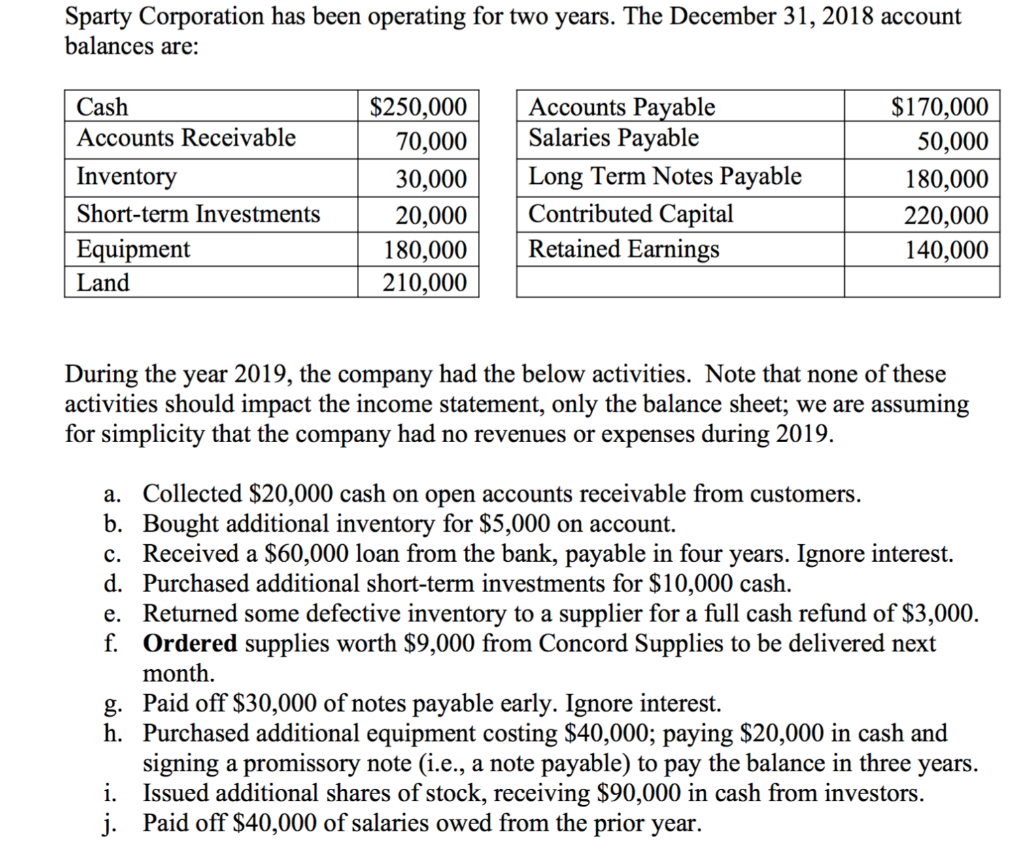

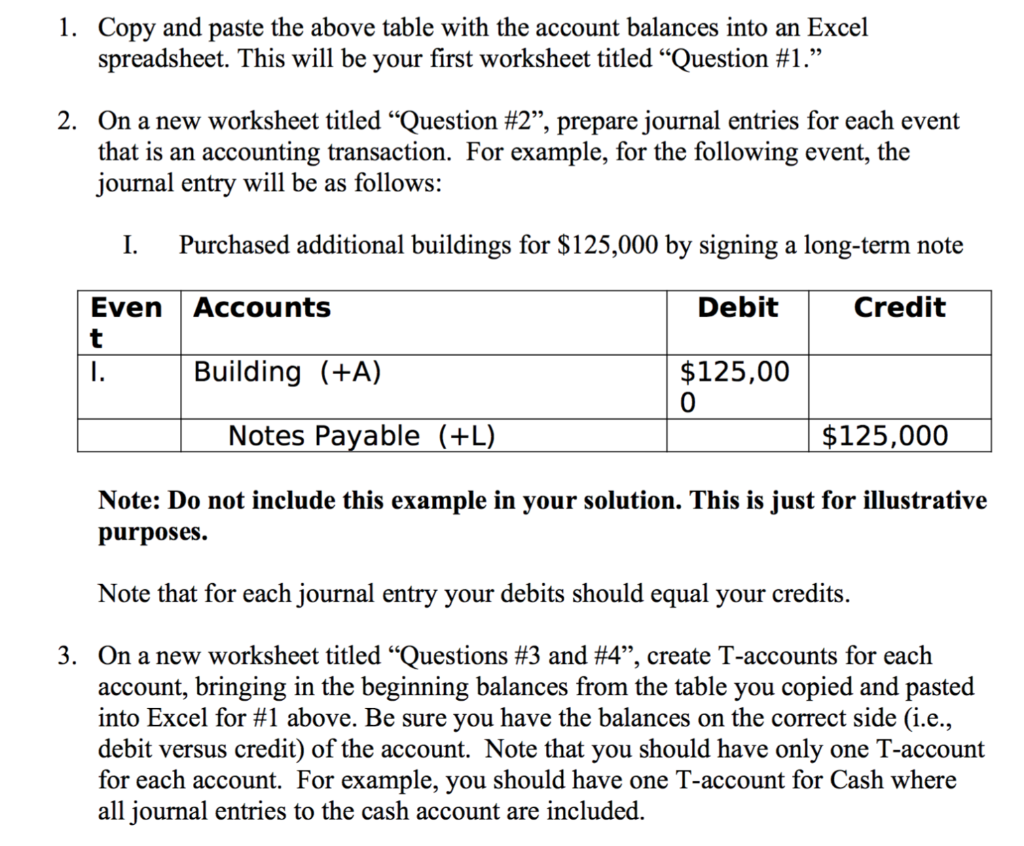

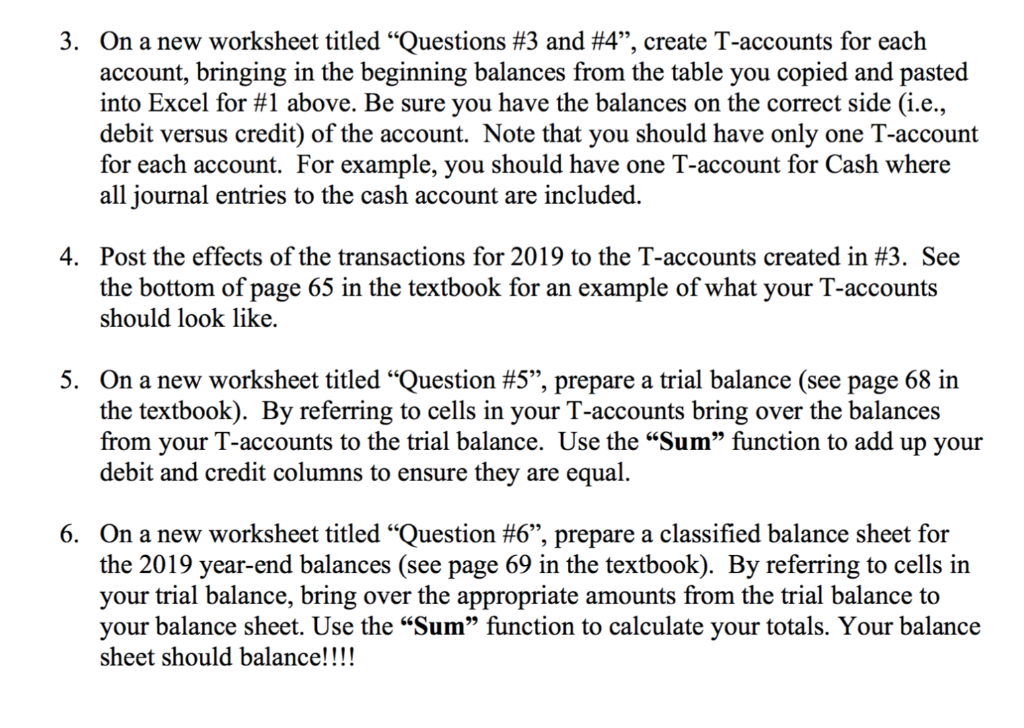

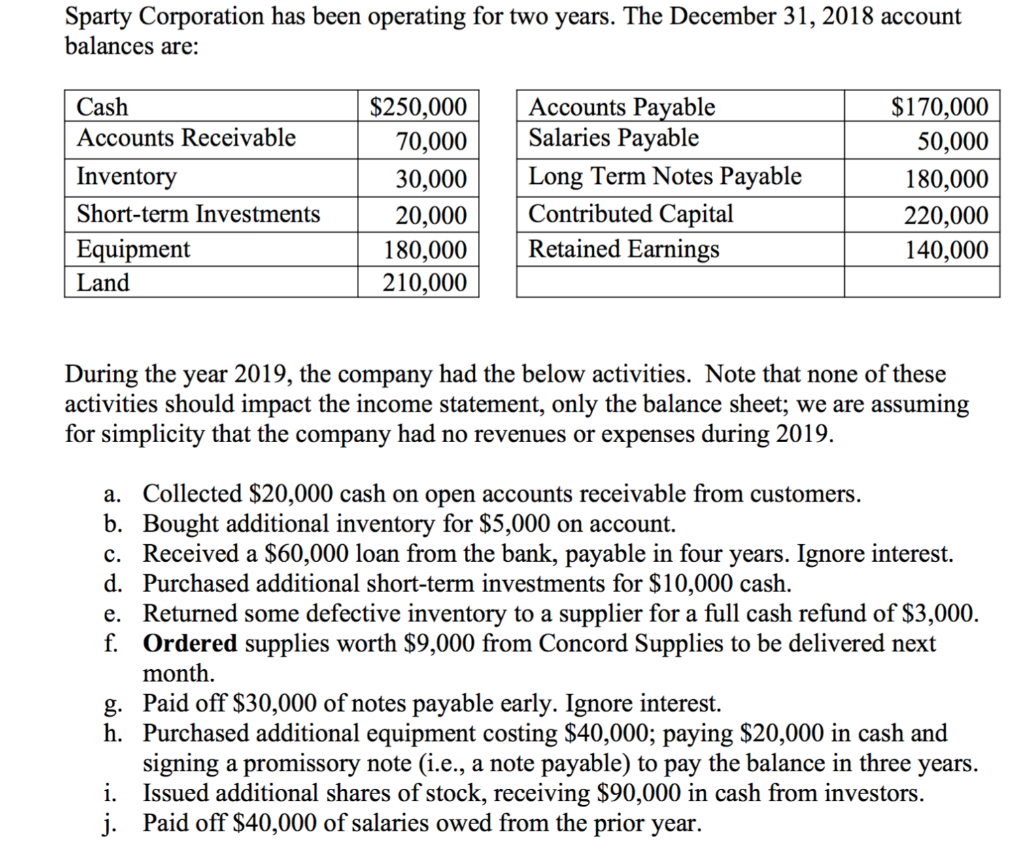

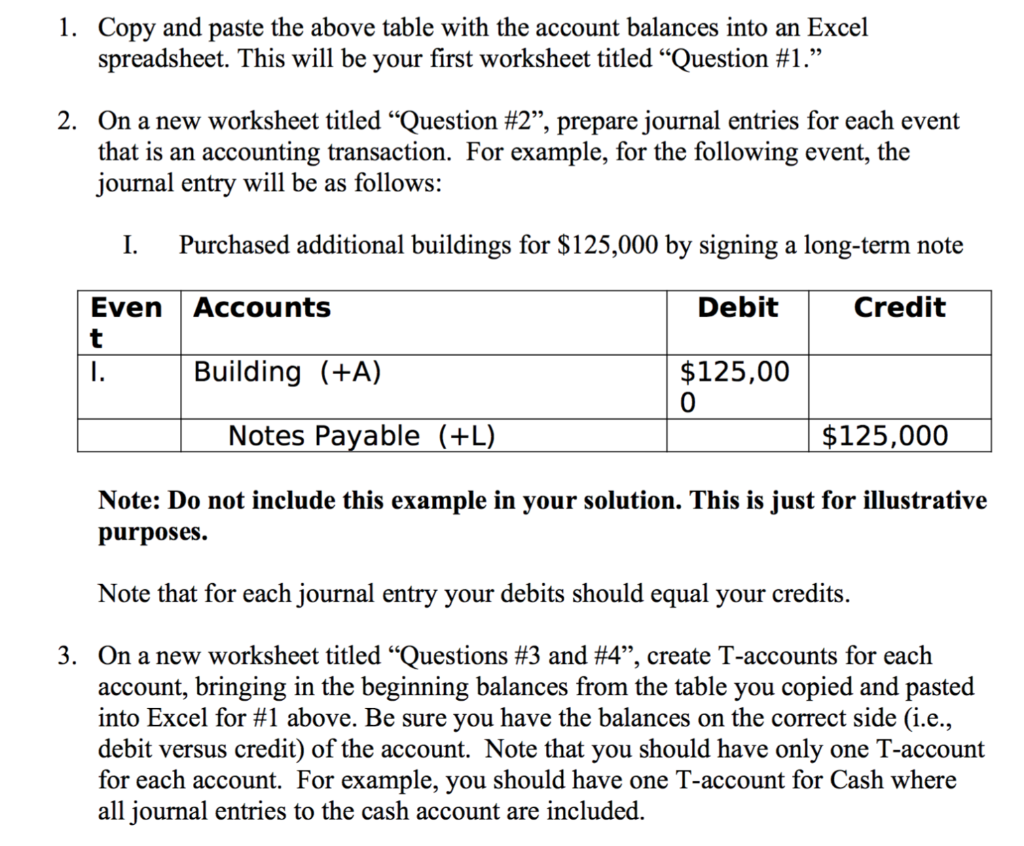

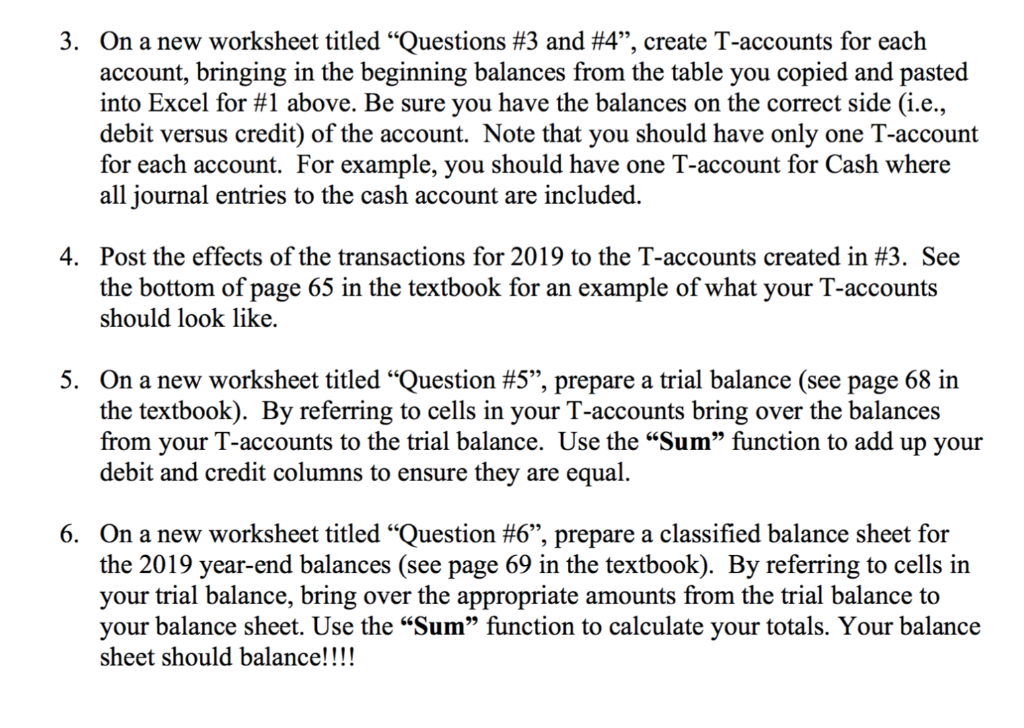

Sparty Corporation has been operating for two years. The December 31, 2018 account balances are: Cash Accounts Receivable Inventory Short-term Investments Equipment Land $250,000 70,000 30,000 20,000 180,000 210,000 Accounts Payable Salaries Payable Long Term Notes Payable Contributed Capital Retained Earnings $170,000 50,000 180,000 220,000 140,000 During the year 2019, the company had the below activities. Note that none of these activities should impact the income statement, only the balance sheet; we are assuming for simplicity that the company had no revenues or expenses during 2019. a. Collected $20,000 cash on open accounts receivable from customers. b. Bought additional inventory for $5,000 on account. c. Received a $60,000 loan from the bank, payable in four years. Ignore interest. d. Purchased additional short-term investments for $10,000 cash. e. Returned some defective inventory to a supplier for a full cash refund of $3,000. f. Ordered supplies worth $9,000 from Concord Supplies to be delivered next month. g. Paid off $30,000 of notes payable early. Ignore interest. h. Purchased additional equipment costing $40,000; paying $20,000 in cash and signing a promissory note (i.e., a note payable) to pay the balance in three years. i. Issued additional shares of stock, receiving $90,000 in cash from investors. j. Paid off $40,000 of salaries owed from the prior year. 1. Copy and paste the above table with the account balances into an Excel spreadsheet. This will be your first worksheet titled Question #1. 