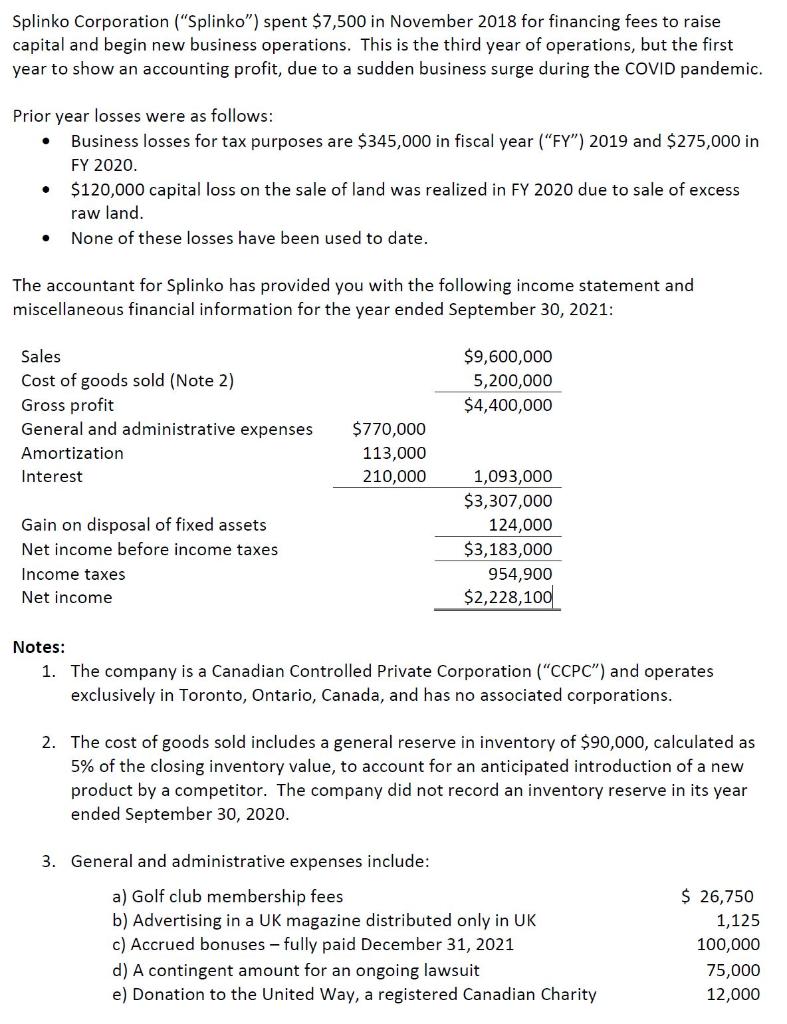

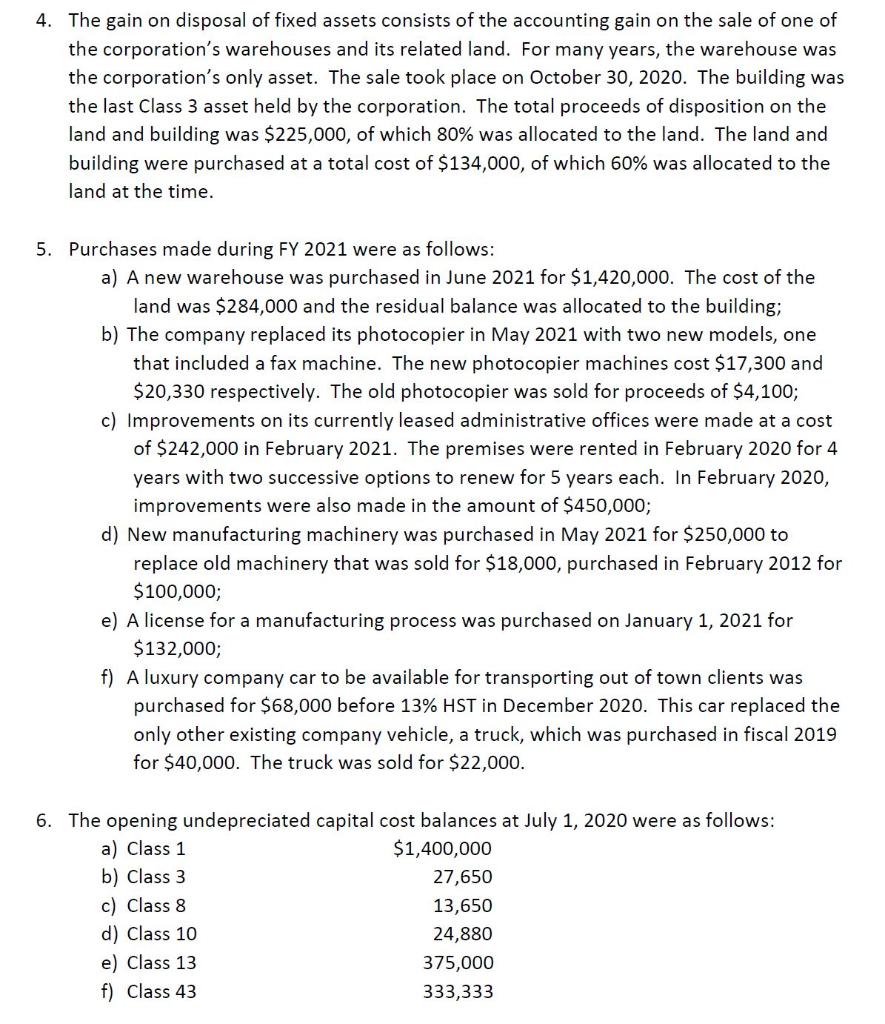

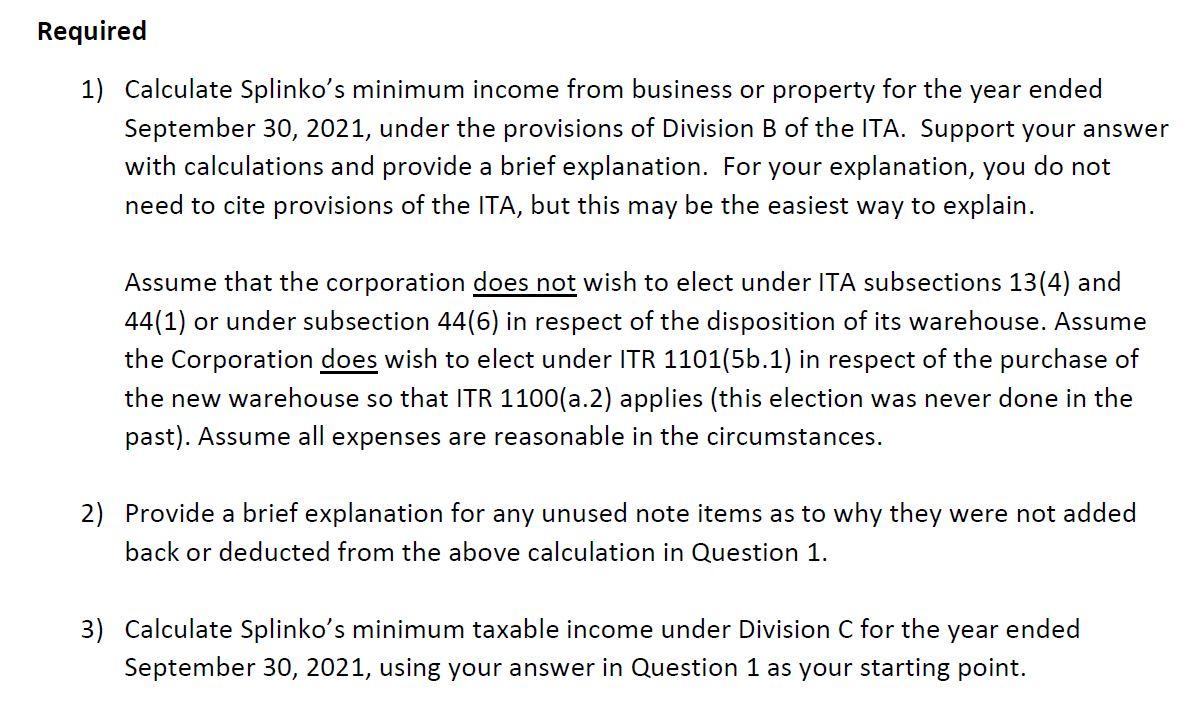

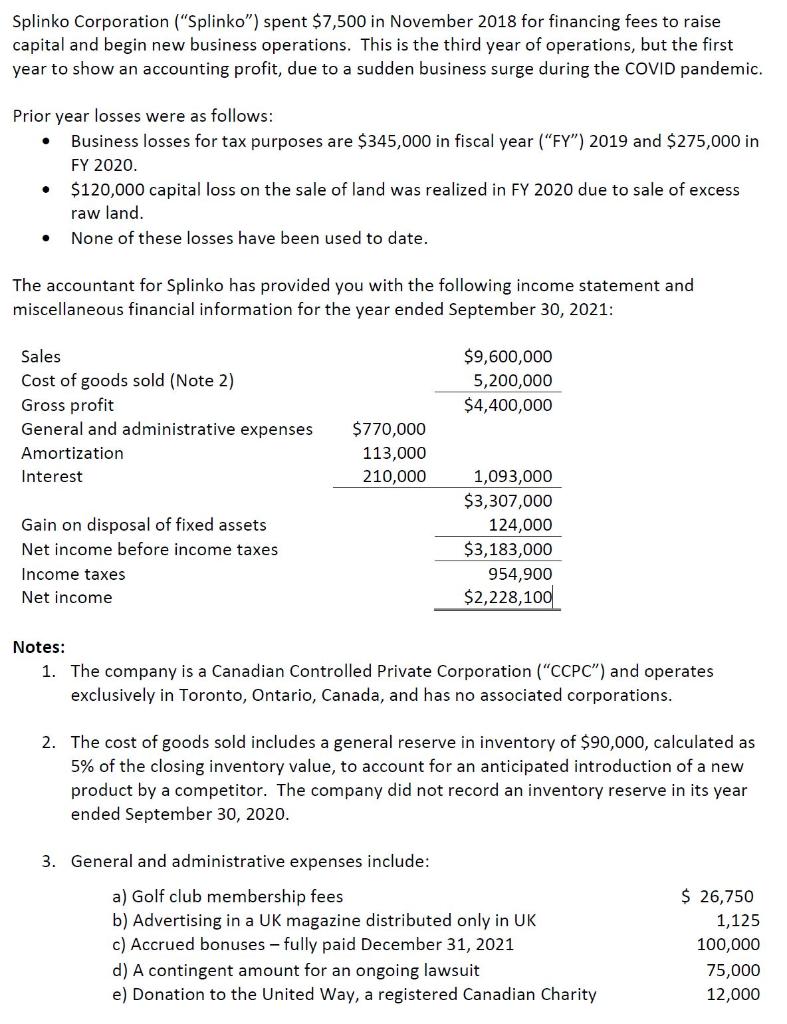

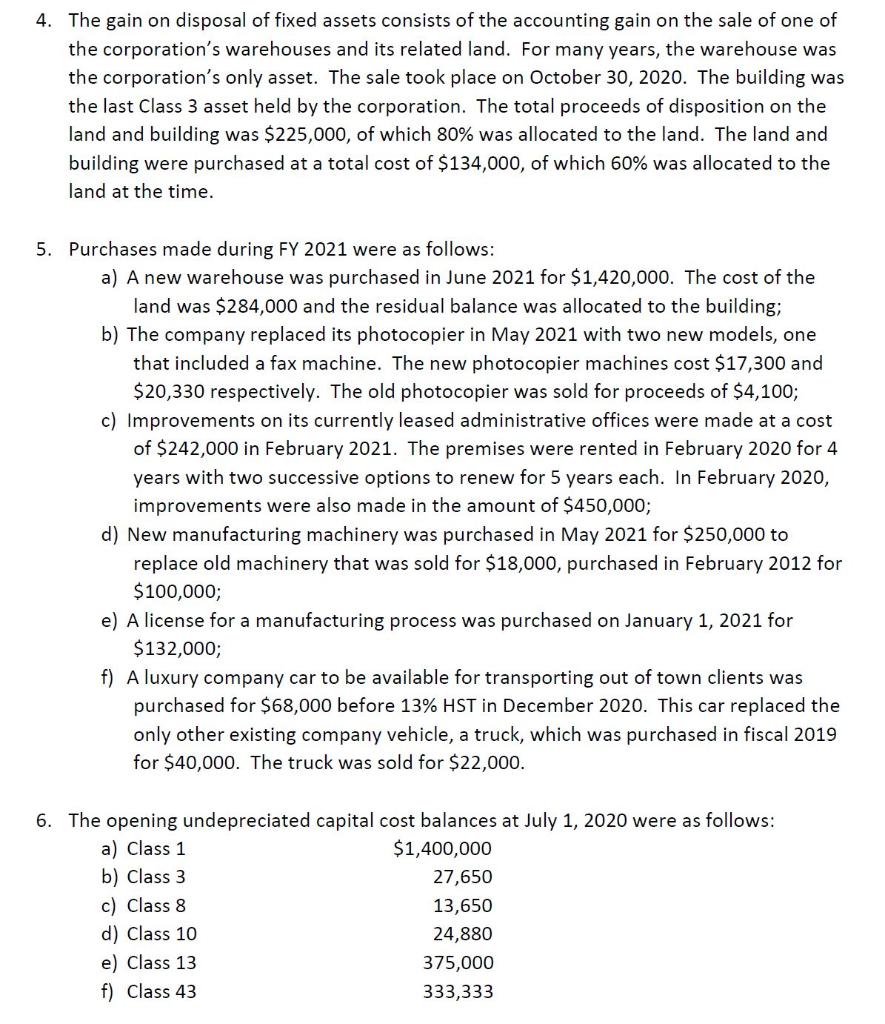

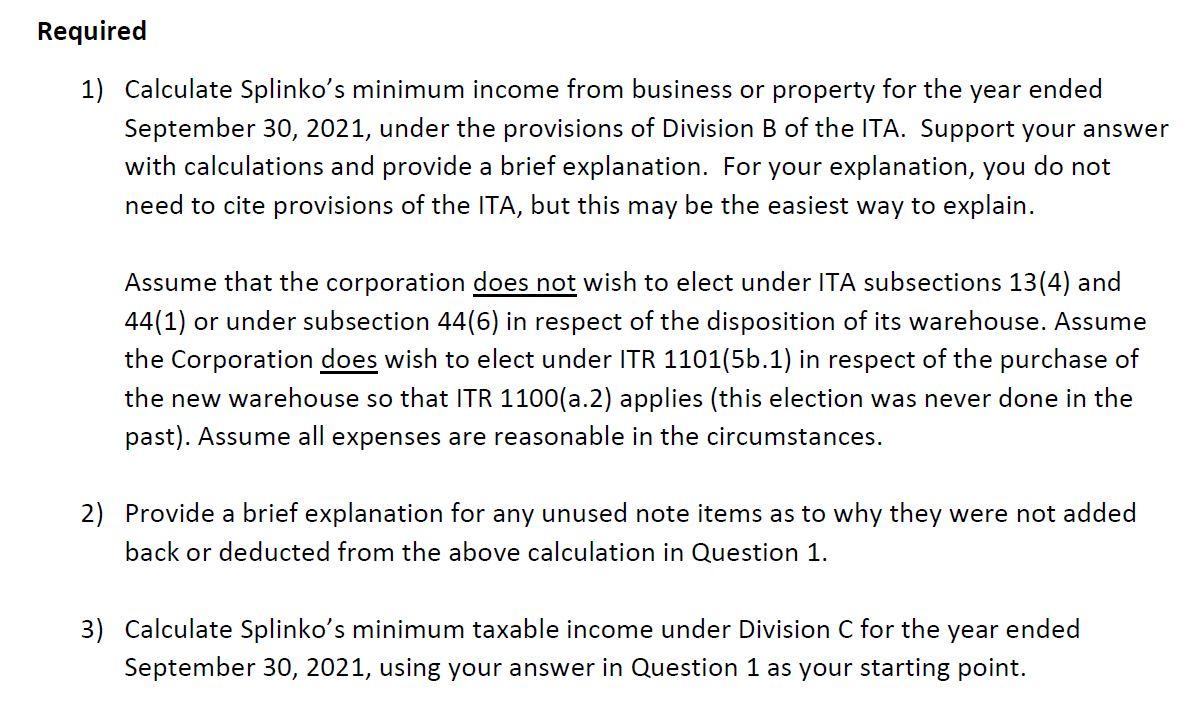

Splinko Corporation ("Splinko") spent $7,500 in November 2018 for financing fees to raise capital and begin new business operations. This is the third year of operations, but the first year to show an accounting profit, due to a sudden business surge during the COVID pandemic. Prior year losses were as follows: Business losses for tax purposes are $345,000 in fiscal year ("FY") 2019 and $275,000 in FY 2020. $120,000 capital loss on the sale of land was realized in FY 2020 due to sale of excess raw land. None of these losses have been used to date. . . The accountant for Splinko has provided you with the following income statement and miscellaneous financial information for the year ended September 30, 2021: $9,600,000 5,200,000 $4,400,000 Sales Cost of goods