Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sparks Ltd is a recently formed company aiming to provide alternative energy solutions to a broad market. The company imports and pays for all

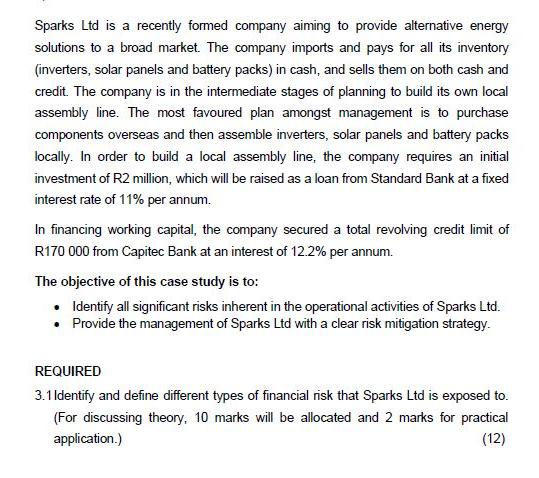

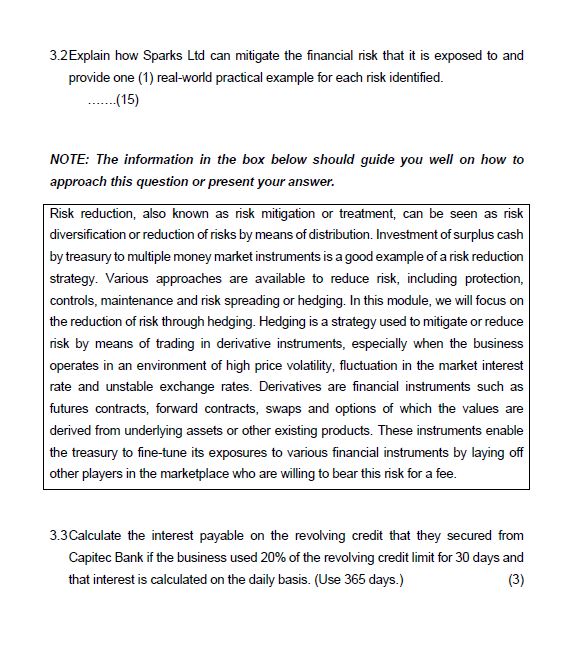

Sparks Ltd is a recently formed company aiming to provide alternative energy solutions to a broad market. The company imports and pays for all its inventory (inverters, solar panels and battery packs) in cash, and sells them on both cash and credit. The company is in the intermediate stages of planning to build its own local assembly line. The most favoured plan amongst management is to purchase components overseas and then assemble inverters, solar panels and battery packs locally. In order to build a local assembly line, the company requires an initial investment of R2 million, which will be raised as a loan from Standard Bank at a fixed interest rate of 11% per annum. In financing working capital, the company secured a total revolving credit limit of R170 000 from Capitec Bank at an interest of 12.2% per annum. The objective of this case study is to: Identify all significant risks inherent in the operational activities of Sparks Ltd. Provide the management of Sparks Ltd with a clear risk mitigation strategy. REQUIRED 3.1 Identify and define different types of financial risk that Sparks Ltd is exposed to. (For discussing theory, 10 marks will be allocated and 2 marks for practical application.) (12) 3.2 Explain how Sparks Ltd can mitigate the financial risk that it is exposed to and provide one (1) real-world practical example for each risk identified. ....... (15) NOTE: The information in the box below should guide you well on how to approach this question or present your answer. Risk reduction, also known as risk mitigation or treatment, can be seen as risk diversification or reduction of risks by means of distribution. Investment of surplus cash by treasury to multiple money market instruments is a good example of a risk reduction strategy. Various approaches are available to reduce risk, including protection, controls, maintenance and risk spreading or hedging. In this module, we will focus on the reduction of risk through hedging. Hedging is a strategy used to mitigate or reduce risk by means of trading in derivative instruments, especially when the business operates in an environment of high price volatility, fluctuation in the market interest rate and unstable exchange rates. Derivatives are financial instruments such as futures contracts, forward contracts, swaps and options of which the values are derived from underlying assets or other existing products. These instruments enable the treasury to fine-tune its exposures to various financial instruments by laying off other players in the marketplace who are willing to bear this risk for a fee. 3.3 Calculate the interest payable on the revolving credit that they secured from Capitec Bank if the business used 20% of the revolving credit limit for 30 days and that interest is calculated on the daily basis. (Use 365 days.) (3)

Step by Step Solution

★★★★★

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

31 Types of financial risks that Sparks Ltd ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started