Question: Springfield Bank is evaluating Creek Enterprises, which has requested a $4,150,000 loan, to assess the firm's financial leverage and financial risk. On the basis of

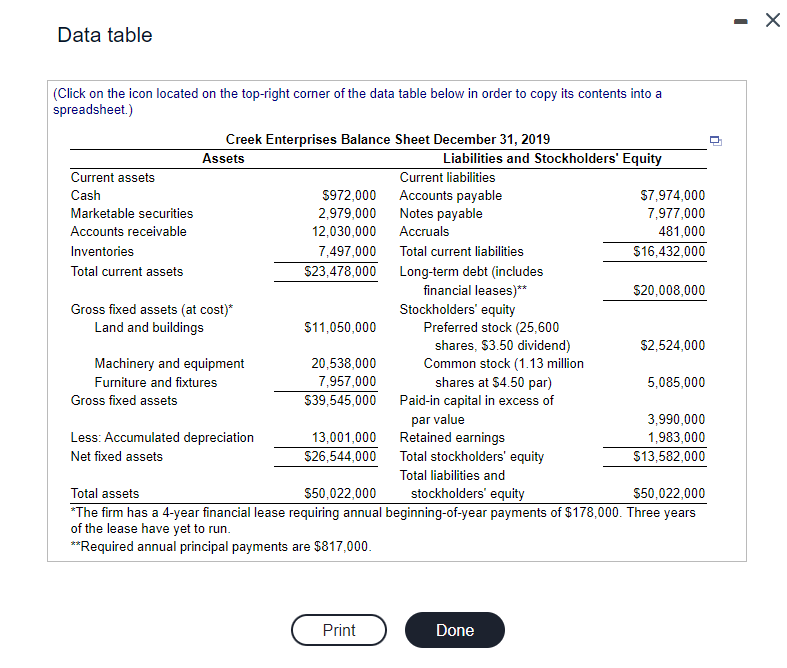

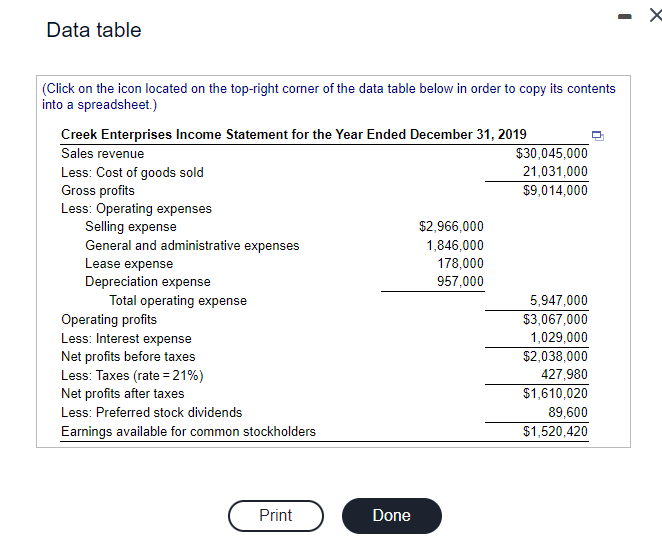

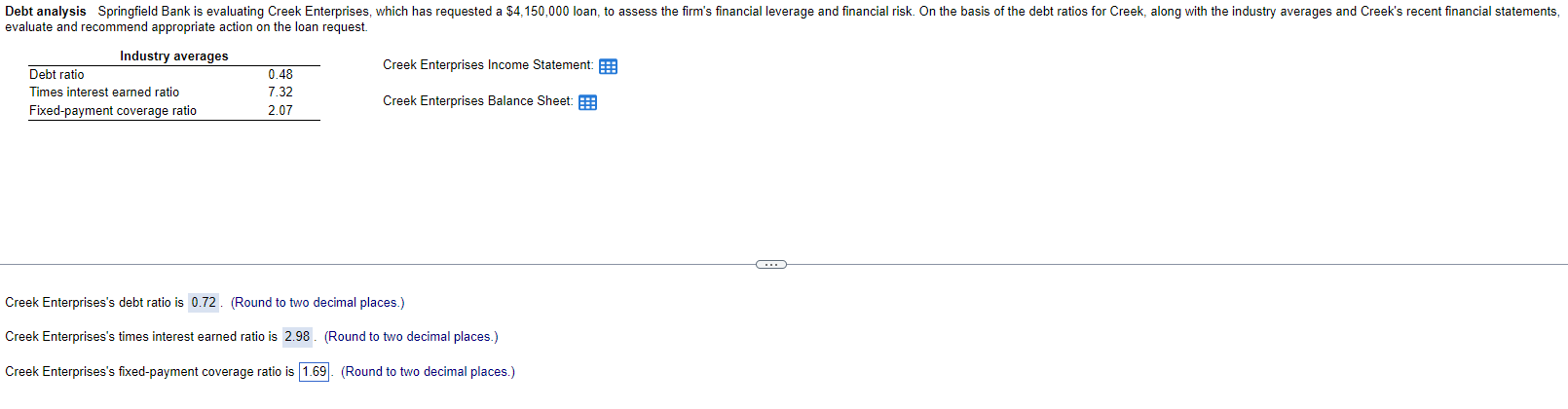

Springfield Bank is evaluating Creek Enterprises, which has requested a $4,150,000 loan, to assess the firm's financial leverage and financial risk. On the basis of the debt ratios for Creek, along with the industry averages and Creek's recent financial statements, evaluate and recommend appropriate action on the loan request.

Please help with the Creek Enterprises Fixed payment coverage ratio cuz I think that number is wrong. Thank you

Please help with the Creek Enterprises Fixed payment coverage ratio cuz I think that number is wrong. Thank you

Data table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) of the lease have yet to run. Required annual principal payments are $817,000. Data table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) evaluate and recommend appropriate action on the loan request. Creek Enterprises Income Statement: Creek Enterprises Balance Sheet: Creek Enterprises's debt ratio is (Round to two decimal places.) Creek Enterprises's times interest earned ratio is (Round to two decimal places.) Creek Enterprises's fixed-payment coverage ratio is (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts