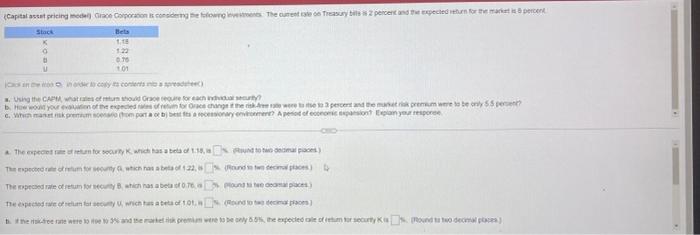

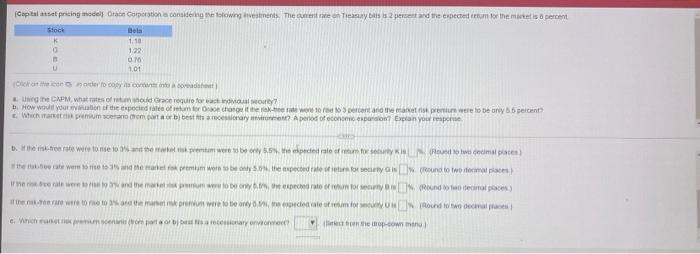

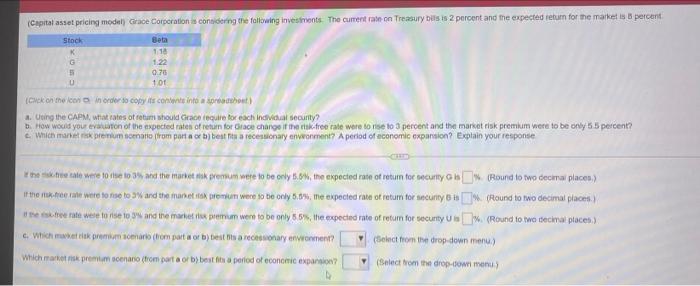

Stack Capital aset pricing modele Corporacions com efter The cente e Treasury bits *7 percent and the spected to the market is percent Bets 18 0 10 70 01 . Using the CA was the forew boyut not the force change to operatorem were to be only pe? c. What report on your pre . The expect to tanto soy Kwiatos beta 1.18 10 nap The expected to which habets of 4:22. und wew) The date ofrem for which has been Teepee for which has been to the tree rate witte 100 de rostetik premiu were the only the expected ble det for aty mound to decimo) Capital aset pricing model a portions considering the longestinents. The Teasy s perest and cred tumor the mattis percent 12 Stock Bela 1.10 1.22 010 U 101 Conocer to copy consort) UCAPM, what rates of moud Grace required by h How would your of the speciedale of an order to it and is pretium were to be any operont Wechat seem to be the recerary period of economic plan your respo there were to me to them by the resowe cecimal places these were made me more on the expected for you to two map were and the man who I Randers there were to read their wrote onde confortowe c. nicht so hombrary e opowi Capital asset pricing model Grace Corporation is considering the following investments. The current on Treasury bits is 2 percent and the expected return for the market is 8 percent Stock Beta 118 G 1.22 5 078 U 101 Cek on the core in order to copy its content into a shout) 1. Using the CAPM, what rates of return should acquire for each individual security? How would your evafon of the expected rates of return for Grace change it the free rate were to rise to 3 percent and the market risk premium were to be only 55 percent? Which marek premium morom parta or b) best to recessionary environment? A period of aconomic expansion? Explain your response Ythe tale were to let and the market tik premium were to be only 6.6%, the expected rate of return toe ecurty (Round to wo decimal places of the store were tone to and the monet tok premium were to be only 6.8%, me expected rate of return for security found to two decimal places the stere were to rise to and the market tok pomum were to be only 6.86, the expected rate of retum for security (Round to two tecial places) c. Which premium scenario (rom part of b) Dessa reconary environment? (Select from the drop-down menu) which premium scenario (rom part of best is a period of economic expansion (Select from the drop-down menu