Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SSS Problem 2-4 (Instalments, Interest, and Penalties for Corporations) The taxation year of the Sloan Company, a public company, ends on October 31. During the

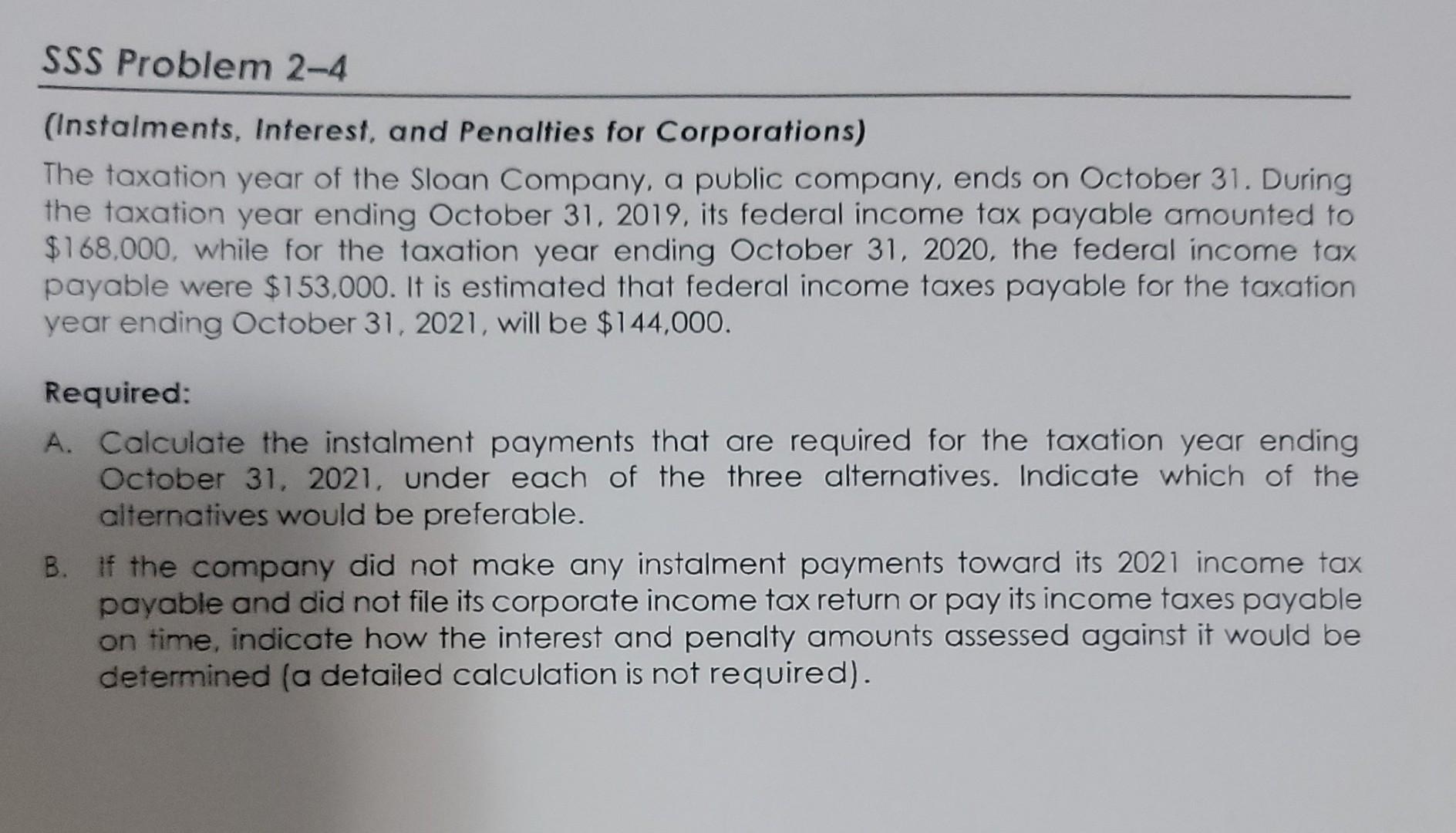

SSS Problem 2-4 (Instalments, Interest, and Penalties for Corporations) The taxation year of the Sloan Company, a public company, ends on October 31. During the taxation year ending October 31, 2019, its federal income tax payable amounted to $168,000, while for the taxation year ending October 31, 2020, the federal income tax payable were $153.000. It is estimated that federal income taxes payable for the taxation year ending October 31, 2021, will be $144,000. Required: A. Calculate the instalment payments that are required for the taxation year ending October 31, 2021, under each of the three alternatives. Indicate which of the alternatives would be preferable. B. If the company did not make any instalment payments toward its 2021 income tax payable and did not file its corporate income tax return or pay its income taxes payable on time, indicate how the interest and penalty amounts assessed against it would be determined a detailed calculation is not required)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started