Question

Sponge Todd Square Corp (STSC) is a corporation resident in Canada that has asked you to prepare a calculation of their corporate Part I

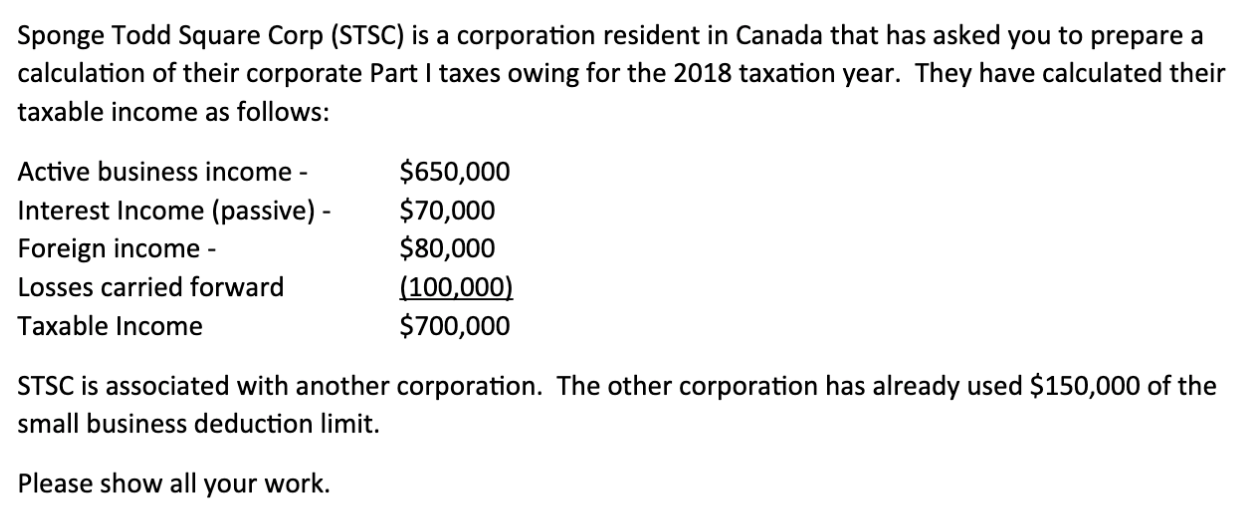

Sponge Todd Square Corp (STSC) is a corporation resident in Canada that has asked you to prepare a calculation of their corporate Part I taxes owing for the 2018 taxation year. They have calculated their taxable income as follows: Active business income - Interest Income (passive) - Foreign income - Losses carried forward Taxable Income $650,000 $70,000 $80,000 (100,000) $700,000 STSC is associated with another corporation. The other corporation has already used $150,000 of the small business deduction limit. Please show all your work.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The image you have provided contains financial data of a corporation Sponge Todd Square Corp STSC and instructions to prepare a calculation of their c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Modern Advanced Accounting In Canada

Authors: Hilton Murray, Herauf Darrell

7th Edition

1259066487, 978-1259066481

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App