Answered step by step

Verified Expert Solution

Question

1 Approved Answer

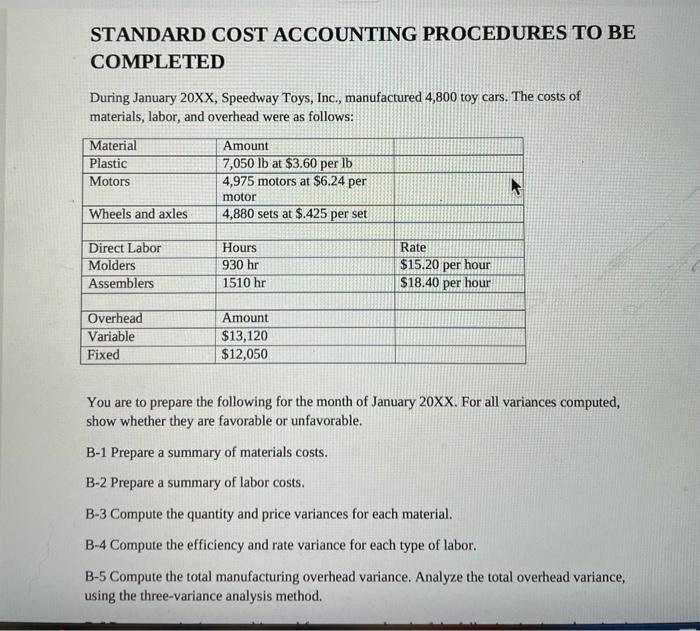

STANDARD COST ACCOUNTING PROCEDURES TO BE COMPLETED During January 20XX, Speedway Toys, Inc., manufactured 4,800 toy cars. The costs of materials, labor, and overhead

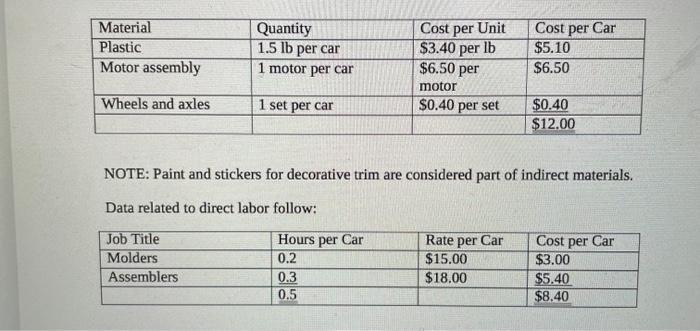

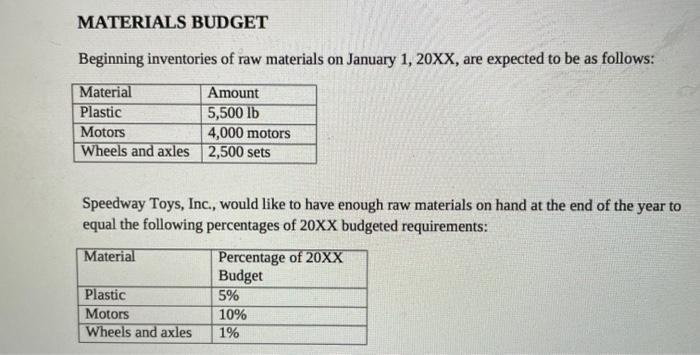

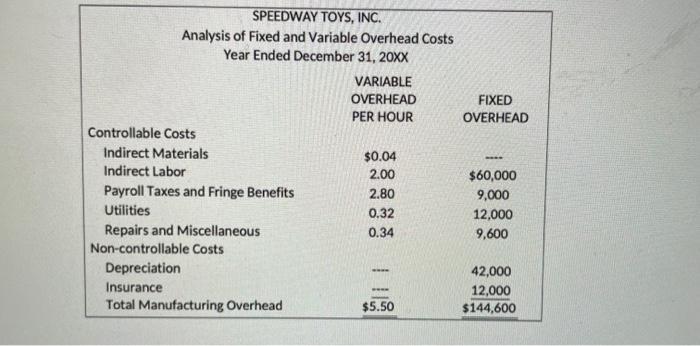

STANDARD COST ACCOUNTING PROCEDURES TO BE COMPLETED During January 20XX, Speedway Toys, Inc., manufactured 4,800 toy cars. The costs of materials, labor, and overhead were as follows: Material Plastic Motors Wheels and axles Direct Labor Molders Assemblers Overhead Variable Fixed Amount 7,050 lb at $3.60 per lb 4,975 motors at $6.24 per motor 4,880 sets at $.425 per set Hours 930 hr 1510 hr Amount $13,120 $12,050 Rate $15.20 per hour $18.40 per hour You are to prepare the following for the month of January 20XX. For all variances computed, show whether they are favorable or unfavorable. B-1 Prepare a summary of materials costs. B-2 Prepare a summary of labor costs. B-3 Compute the quantity and price variances for each material. B-4 Compute the efficiency and rate variance for each type of labor. B-5 Compute the total manufacturing overhead variance. Analyze the total overhead variance, using the three-variance analysis method. Material Plastic Motor assembly Wheels and axles Quantity 1.5 lb per car 1 motor per car 1 set per car Cost per Unit $3.40 per lb $6.50 per motor $0.40 per set Hours per Car 0.2 0.3 0.5 Cost per Car $5.10 $6.50 NOTE: Paint and stickers for decorative trim are considered part of indirect materials. Data related to direct labor follow: Job Title Molders Assemblers Rate per Car $15.00 $18.00 $0.40 $12.00 Cost per Car $3.00 $5.40 $8.40 MATERIALS BUDGET Beginning inventories of raw materials on January 1, 20XX, are expected to be as follows: Material Amount 5,500 lb Plastic Motors 4,000 motors Wheels and axles 2,500 sets Speedway Toys, Inc., would like to have enough raw materials on hand at the end of the year to equal the following percentages of 20XX budgeted requirements: Material Plastic Motors Wheels and axles Percentage of 20XX Budget 5% 10% 1% SPEEDWAY TOYS, INC. Analysis of Fixed and Variable Overhead Costs Year Ended December 31, 20XX Controllable Costs Indirect Materials Indirect Labor Payroll Taxes and Fringe Benefits Utilities Repairs and Miscellaneous Non-controllable Costs Depreciation Insurance Total Manufacturing Overhead VARIABLE OVERHEAD PER HOUR $0.04 2.00 2.80 0.32 0.34 $5.50 FIXED OVERHEAD -*** $60,000 9,000 12,000 9,600 42,000 12,000 $144,600

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started