Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Stan Todd, Inc. wants to manufacture a new cell phone that can be worn on the wrist. Information from doing market research shows that

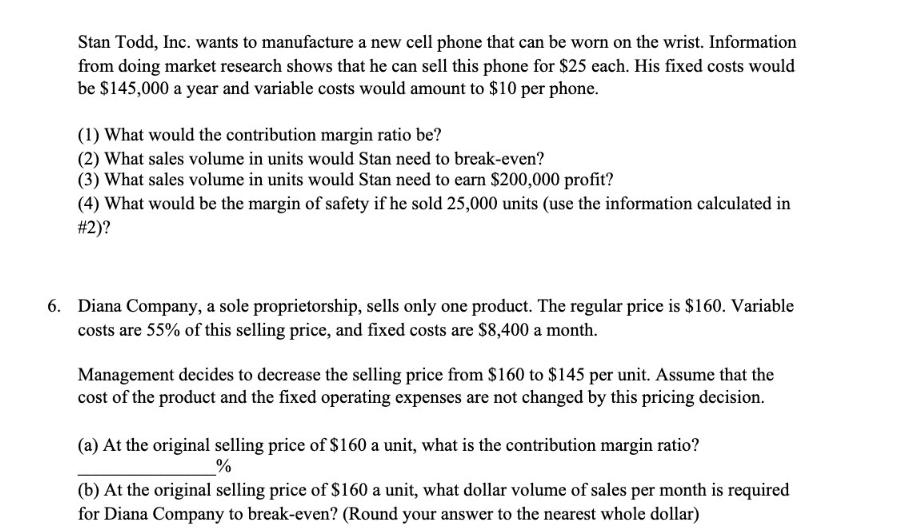

Stan Todd, Inc. wants to manufacture a new cell phone that can be worn on the wrist. Information from doing market research shows that he can sell this phone for $25 each. His fixed costs would be $145,000 a year and variable costs would amount to $10 per phone. (1) What would the contribution margin ratio be? (2) What sales volume in units would Stan need to break-even? (3) What sales volume in units would Stan need to earn $200,000 profit? (4) What would be the margin of safety if he sold 25,000 units (use the information calculated in #2)? 6. Diana Company, a sole proprietorship, sells only one product. The regular price is $160. Variable costs are 55% of this selling price, and fixed costs are $8,400 a month. Management decides to decrease the selling price from $160 to $145 per unit. Assume that the cost of the product and the fixed operating expenses are not changed by this pricing decision. (a) At the original selling price of $160 a unit, what is the contribution margin ratio? % (b) At the original selling price of $160 a unit, what dollar volume of sales per month is required for Diana Company to break-even? (Round your answer to the nearest whole dollar)

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

1 The contribution margin ratio can be calculated using the formula Contribution Margin Ratio Selling Price Variable Costs Selling Price In this case ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started