a decimal to two places, XXX; not a percentage.

Debtequity ratio

More info

a South Valley's debttoequity ratio is It is considering issuing $ million in bonds

that would increase its total liabilities to $ million. What would South Valley's

debttoequity ratio be if it issued the bonds?

b South Valley's currrent ratio is It is considering issuing $ million in bonds to

purchase a new manufacturing facility. Its current liabilities are $ million but the new

debt would increase the current portion of its longterm debt payable by $ million.

What would South Valley's current ratio be if it issued the bonds and used the proceeds

to purchase the facility?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started