Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Speer Company received its September 30, 2016, bank statement. The following information is provided. Our cash account shows a September 30 balance of $6, 966.14,

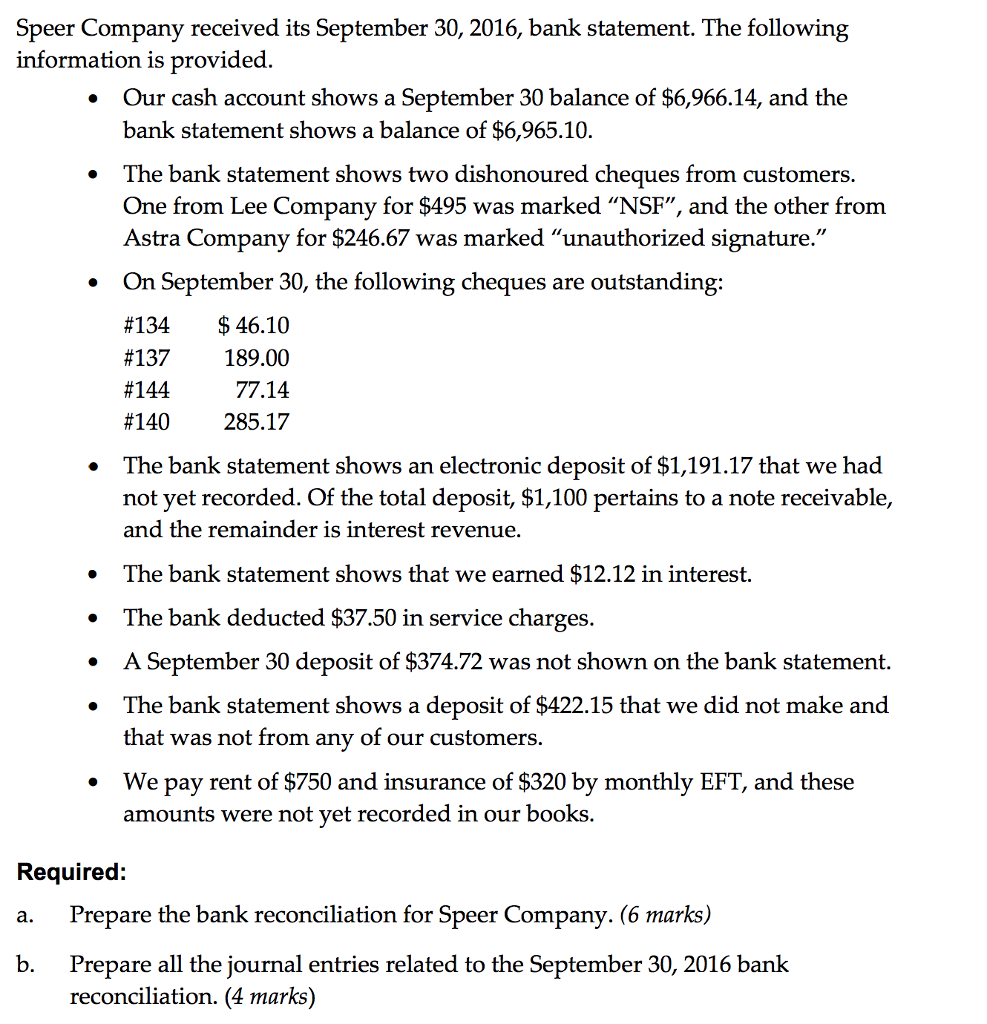

Speer Company received its September 30, 2016, bank statement. The following information is provided. Our cash account shows a September 30 balance of $6, 966.14, and the bank statement shows a balance of $6, 965.10. The bank statement shows two dishonoured cheques from customers. One from Lee Company for $495 was marked "NSF", and the other from Astra Company for $246.67 was marked "unauthorized signature". On September 30, the following cheques are outstanding: #134 $46.10 #137 189.00 #144 77.14 #140 285.17 The bank statement shows an electronic deposit of $1, 191.17 that we had not yet recorded. Of the total deposit, $1, 100 pertains to a note receivable, and the remainder is interest revenue. The bank statement shows that we earned $12.12 in interest. The bank deducted $37.50 in service charges. A September 30 deposit of $374.72 was not shown on the bank statement. The bank statement shows a deposit of $422.15 that we did not make and that was not from any of our customers. We pay rent of $750 and insurance of $320 by monthly EFT, and these amounts were not yet recorded in our books. Required Prepare the bank reconciliation for Speer Company. Prepare all the journal entries related to the September 30, 2016 bank reconciliation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started