Answered step by step

Verified Expert Solution

Question

1 Approved Answer

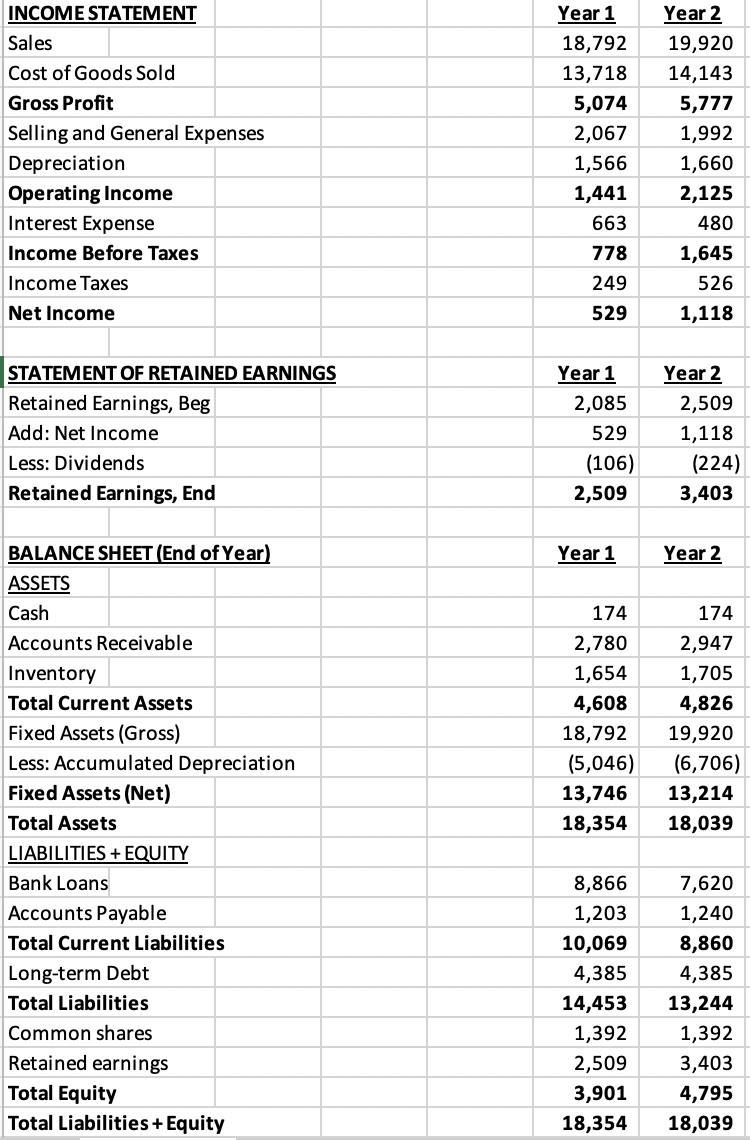

[ Standalone Question ] Suppose the annual sales growth in Year 3 is 6%. Assume the same Fixed Assets (Gross) Turnover in Year 3 as

[Standalone Question] Suppose the annual sales growth in Year 3 is 6%. Assume the same Fixed Assets (Gross) Turnover in Year 3 as in Year 2, where the turnover is calculated using the average fixed assets. Also assume that the useful life of fixed assets in Year 3 is the same as that in Year 2 with no salvage value, where the useful life is calculated using year-end fixed assets (i.e. not the average). What is the forecasted Depreciation in Year 3?

INCOME STATEMENT Sales Cost of Goods Sold Gross Profit Selling and General Expenses Depreciation Operating Income Interest Expense Income Before Taxes Income Taxes Net Income Year 1 18,792 13,718 5,074 2,067 1,566 1,441 663 Year 2 19,920 14,143 5,777 1,992 1,660 2,125 480 1,645 526 1,118 778 249 529 STATEMENT OF RETAINED EARNINGS Retained Earnings, Beg Add: Net Income Less: Dividends Retained Earnings, End Year 1 2,085 529 (106) 2,509 Year 2 2,509 1,118 (224) 3,403 Year 1 Year 2 174 2,780 1,654 4,608 18,792 (5,046) 13,746 18,354 174 2,947 1,705 4,826 19,920 (6,706) 13,214 18,039 BALANCE SHEET (End of Year) ASSETS Cash Accounts Receivable Inventory Total Current Assets Fixed Assets (Gross) Less: Accumulated Depreciation Fixed Assets (Net) Total Assets LIABILITIES + EQUITY Bank Loans Accounts Payable Total Current Liabilities Long-term Debt Total Liabilities Common shares Retained earnings Total Equity Total Liabilities + Equity 8,866 1,203 10,069 4,385 14,453 1,392 2,509 3,901 18,354 7,620 1,240 8,860 4,385 13,244 1,392 3,403 4,795 18,039Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started