Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Stanzer Inc is a US based telecommunications company listed on the NYSE. The company is considering the purchase of Basser Ltd, an unlisted company

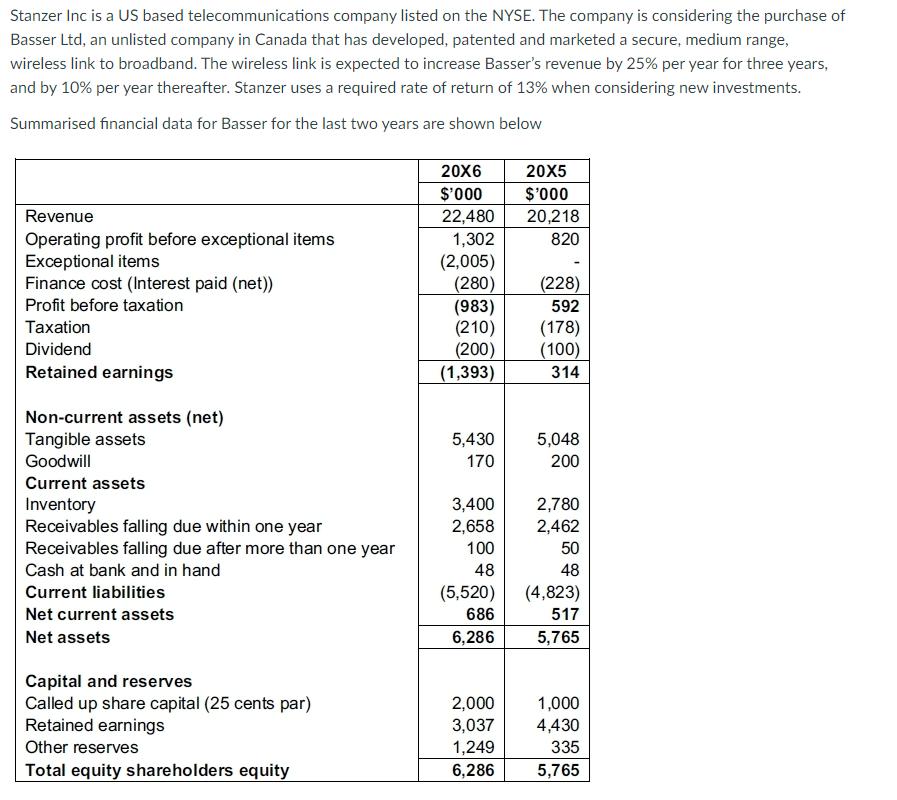

Stanzer Inc is a US based telecommunications company listed on the NYSE. The company is considering the purchase of Basser Ltd, an unlisted company in Canada that has developed, patented and marketed a secure, medium range, wireless link to broadband. The wireless link is expected to increase Basser's revenue by 25% per year for three years, and by 10% per year thereafter. Stanzer uses a required rate of return of 13% when considering new investments. Summarised financial data for Basser for the last two years are shown below Revenue Operating profit before exceptional items Exceptional items Finance cost (Interest paid (net)) Profit before taxation Taxation Dividend Retained earnings Non-current assets (net) Tangible assets Goodwill Current assets Inventory Receivables falling due within one year Receivables falling due after more than one year Cash at bank and in hand Current liabilities Net current assets Net assets Capital and reserves Called up share capital (25 cents par) Retained earnings Other reserves Total equity shareholders equity 20X6 $'000 22,480 1,302 (2,005) (280) (983) (210) (200) (1,393) 5,430 170 3,400 2,658 100 48 (5,520) 686 6,286 2,000 3,037 1,249 6,286 20X5 $'000 20,218 820 (228) 592 (178) (100) 314 5,048 200 2,780 2,462 50 48 (4,823) 517 5,765 1,000 4,430 335 5,765 Other information relating to Basser 1. Corporate taxation is at the rate of 30% per year 2. The current liabilities in the balance sheet are financial, interest-bearing debt. The book value of its debt is the same as its market value 3. Operating profit is expected to be approximately 8% of revenue in FYE 20X7, and to remain at the same percentage in future years. 4. Dividends are expected to grow at the same rate as revenue. Information regarding the industry sector of Basser 1. The average Price to Earnings ratio of listed companies of similar size to Basser is 30 times 2. The average Price to Book ratio of listed companies of similar size to Basser is 3 times 3. Average earnings growth in the industry is 6% per year Required: (a) Estimate the equity value of Basser Ltd using: (i) Price to Earnings ratio (ii) Price to Book ratio (iii) Dividend based valuation Recommend a range of values that Stanzer might bid for Basser. State clearly any assumptions that you make.

Step by Step Solution

★★★★★

3.24 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Here are the calculations to estimate the equity value of Basser Ltd using different valuation metho...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started