Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sovereign Debt Negotiations. A sovereign borrower is considering a $100 million loan for a 4-year maturity. It will be an amortizing loan, meaning that the

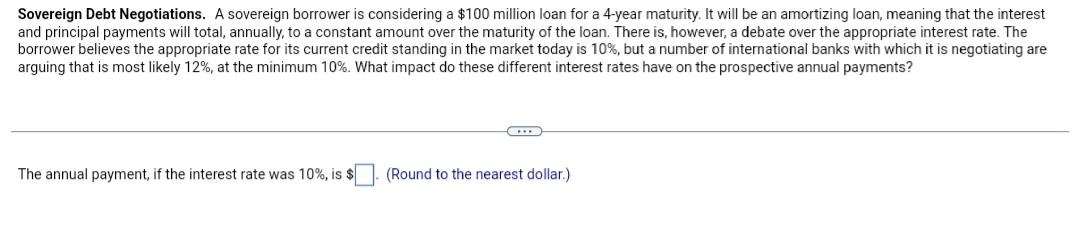

Sovereign Debt Negotiations. A sovereign borrower is considering a $100 million loan for a 4-year maturity. It will be an amortizing loan, meaning that the interest and principal payments will total, annually, to a constant amount over the maturity of the loan. There is, however, a debate over the appropriate interest rate. The borrower believes the appropriate rate for its current credit standing in the market today is 10%, but a number of international banks with which it is negotiating are arguing that is most likely 12%, at the minimum 10%. What impact do these different interest rates have on the prospective annual payments? The annual payment, if the interest rate was 10%, is $ (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started