Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a York College, CUNY graduate and a member of a management consulting team from one of the Big 4 CPA firms. Your group

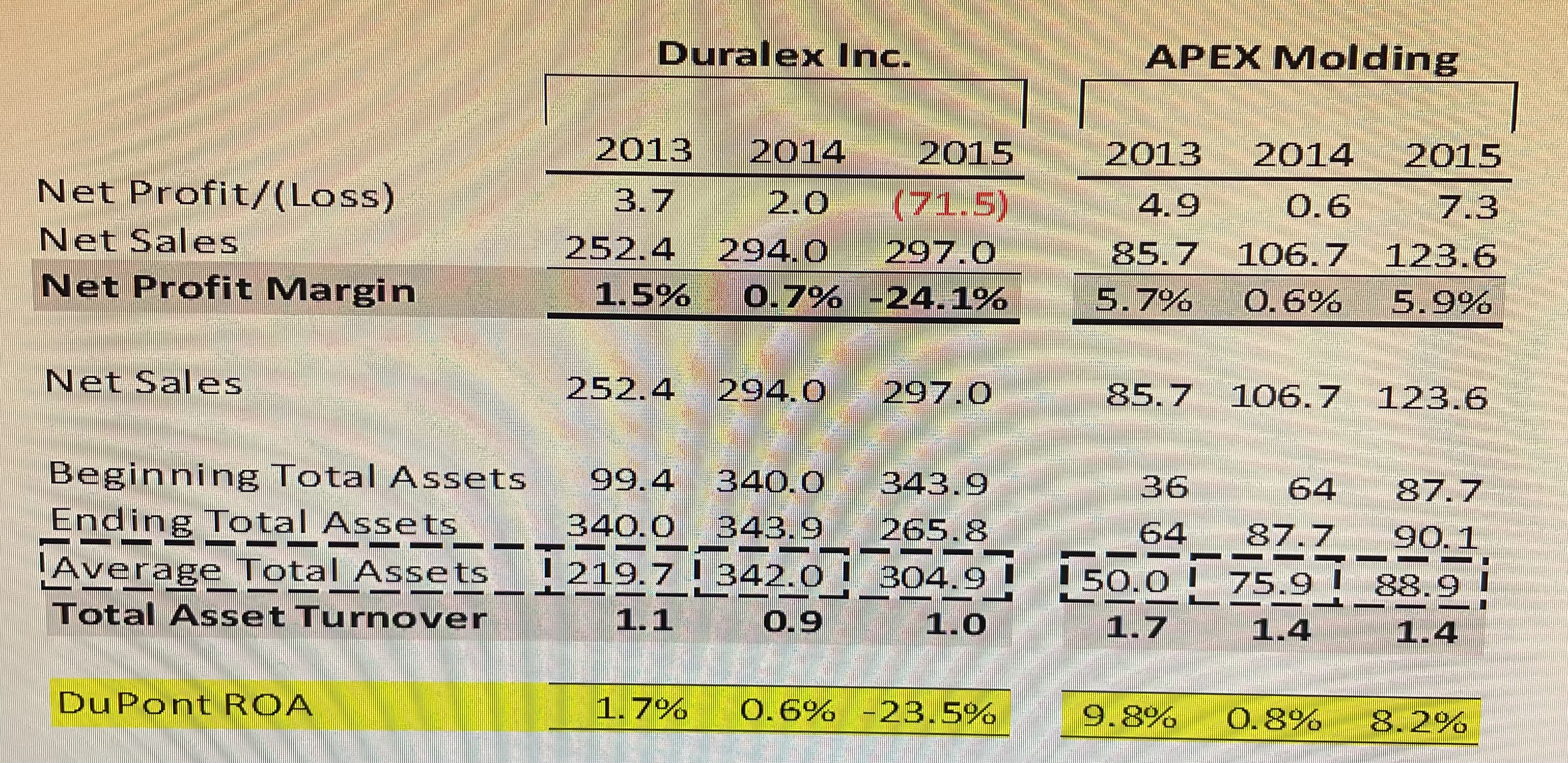

You are a York College, CUNY graduate and a member of a management consulting team from one of the Big CPA firms. Your group is tasked with evaluating the performance of Duralex Inc. management team compared to the management team performance of APEX Molding, the firms largest competitor. You will assess both companys management performance using the DuPont Return on Asset ratio. The ratio is comprised of the product of the Net Profit Margin and the Total Asset Turnover.The Financial Analysts at the Big CPA firms prepared the below DuPont ROA for the years to for both companies. It is your teams responsibility to interpret and communicate the results to Duralex Inc. board of Director, and advise the board if they should retain or fire the management team.

Did Duralex Inc. management created value for the shareholders and investors from to Your answer must include the Net Profit Margin and Total Asset Turnover trends from one year to the next. Did the management increase sales, reduce expenses, fully utilize the assets to generate revenue? Please be detailed as your assessment will be used by the Board of Director to retain or fire the management team.

Only using the ratio calculation, how did the Duralex Inc. management team performed compared to the APEX Molding management team in creating value for shareholders and investors? Please provide three recommendations for improvement IF the Duralex Inc. management performance was worse than that of APEX Molding.Please write a professional and concise report. Please begin the report with Question which is entirely focused on Duralex Inc then Question which is the comparison to APEX Molding and finally recommend if the management team should be retained or fired. Write a lot. envision yourself preparing a report like this after graduating York College, CUNY.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started