Question

Southern Atlantic Distributors began operations in January 2021 and purchased a delivery truck for $40,000. Southern Atlantic plans to use straight-line depreciation over a four-year

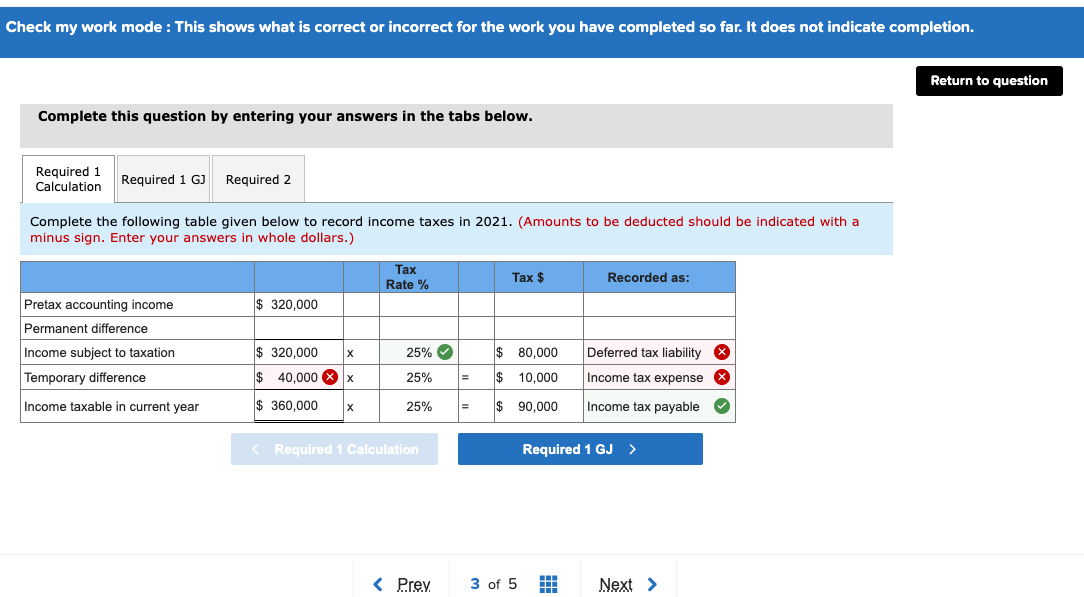

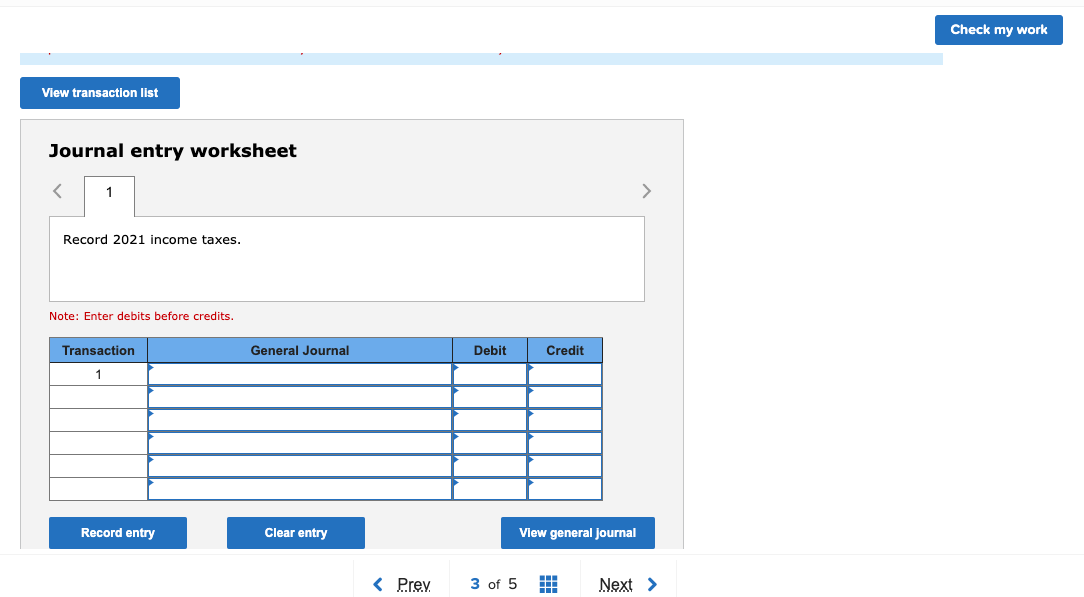

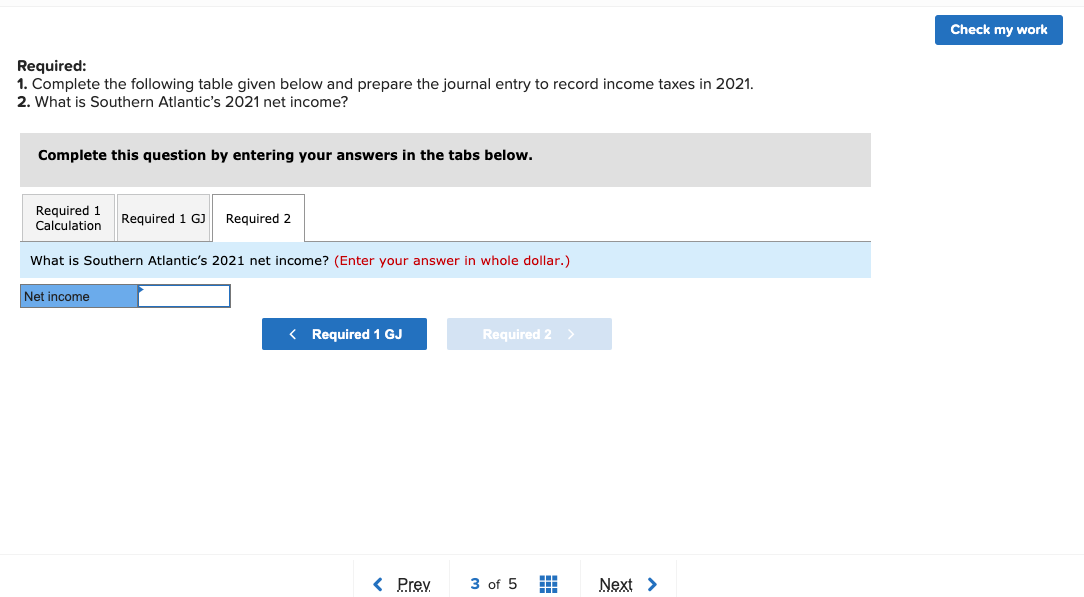

Southern Atlantic Distributors began operations in January 2021 and purchased a delivery truck for $40,000. Southern Atlantic plans to use straight-line depreciation over a four-year expected useful life for financial reporting purposes. For tax purposes, the deduction is 50% of cost in 2021, 30% in 2022, and 20% in 2023. Pretax accounting income for 2021 was $320,000, which includes interest revenue of $32,000 from municipal governmental bonds. The enacted tax rate is 25%. Assuming no differences between accounting income and taxable income other than those described above: Required: 1. Complete the following table given below and prepare the journal entry to record income taxes in 2021. 2. What is Southern Atlantics 2021 net income?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started