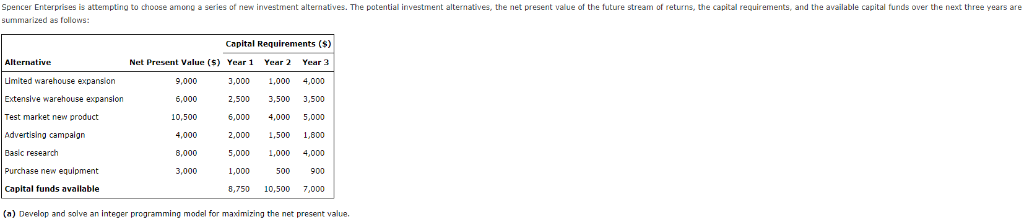

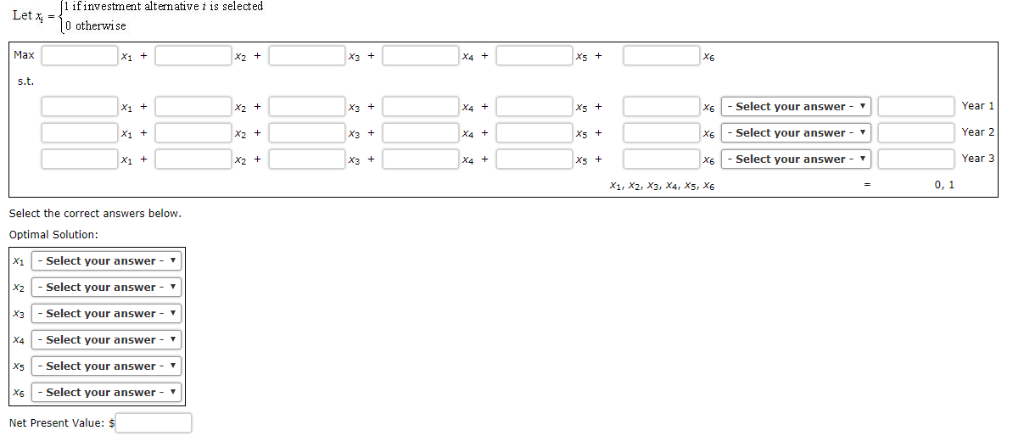

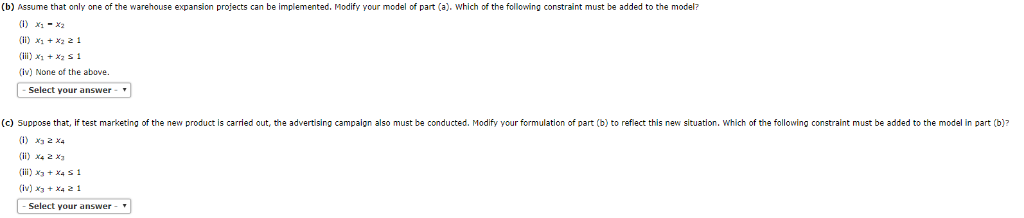

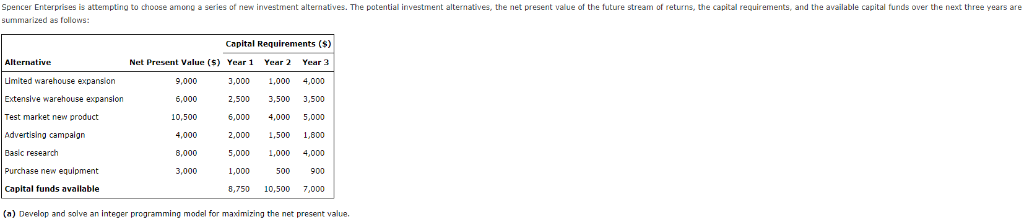

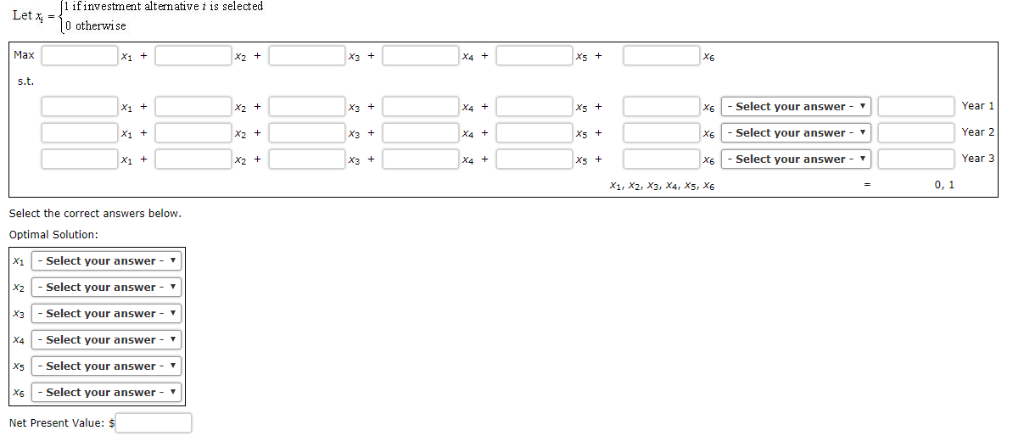

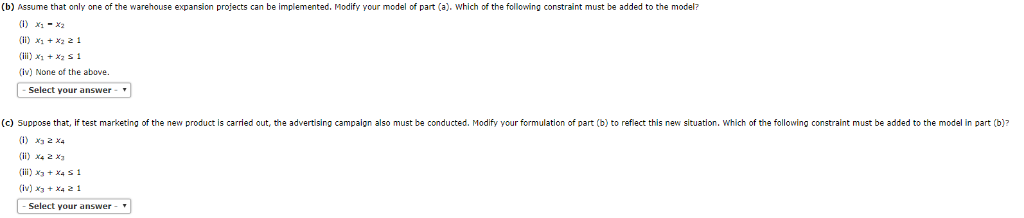

Spencer Enterprises is attempting to choose among a series of new investment alternatives. The potential investment alternatives, the net present value of the future stream of returns, the capital requirements, and the available capital funds over the next three years are summarized as follows: Capital Requirements (s) Net Present Value (S) Year 1 Year 2 Year 3 Limited warehouse expansion Extensive warehouse expansion Test market new product Advertising campaign Basic research Purchase new equipment Capital funds avallable (a) Develop and solve an integer programming model for maximizing the net present value 9,000 6,000 10,500 4,000 8,000 3,000 3,000 1,000 4,000 2,500 3,500 3,500 6,000 4,000 5,000 2,000 ,500 1,800 5,000 1,000 4,000 1,000 8,750 10,500 7,000 500 900 l if investment alternative i is selected Let -0 otherwise Max X1+ X4 T Xs+ X6 s.t. x6 | -Select your answer- XG | -Select your answer- x6Select Year 1 Year 2 Year 3 X1+ X1+ x1+ X2 X4 x5+ X3 X4 x5 your answer . 0, 1 X1, X2, X3, X4, X5, X6 Select the correct answers below Optimal Solution x1 Select your answer- X2-Select your answer- X3Select your answer- X4 | -Select your answer- X5 | -Select your answer- x6Select your answer- Net Present Value: $ (b) Assume that only one of the warehouse expansion projects can be implemented. Modify your model of part (a). Which of the following constraint must be added to the model? ()+x2 21 (ii) x X2 S 1 (iv) None of the above. Select your answer (c) Suppose that, if test marketing of the new product is carried out, the advertising campaign also must be conducted. Modify your formulation of part (b) to reflect this new