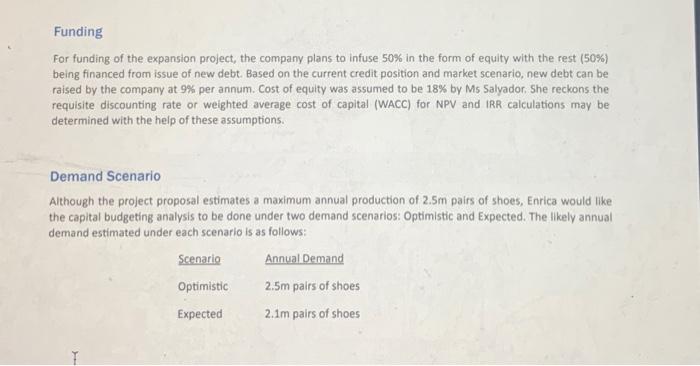

Spanish Footwear Market The Spanish footwear market is a very vibrant one and accounts for a respectable amount of the country's GDP (Gross Domestic Product). The footwear market in Spain Is a $8bn Industry and it has been growing at a compounded annual rate of 2.7% in recent years, 0.2% faster than the country's economy. The market for women's footwear (56%) is slightly larger than for men's (46%), and women's footwear has been the higher earner in terms of profit margins for several years. The industry is expected to maintain its steady growth and to continue attracting the attention of potential new entrants (and thus, competitors) into the sector. Company Background Calzados Pasoli is a luxury shoe manufacturer based just outside the city center in Elche, a lovely city on the southeast coast of Spain, in the province of Alicante. The city was founded in the 5th century BC as an Iberian settleinent and boasts several historical sites and lots of tourist attractions. It presently has a population of just over 230,000, a number that has not changed significantly over the past ten years. With that population size, Elche is home to less than one percent of Spain's residents, but with its more than 1,000 shoe factories, it is easily the most important footwear center in Spain and, Indeed, one of the most important in the whole of Europe. The footwear industry has been synonymous with the city of Elche for centuries. Calzados Pasoll Shoe Company was founded by the Pasoll family only relatively recently, in 1982, but has grown in strength and stature since then, and has become one of the top luxury shoe manufacturers in the whole of Spain, exporting its footwear to continents as far away as Australia. It currently has a healthy operating margin ratio and low leverage levels, and has been growing its profits at a CAGR (compounded annual growth rate) of 25% during the last 8 years Project Investment Proposal Details The project is estimated to be of 10 years duration and is expected to begin at the start of 2022, if it goes ahead. It involves setting up new machinery with an estimated cost of as much as $550m, including installation. This amount could be depreciated using the straight line method (SLM) over a period of 10 years with a resale value of $10m. The project would require an initial working capital of $25m with cumulative Investment in net working capital to be maintained at 10% of each year's projected revenue. With the planned new capacity, the company would be able to produce 2.5m pairs of shoes each year for the next 10 years. In terms of pricing, each pair of shoes can Initially be sold at $130. The project proposal incorporates an annual increase of 2.5% in the price of the shoes to compensate for inflationary impact. With regards to the raw material costs and other expenses, the project estimated the following details: Raw materials cost for manufacturing: $45 per pair of shoes slated to rise by 3% per annum on account of inflation Other direct manufacturing costs: $15 per pair of shoes, with an annual increase of 3% per annum on account of inflation . Selling, general, and administrative expenses (including employee expenses): $30m per annum, expected to increase by 10% each year. Depreciation expense on the basis of SLM. Tax rate is assumed to be 25% I Funding For funding of the expansion project, the company plans to infuse 50% in the form of equity with the rest (50%) being financed from issue of new debt. Based on the current credit position and market scenario, new debt can be raised by the company at 9% per annum. Cost of equity was assumed to be 18% by Ms Salyador . She reckons the requisite discounting rate or weighted average cost of capital (WACC) for NPV and IRR calculations may be determined with the help of these assumptions. Demand Scenario Although the project proposal estimates a maximum annual production of 2.5m pairs of shoes, Enrica would like the capital budgeting analysis to be done under two demand scenarios: Optimistic and Expected. The likely annual demand estimated under each scenario is as follows: Scenario Annual Demand Optimistic 2.5m palrs of shoes Expected 2.1m pairs of shoes Your Mandate 1. On the basis of the financial information given here, calculate the after-tax free cash flows (FCF), NPV, and IRR under the Optimistic and Expected scenarios. Clearly specify the calculations applied. II. Based on your analysis, what recommendation would you make on whether the company should undertake the project or not? Clearly specify the decision based on both the NPV and the IRR criteria