2. On a new worksheet titled Question #2, prepare journal entries for each event that is an accounting transaction. For example, for the following event, the journal entry will be as follows: I. Purchased additional buildings for $125,000 by signing a long-term note Accounts Debit Credit Even t 1. Building (+A) $125,00 0 Notes Payable (+L) $125,000 Note: Do not include this example in your solution. This is just for illustrative purposes. Note that for each journal entry your debits should equal your credits. 3. On a new worksheet titled Questions #3 and #4, create T-accounts for each account, bringing in the beginning balances from the table you copied and pasted into Excel for #1 above. Be sure you have the balances on the correct side (i.e., debit versus credit) of the account. Note that you should have only one T-account for each account. For example, you should have one T-account for Cash where all journal entries to the cash account are included. 3. On a new worksheet titled Questions #3 and #4, create T-accounts for each account, bringing in the beginning balances from the table you copied and pasted into Excel for #1 above. Be sure you have the balances on the correct side (i.e., debit versus credit) of the account. Note that you should have only one T-account for each account. For example, you should have one T-account for Cash where all journal entries to the cash account are included. 4. Post the effects of the transactions for 2019 to the T-accounts created in #3. See the bottom of page 65 in the textbook for an example of what your T-accounts should look like. 5. On a new worksheet titled Question #5, prepare a trial balance (see page 68 in the textbook). By referring to cells in your T-accounts bring over the balances from your T-accounts to the trial balance. Use the Sum function to add up your debit and credit columns to ensure they are equal. 6. On a new worksheet titled Question #6, prepare a classified balance sheet for the 2019 year-end balances (see page 69 in the textbook). By referring to cells in your trial balance, bring over the appropriate amounts from the trial balance to your balance sheet. Use the Sum function to calculate your totals. Your balance sheet should balance!!!! Sparty Corporation has been operating for two years. The December 31, 2018 account balances are: Cash Accounts Receivable Inventory Short-term Investments Equipment Land $250,000 70,000 30,000 20,000 180,000 210,000 Accounts Payable Salaries Payable Long Term Notes Payable Contributed Capital Retained Earnings $170,000 50,000 180,000 220,000 140,000 During the year 2019, the company had the below activities. Note that none of these activities should impact the income statement, only the balance sheet; we are assuming for simplicity that the company had no revenues or expenses during 2019. a. Collected $20,000 cash on open accounts receivable