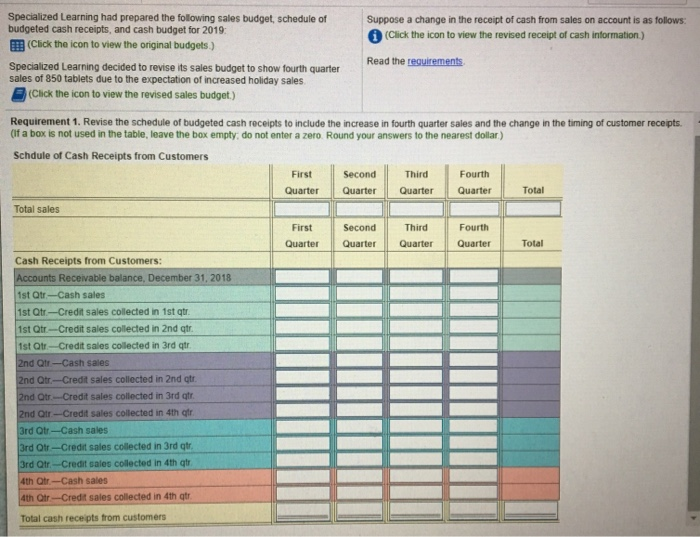

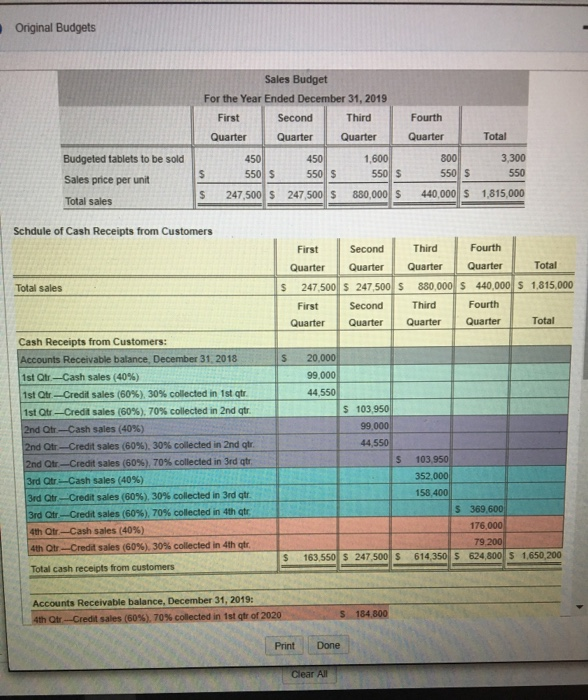

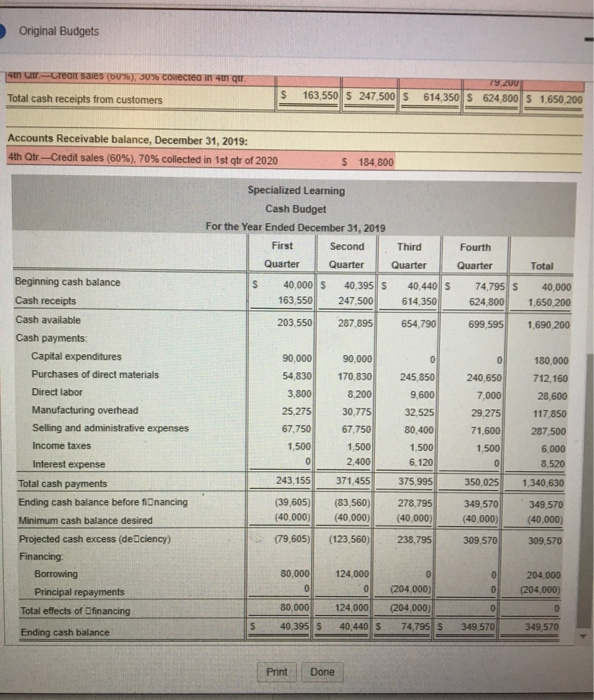

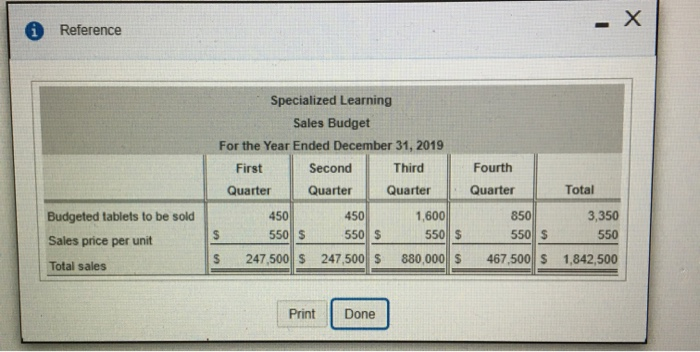

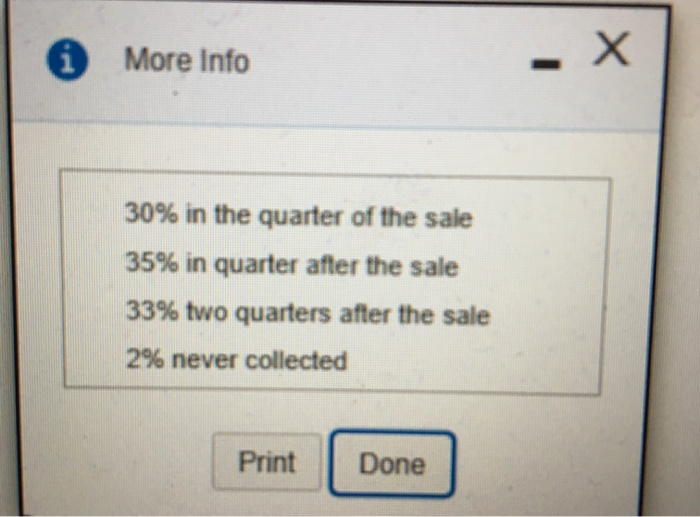

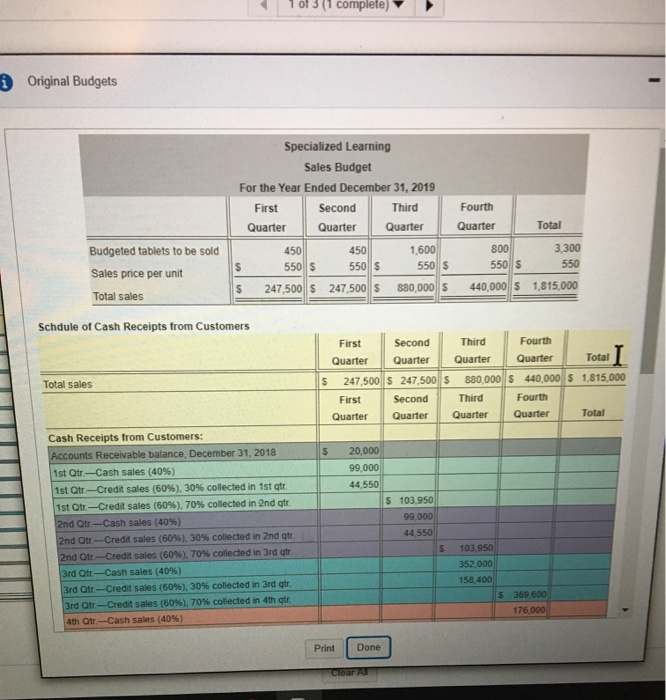

Specialized Learning had prepared the following sales budget, schedule of budgeted cash receipts, and cash budget for 2019: (Click the icon to view the original budgets.) Suppose a change in the receipt of cash from sales on account is as follows: (Click the icon to view the revised receipt of cash information) Read the requirements Specialized Learning decided to revise its sales budget to show fourth quarter sales of 850 tablets due to the expectation of increased holiday sales (Click the icon to view the revised sales budget.) Requirement 1. Revise the schedule of budgeted cash receipts to include the increase in fourth quarter sales and the change in the timing of customer receipts. (If a box is not used in the table, leave the box empty do not enter a zero Round your answers to the nearest dollar) Schdule of Cash Receipts from Customers First Second Third Fourth Quarter Quarter Quarter Quarter Total Total sales Second First Quarter Third Quarter Fourth Quarter Quarter Total Cash Receipts from Customers Accounts Receivable balance, December 31, 2018 1st Qtr-Cash sales 1st Qtr.--Credit sales collected in 1st qtr. 1st Qtr-Credit sales collected in 2nd qtr. 1st QtrCredit sales collected in 3rd qtr. 2nd Qtr-Cash sales 2nd Qtr.---Credit sales collected in 2nd qtr. 2nd Or-Credit sales collected in 3rd qtr. 2nd Qir-Credit sales collected in 4th gr. 3rd Qtr-Cash sales 3rd Qtr-Credit sales collected in 3rd qtr. 3rd QtrCredit sales collected in 4th qtr 4th Q.-Cash sales 4th Or-Credit sales collected in 4th qtr. Total cash receipts from customers Original Budgets Fourth Sales Budget For the Year Ended December 31, 2019 Second Third Quarter Quarter Quarter 450 550 S 550 $ $ 247,500 $ 247,500 $ 880,000 $ Quarter Total 450 Budgeted tablets to be sold Sales price per unit Total sales 800 550 3,300 $ 550 440,000 $ 1,815,000 