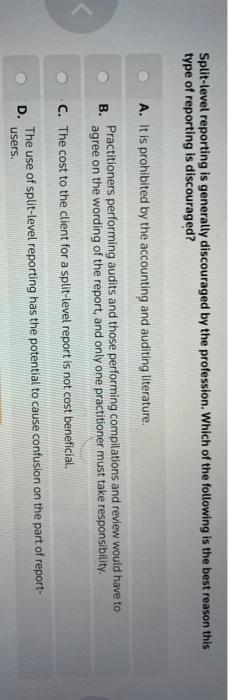

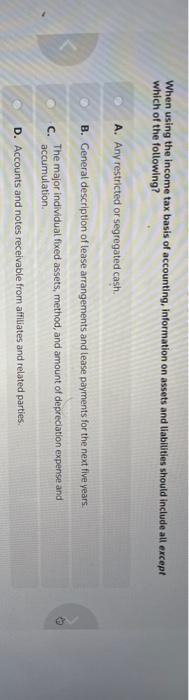

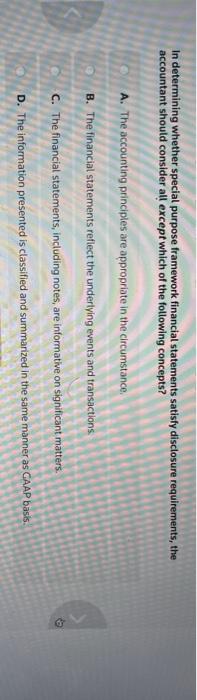

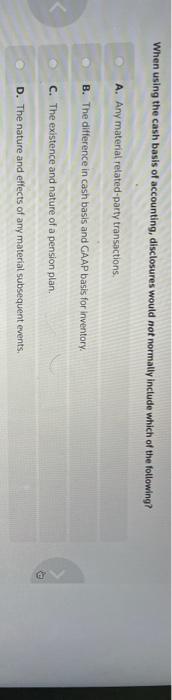

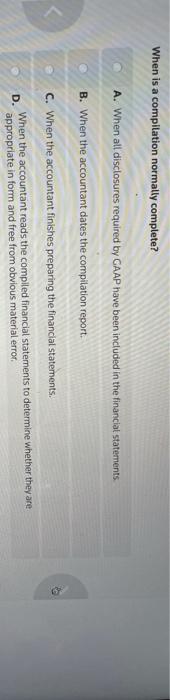

Split-level reporting is generally discouraged by the profession. Which of the following is the best reason this type of reporting is discouraged? A. It is prohibited by the accounting and auditing literature. B. Practitioners performing audits and those performing compilations and review would have to agree on the wording of the report, and only one practitioner must take responsibility. C. The cost to the client for a split-level report is not cost beneficial. D The use of split-level reporting has the potential to cause confusion on the part of report- users. When using the income tax basis of accounting, information on assets and liabilities should include all except which of the following? A. Any restricted or segregated cash. B. General description of lease arrangements and lease payments for the next five years. The major individual fixed assets, method, and amount of depreciation expense and C. accumulation D. Accounts and notes receivable from affiliates and related parties. In determining whether special purpose framework financial statements satisfy disclosure requirements, the accountant should consider all except which of the following concepts? A. The accounting principles are appropriate in the circumstance B. The financial statements reflect the underlying events and transactions C. The financial statements, including notes, are informative on significant matters. D. The information presented is classified and summarized in the same manner as GAAP basis. When using the cash basis of accounting, disclosures would not normally include which of the following? A. Any material related-party transactions B. The difference in cash basis and GAAP basis for inventory C. The existence and nature of a pension plan. D. The nature and effects of any material subsequent events. When is a compilation normally complete? A. When all disclosures required by GAAP have been included in the financial statements B. When the accountant dates the compilation report. C. When the accountant finishes preparing the financial statements. When the accountant reads the compiled financial statements to determine whether they are D. appropriate in form and free from obvious material error