from customers. b. Bought additional inventory for $5,000 on account. c. Received a $60,000 loan from the bank, payable in four years. Ignore interest. d. Purchased additional short-term investments for $10,000 cash. e. Returned some defective inventory to a supplier for a full cash refund of $3,000. f. Ordered supplies worth $9,000 from Concord Supplies to be delivered next month. g. Paid off $30,000 of notes payable early. Ignore interest. h. Purchased additional equipment costing $40,000; paying $20,000 in cash and signing a promissory note (i.e., a note payable) to pay the balance in three years. i. Issued additional shares of stock, receiving $90,000 in cash from investors. j. Paid off $40,000 of salaries owed from the prior year. 1. Copy and paste the above table with the account balances into an Excel spreadsheet. This will be your first worksheet titled Question #1. 2. On a new worksheet titled Question #2, prepare journal entries for each event that is an accounting transaction. For example, for the following event, the journal entry will be as follows: I. Purchased additional buildings for $125,000 by signing a long-term note Accounts Debit Credit Even t 1. Building (+A) $125,00 0 Notes Payable (+L) $125,000 Note: Do not include this example in your solution. This is just for illustrative purposes. Note that for each journal entry your debits should equal your credits. 3. On a new worksheet titled Questions #3 and #4, create T-accounts for each account, bringing in the beginning balances from the table you copied and pasted into Excel for #1 above. Be sure you have the balances on the correct side (i.e., debit versus credit) of the account. Note that you should have only one T-account for each account. For example, you should have one T-account for Cash where all journal entries to the cash account are included. 3. On a new worksheet titled Questions #3 and #4, create T-accounts for each account, bringing in the beginning balances from the table you copied and pasted into Excel for #1 above. Be sure you have the balances on the correct side (i.e., debit versus credit) of the account. Note that you should have only one T-account for each account. For example, you should have one T-account for Cash where all journal entries to the cash account are included. 4. Post the effects of the transactions for 2019 to the T-accounts created in #3. See the bottom of page 65 in the textbook for an example of what your T-accounts should look like. 5. On a new worksheet titled Question #5, prepare a trial balance (see page 68 in the textbook). By referring to cells in your T-accounts bring over the balances from your T-accounts to the trial balance. Use the Sum function to add up your debit and credit columns to ensure they are equal. 6. On a new worksheet titled Question #6, prepare a classified balance sheet for the 2019 year-end balances (see page 69 in the textbook). By referring to cells in your trial balance, bring over the appropriate amounts from the trial balance to your balance sheet. Use the Sum function to calculate your totals. Your balance sheet should balance