Schdule of Cash Receipts from Customers Total sales First Second Third Fourth Quarter Quarter Quarter Quarter Total 247.500 $ 247.500 $ 880,000 $ 440,000 $ 1,815,000 Second Third Fourth Quarter Quarter Quarter Quarter Total First $ 20,000 99.000 44.550 $ 103,950 99.000 44,550 Cash Receipts from Customers: Accounts Receivable balance, December 31, 2018 Ist Otr-Cash sales (40%) 1st Or-Credit sales (60%), 30% collected in 1st qtr. 1st Otr --Credit sales (60%). 70% collected in 2nd qtr. 2nd Qtr-Cash sales (40%) 2nd Qtr-Credit sales (60%), 30% collected in 2nd qlr. 2nd Qur-Credit sales (60%), 70% collected in 3rd qr 3rd Qtr-Cash sales (40%) 3rd Qtr-Credit sales (60%). 30% collected in 3rd qr. 3rd Qtr-Credit sales (60%), 70% collected in that 4th Otr-Cash sales (40%) 4th Or-Credit sales (60%) 30% collected in 4th gr Total cash receipts from customers 103.950 352.000 158.400 369.600 176,000 79 200 614,350 624,800 5 1,650,200 $ 163,550 S 247.500 S Accounts Receivable balance, December 31, 2019: 4th Or --Credit sales (60%), 70% collected in 1st at of 2020 5 184.800 Print Done IL Clear All Original Budgets 140 -Crear sales (u ), 30% conected in un qur Total cash receipts from customers 163,550 S 247.500S 614,350 S 624 800 S 1650 200 Accounts Receivable balance, December 31, 2019: 4th Or --Credit sales (60%). 70% collected in 1st or of 2020 $ 184 800 Specialized Learning Cash Budget For the Year Ended December 31, 2019 First Second Third Quarter Quarter Quarter 40,000 $ 40,395 S 40.440 $ 163,550 247,500 614,350 203.550 287,895 654,790 Total Fourth Quarter 74,795 $ 624,800 699,595 40,000 1,650,200 1,690,200 90,000 54830 3,800 25,275 67.750 1,500 Beginning cash balance Cash receipts Cash available Cash payments: Capital expenditures Purchases of direct materials Direct labor Manufacturing overhead Selling and administrative expenses Income taxes Interest expense Total cash payments Ending cash balance before financing Minimum cash balance desired Projected cash excess (de Ociency) Financing Borrowing Principal repayments Total effects of financing Ending cash balance 