sold (Note 2) Gross profit General and administrative expenses Amortization Interest $770,000 113,000 210,000 Gain on disposal of fixed assets Net income before income taxes Income taxes Net income 1,093,000 $3,307,000 124,000 $3,183,000 954,900 $2,228,100 Notes: 1. The company is a Canadian Controlled Private Corporation ("CCPC") and operates exclusively in Toronto, Ontario, Canada, and has no associated corporations. 2. The cost of goods sold includes a general reserve in inventory of $90,000, calculated as 5% of the closing inventory value, to account for an anticipated introduction of a new product by a competitor. The company did not record an inventory reserve in its year ended September 30, 2020. 3. General and administrative expenses include: a) Golf club membership fees b) Advertising in a UK magazine distributed only in UK c) Accrued bonuses - fully paid December 31, 2021 d) A contingent amount for an ongoing lawsuit e) Donation to the United Way, a registered Canadian Charity $ 26,750 1,125 100,000 75,000 12,000 4. The gain on disposal of fixed assets consists of the accounting gain on the sale of one of the corporation's warehouses and its related land. For many years, the warehouse was the corporation's only asset. The sale took place on October 30, 2020. The building was the last Class 3 asset held by the corporation. The total proceeds of disposition on the land and building was $225,000, of which 80% was allocated to the land. The land and building were purchased at a total cost of $134,000, of which 60% was allocated to the land at the time. 5. Purchases made during FY 2021 were as follows: a) A new warehouse was purchased in June 2021 for $1,420,000. The cost of the land was $284,000 and the residual balance was allocated to the building; b) The company replaced its photocopier in May 2021 with two new models, one that included a fax machine. The new photocopier machines cost $17,300 and $20,330 respectively. The old photocopier was sold for proceeds of $4,100; c) Improvements on its currently