**specifically part E please!**

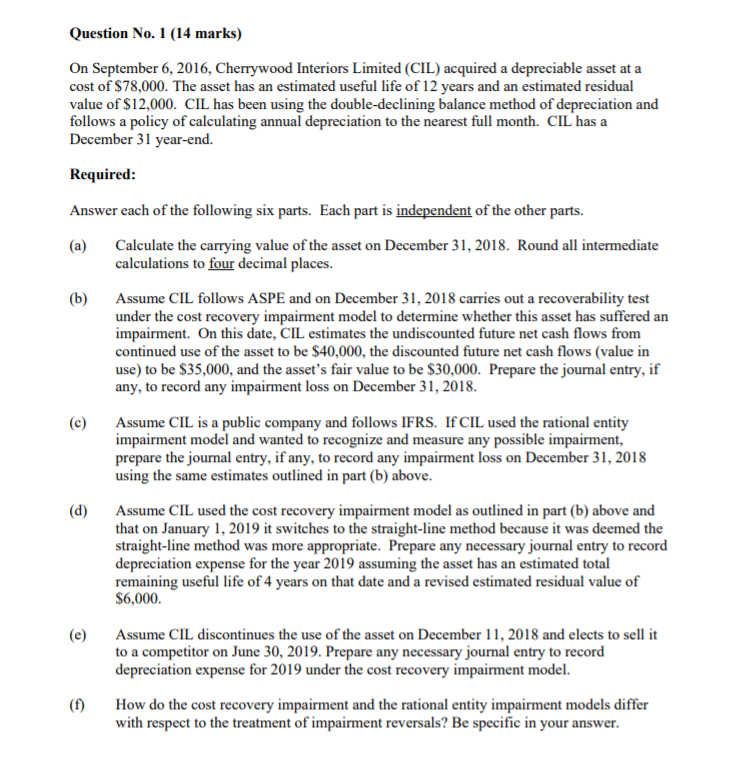

(b) Question No. 1 (14 marks) On September 6, 2016, Cherrywood Interiors Limited (CIL) acquired a depreciable asset at a cost of $78,000. The asset has an estimated useful life of 12 years and an estimated residual value of $12,000. CIL has been using the double-declining balance method of depreciation and follows a policy of calculating annual depreciation to the nearest full month. CIL has a December 31 year-end. Required: Answer each of the following six parts. Each part is independent of the other parts. Calculate the carrying value of the asset on December 31, 2018. Round all intermediate calculations to four decimal places. Assume CIL follows ASPE and on December 31, 2018 carries out a recoverability test under the cost recovery impairment model to determine whether this asset has suffered an impairment. On this date, CIL estimates the undiscounted future net cash flows from continued use of the asset to be $40,000, the discounted future net cash flows (value in use) to be $35,000, and the asset's fair value to be $30,000. Prepare the journal entry, if any, to record any impairment loss on December 31, 2018. Assume CIL is a public company and follows IFRS. IF CIL used the rational entity impairment model and wanted to recognize and measure any possible impairment, prepare the journal entry, if any, to record any impairment loss on December 31, 2018 using the same estimates outlined in part (b) above. (d) Assume CIL used the cost recovery impairment model as outlined in part (b) above and that on January 1, 2019 it switches to the straight-line method because it was deemed the straight-line method was more appropriate. Prepare any necessary journal entry to record depreciation expense for the year 2019 assuming the asset has an estimated total remaining useful life of 4 years on that date and a revised estimated residual value of $6,000. Assume CIL discontinues the use of the asset on December 11, 2018 and elects to sell it to a competitor on June 30, 2019. Prepare any necessary journal entry to record depreciation expense for 2019 under the cost recovery impairment model. How do the cost recovery impairment and the rational entity impairment models differ with respect to the treatment of impairment reversals? Be specific in your answer. (c) (e) (1)