90,000 170,830 8.200 30,775 67,750 1,500 2.400 371.455 245,850 9,600 32,525 80,400 1,500 6,120 375,995 240,650 7,000 29,275 71,600 1,500 180,000 712,160 28,600 117,850 287,500 6.000 8.520 243,155 350.025 1,340,630 (39,605) (40,000) (83.560) (40,000) (123,560) 278,795 (40.000) 349,570 (40.000) 349,570 (40,000) (79.605) 238,795 309,570 309,570 80,000 124.000 204.000 (204.000) 80,000 40.395 S 124.000 40.440 5 (204,000) (204.000) 74.795 S 5 349.570 349 570 Print Done Reference Specialized Learning Sales Budget For the Year Ended December 31, 2019 First Second Third Fourth Quarter Quarter Quarter Quarter Total 450 1,600 850 3,350 550 $ 550 $ 550 550 $ 550 $ 247,500 $ 247,500 $ 880,000 S 467,500 $ 1,842,500 450 Budgeted tablets to be sold Sales price per unit Total sales Print Done * More Info - X 30% in the quarter of the sale 35% in quarter after the sale 33% two quarters after the sale 29 never collected Print Done 1 of 3 (1 complete) i Original Budgets Specialized Learning Sales Budget For the Year Ended December 31, 2019 First Second Third Quarter Quarter Quarter Fourth Quarter Total 450 800 3,300 Budgeted tablets to be sold Sales price per unit 450 550 550 1,600 550 880,000 S 550 5 440,000 $ 550 1,815,000 $ 247,500 S 247,500 $ Total sales Schdule of Cash Receipts from Customers Total First Second Third Fourth Quarter Quarter Quarter Quarter 247,500 $ 247,500 $ 880,000 $ 440,000 $ First Second Third Fourth Quarter Quarter Quarter Quarter 1,815,000 Total sales Total 20,000 99,000 44,550 Cash Receipts from Customers: Accounts Receivable balance, December 31, 2018 1st Qtr-Cash sales (40%) 1st Qtr-Credit sales (60%), 30% collected in 1st qtr. 1st Qtr --Credit sales (60%), 70% collected in 2nd qtr. 2nd Otr-Cash sales (409) 2nd Otr-Credit sales (60%), 30% collected in 2nd qtr. 2nd Ott --Credit sales (60%). 70% collected in 3rd qtr 3rd Qtr-Cash sales (40%) 3rd Qtr-Credit sales (60%), 30% collected in 3rd gr. 3rd Otr-Credit sales (60%), 70% collected in 4th qtr. 4th Qt-Cash sales (40%) $ 103950 99,000 44,550 $ 103.950 352.000 158,400 5 369.600 176.000 Print Print Done