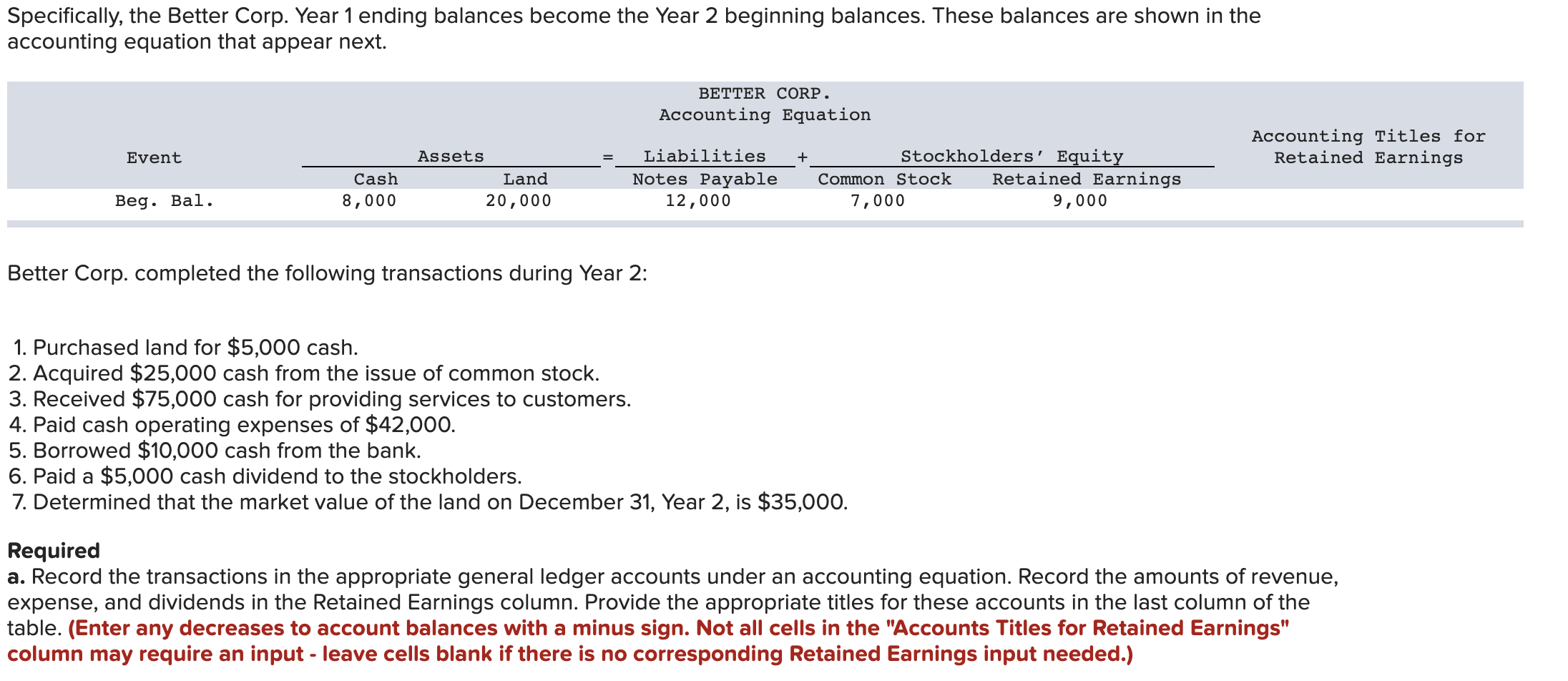

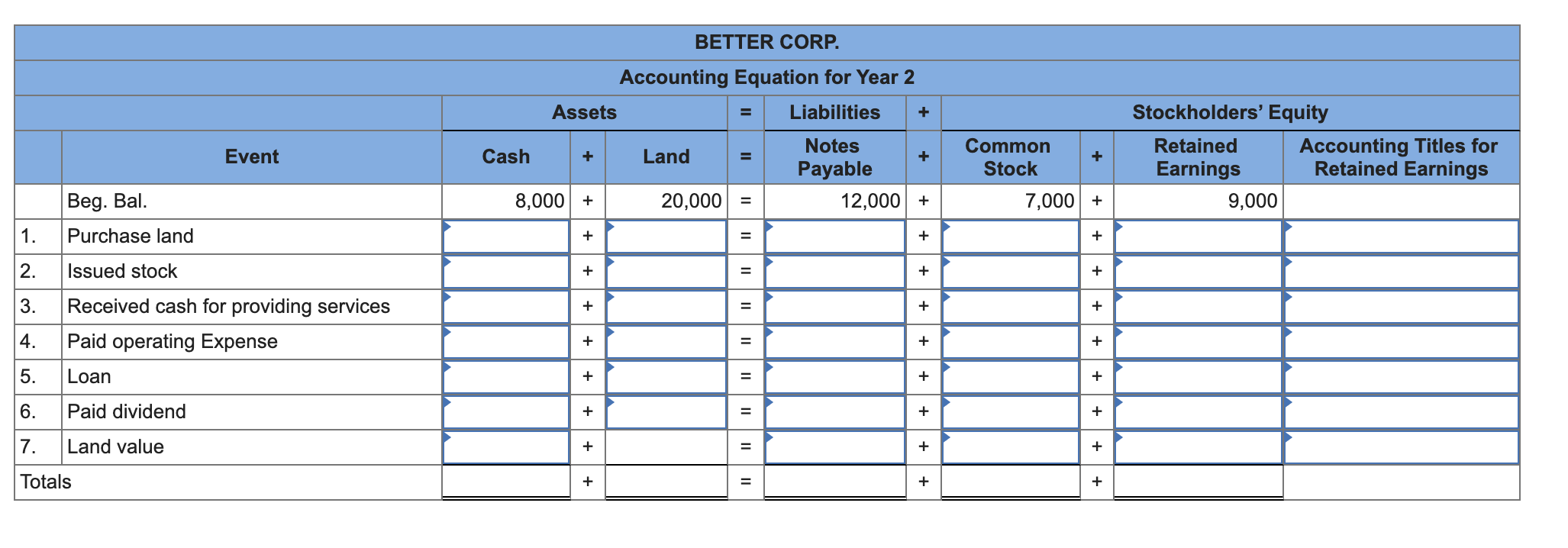

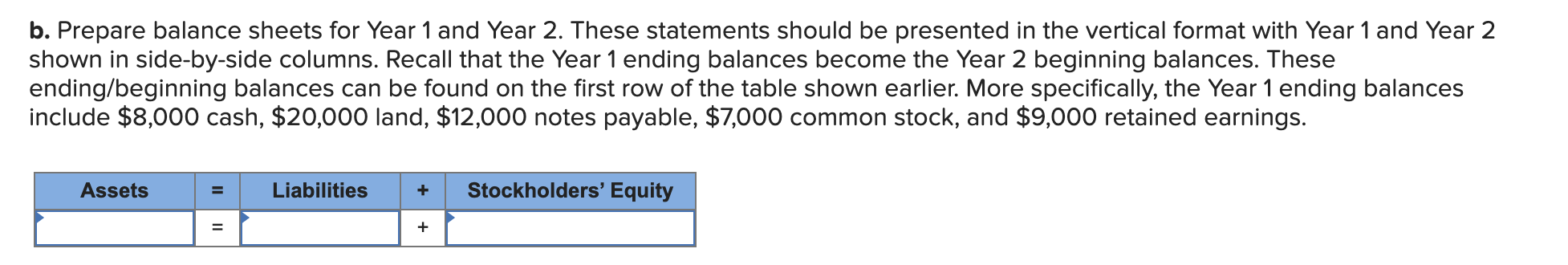

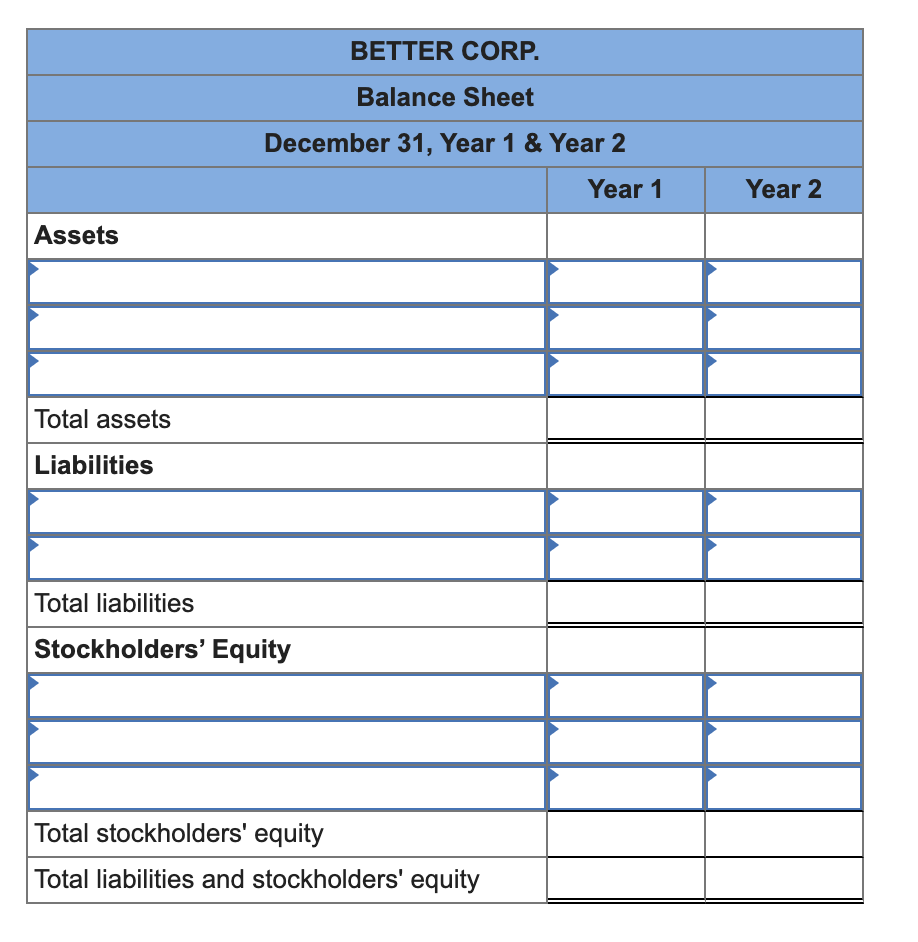

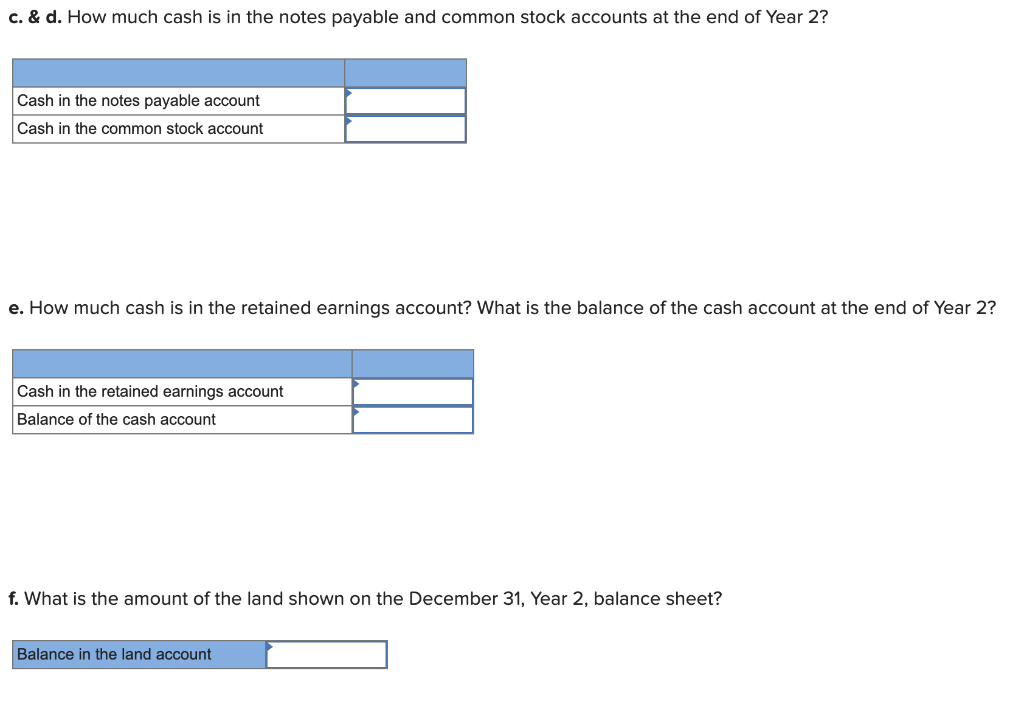

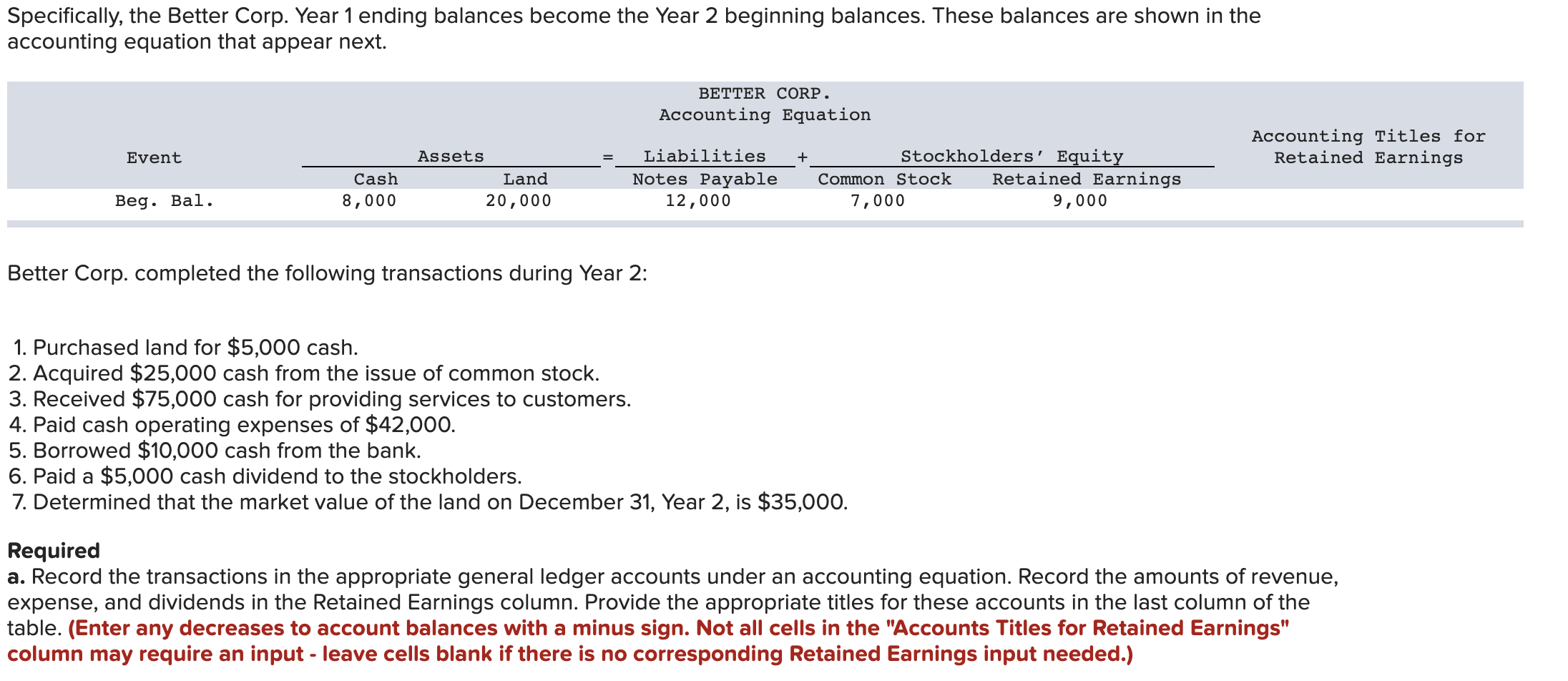

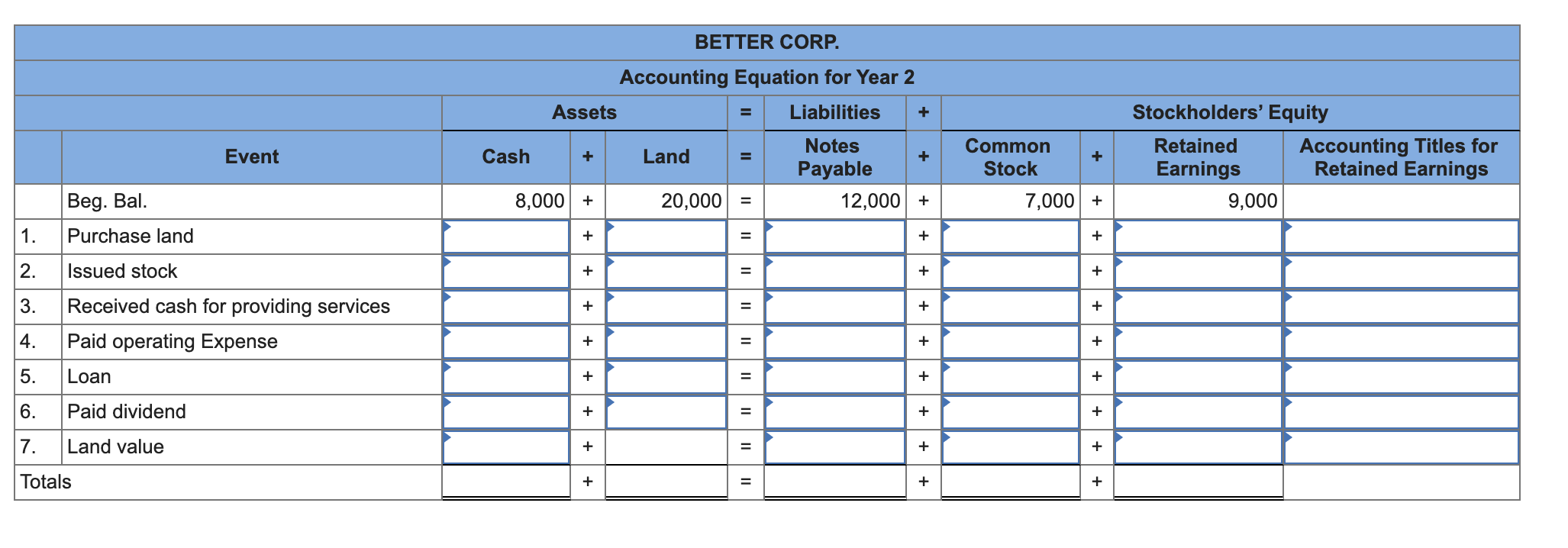

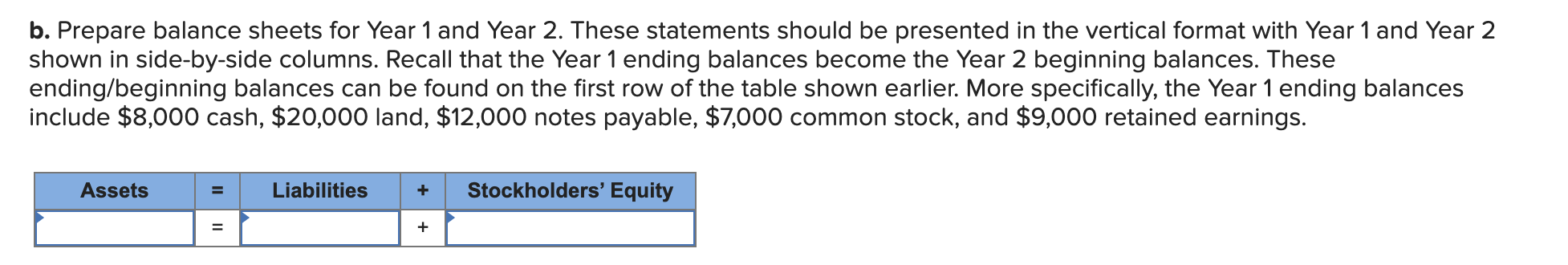

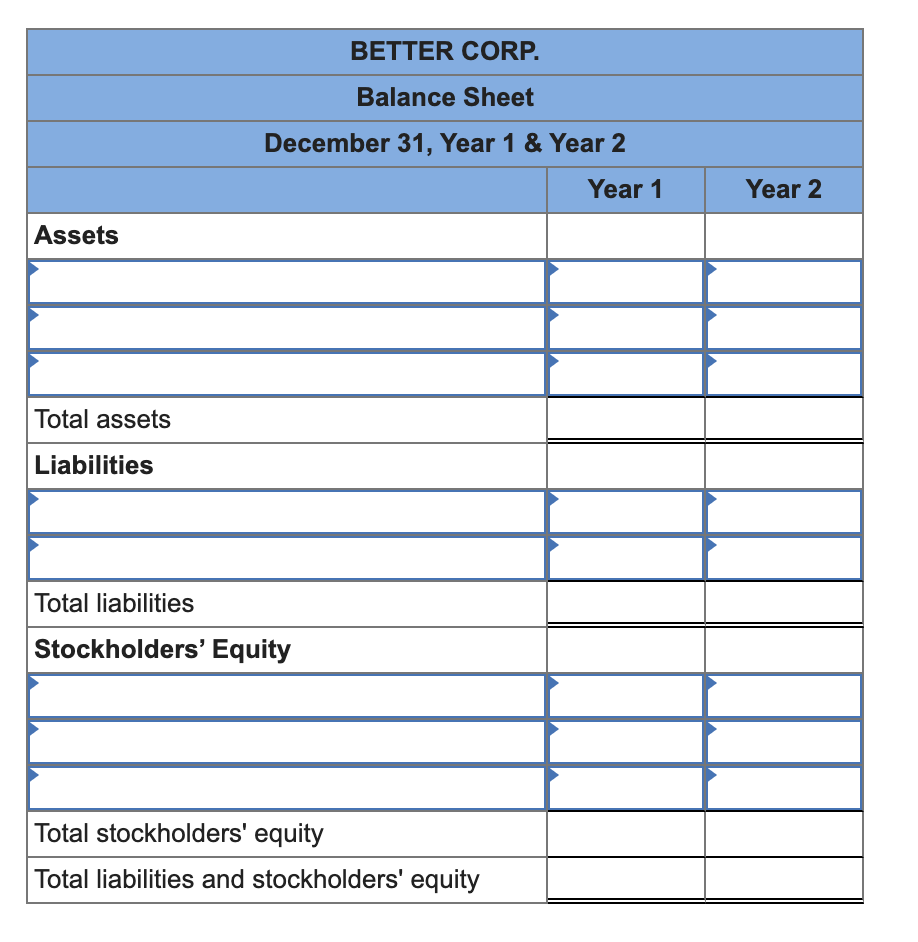

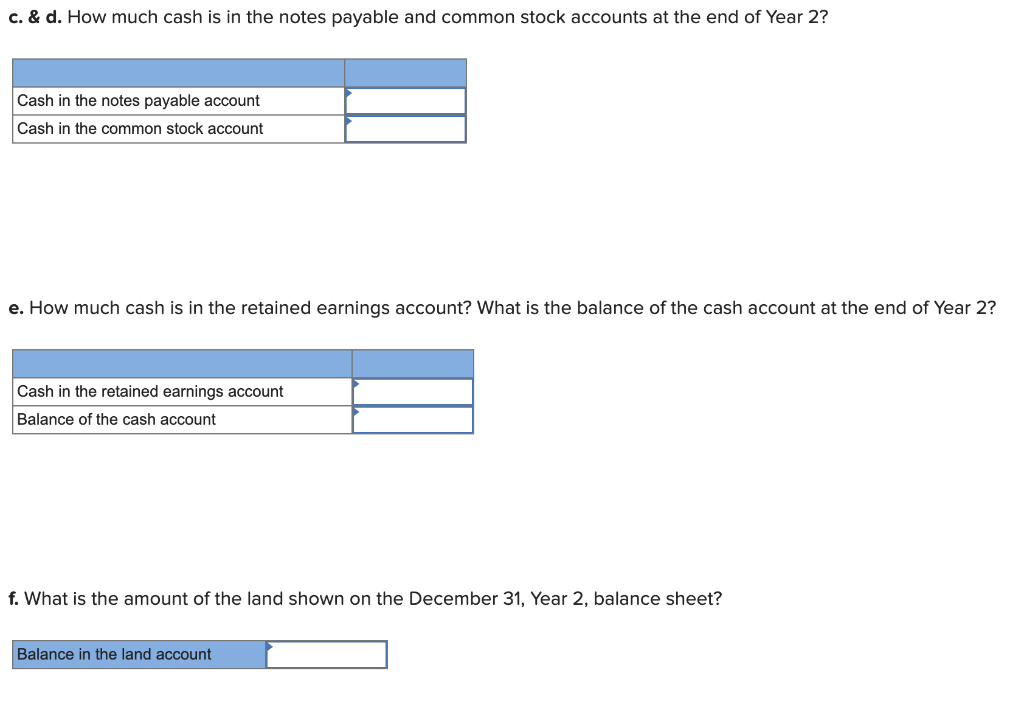