situation. Which of the following constraint must be added to the model in part (b)? (ili) x3+ x4s1 (iv) x3+ x4 21 Select your answer Spencer Enterprises is attempting to choose among a series of new investment alternatives. The potential investment alternatives, the net present value of the future stream of returns, the capital requirements, and the available capital funds over the next three years are summarized as follows: Capital Requirements (s) Net Present Value (S) Year 1 Year 2 Year 3 Limited warehouse expansion Extensive warehouse expansion Test market new product Advertising campaign Basic research Purchase new equipment Capital funds avallable (a) Develop and solve an integer programming model for maximizing the net present value 9,000 6,000 10,500 4,000 8,000 3,000 3,000 1,000 4,000 2,500 3,500 3,500 6,000 4,000 5,000 2,000 ,500 1,800 5,000 1,000 4,000 1,000 8,750 10,500 7,000 500 900 l if investment alternative i is selected Let -0 otherwise Max X1+ X4 T Xs+ X6 s.t. x6 | -Select your answer- XG | -Select your answer- x6Select Year 1 Year 2 Year 3 X1+ X1+ x1+ X2 X4 x5+ X3 X4 x5 your answer . 0, 1 X1, X2, X3, X4, X5, X6 Select the correct answers below Optimal Solution x1 Select your answer- X2-Select your answer- X3Select your answer- X4 | -Select your answer- X5 | -Select your answer- x6Select your answer- Net Present Value: $ (b) Assume that only one of the warehouse expansion projects can be implemented. Modify your model of part (a). Which of the following constraint must be added to the model? ()+x2 21 (ii) x X2 S 1 (iv) None of the above. Select your answer (c) Suppose that, if test marketing of the new product is carried out, the advertising campaign also must be conducted. Modify your formulation of part (b) to reflect this new situation. Which of the following constraint must be added to the model in part (b)? (ili) x3+ x4s1 (iv) x3+ x4 21 Select your