leased administrative offices were made at a cost of $242,000 in February 2021. The premises were rented in February 2020 for 4 years with two successive options to renew for 5 years each. In February 2020, improvements were also made in the amount of $450,000; d) New manufacturing machinery was purchased in May 2021 for $250,000 to replace old machinery that was sold for $18,000, purchased in February 2012 for $100,000; e) A license for a manufacturing process was purchased on January 1, 2021 for $132,000; f) A luxury company car to be available for transporting out of town clients was purchased for $68,000 before 13% HST in December 2020. This car replaced the only other existing company vehicle, a truck, which was purchased in fiscal 2019 for $40,000. The truck was sold for $22,000. 6. The opening undepreciated capital cost balances at July 1, 2020 were as follows: a) Class 1 $1,400,000 b) Class 3 27,650 c) Class 8 13,650 d) Class 10 24,880 e) Class 13 375,000 f) Class 43 333,333 Required 1) Calculate Splinko's minimum income from business or property for the year ended September 30, 2021, under the provisions of Division B of the ITA. Support your answer with calculations and provide a brief explanation. For your explanation, you do not need to cite provisions of the ITA, but this may be the easiest way to explain. Assume that the corporation does not wish to elect under ITA subsections 13(4) and 44(1) or under subsection 44(6) in respect of the disposition of its warehouse. Assume the Corporation does wish to elect under ITR 1101(5b.1) in respect of the purchase of the new warehouse so that ITR 1100(a.2) applies (this election was never done in the past). Assume all expenses are reasonable in the circumstances. 2) Provide a brief explanation for any unused note items as to why they were not added back or deducted from the above calculation in Question 1. 3) Calculate Splinko's minimum taxable income under Division C for the year ended September 30, 2021, using your answer in Question 1 as your starting point