Specifically, the Better Corp. Year 1 ending balances become the Year 2 beginning balances. These balances are shown in the accounting equation that appear next. BETTER CORP. Accounting Equation Accounting Titles for Retained Earnings Event + Cash 8,000 Assets Land 20,000 Liabilities Notes Payable 12,000 Stockholders' Equity Common Stock Retained Earnings 7,000 9,000 Beg. Bal. Better Corp. completed the following transactions during Year 2: 1. Purchased land for $5,000 cash. 2. Acquired $25,000 cash from the issue of common stock. 3. Received $75,000 cash for providing services to customers. 4. Paid cash operating expenses of $42,000. 5. Borrowed $10,000 cash from the bank. 6. Paid a $5,000 cash dividend to the stockholders. 7. Determined that the market value of the land on December 31, Year 2, is $35,000. Required a. Record the transactions in the appropriate general ledger accounts under an accounting equation. Record the amounts of revenue, expense, and dividends in the Retained Earnings column. Provide the appropriate titles for these accounts in the last column of the table. (Enter any decreases to account balances with a minus sign. Not all cells in the "Accounts Titles for Retained Earnings" column may require an input - leave cells blank if there is no corresponding Retained Earnings input needed.) BETTER CORP. Accounting Equation for Year 2 Assets = Liabilities + Notes Cash + Land = Payable 8,000 + 20,000 = 12,000 + Event Common Stock 7,000 + Stockholders' Equity Retained