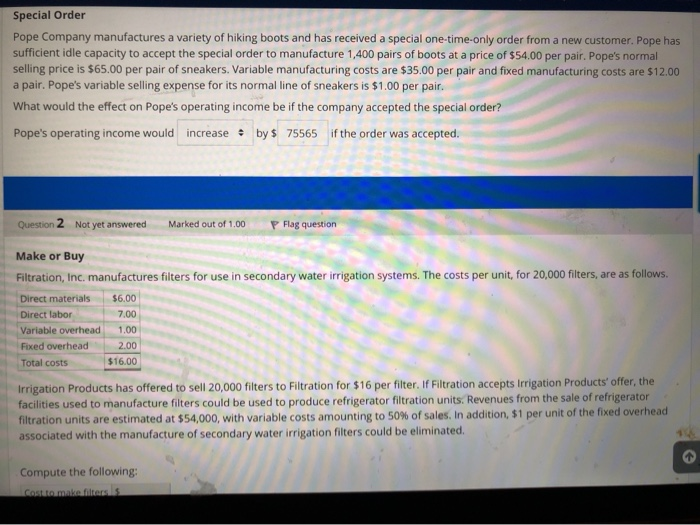

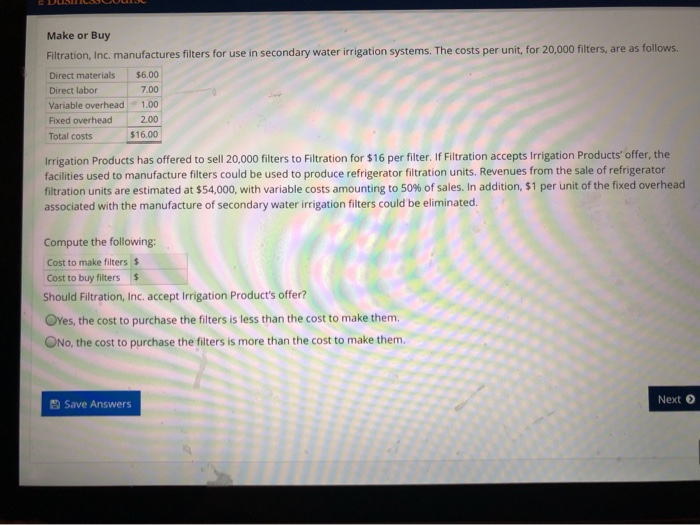

Special Order Pope Company manufactures a variety of hiking boots and has received a special one-time-only order from a new customer. Pope has sufficient idle capacity to accept the special order to manufacture 1,400 pairs of boots at a price of $54.00 per pair. Pope's normal selling price is $65.00 per pair of sneakers. Variable manufacturing costs are $35.00 per pair and fixed manufacturing costs are $12.00 a pair, Pope's variable selling expense for its normal line of sneakers is $1.00 per pair What would the effect on Pope's operating income be if the company accepted the special order? Pope's operating income would increase by $ 75565 if the order was accepted. Question 2 Not yet answered Marked out of 1.00 P Flag question Make or Buy Filtration, Inc. manufactures filters for use in secondary water irrigation systems. The costs per unit, for 20,000 filters, are as follows. Direct materials $6.00 Direct labor 7.00 Variable overhead 1.00 Fixed overhead 2.00 Total costs $16.00 Irrigation Products has offered to sell 20,000 filters to Filtration for $16 per filter. If Filtration accepts Irrigation Products' offer, the facilities used to manufacture filters could be used to produce refrigerator filtration units. Revenues from the sale of refrigerator filtration units are estimated at $54,000, with variable costs amounting to 50% of sales. In addition, $1 per unit of the fixed overhead associated with the manufacture of secondary water irrigation filters could be eliminated. Compute the following: costo makefilters Make or Buy Filtration, Inc. manufactures filters for use in secondary water irrigation systems. The costs per unit, for 20,000 filters, are as follows. Direct materials $6.00 Direct labor 7.00 Variable overhead 1.00 Fixed overhead 2.00 Total costs $16.00 Irrigation Products has offered to sell 20,000 filters to Filtration for $16 per filter. If Filtration accepts Irrigation Products offer, the facilities used to manufacture filters could be used to produce refrigerator filtration units. Revenues from the sale of refrigerator filtration units are estimated at $54,000, with variable costs amounting to 50% of sales. In addition, $1 per unit of the fixed overhead associated with the manufacture of secondary water irrigation filters could be eliminated. Compute the following: Cost to make filters Cost to buy filters $ Should Filtration, Inc. accept Irrigation Product's offer? Yes, the cost to purchase the filters is less than the cost to make them. No, the cost to purchase the filters is more than the cost to make them. Save Answers Next >