Accounting Titles for Earnings Retained Earnings 9,000 Beg. Bal. + + 1. Purchase land + + + Issued stock + + + 3. + + + + + + Received cash for providing services Paid operating Expense Loan Paid dividend Land value + + + + + + + + + Totals + + + b. Prepare balance sheets for Year 1 and Year 2. These statements should be presented in the vertical format with Year 1 and Year 2 shown in side-by-side columns. Recall that the Year 1 ending balances become the Year 2 beginning balances. These ending/beginning balances can be found on the first row of the table shown earlier. More specifically, the Year 1 ending balances include $8,000 cash, $20,000 land, $12,000 notes payable, $7,000 common stock, and $9,000 retained earnings. Assets Liabilities + Stockholders' Equity BETTER CORP. Balance Sheet December 31, Year 1 & Year 2 Year 1 Year 2 Assets Total assets Liabilities Total liabilities Stockholders' Equity Total stockholders' equity Total liabilities and stockholders' equity c. & d. How much cash is in the notes payable and common stock accounts at the end of Year 2? Cash in the notes payable account Cash in the common stock account e. How much cash is in the retained earnings account? What is the balance of the cash account at the end of Year 2? Cash in the retained earnings account Balance of the cash account f. What is the amount of the land shown on the December 31, Year 2, balance sheet? Balance in the land account