Question

Starbucks had total sales of $432,000 in 2015. The growth rate is 9% in 2016 but falls 2% each year to 5% by 2018. The

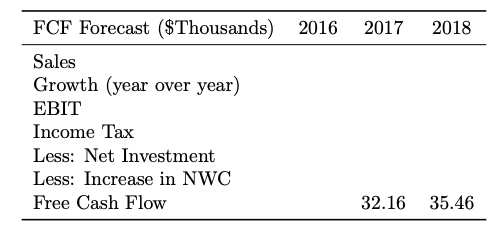

Starbucks had total sales of $432,000 in 2015. The growth rate is 9% in 2016 but falls 2% each year to 5% by 2018. The growth rate of all following years will keep at 5%. EBIT is 9% of sales Increase in NWC is 10% of any increase in sales. net investment is 8% of any increase in sales. The weighted average cost of capital of 11% and the tax rate is 16%. If helpful, use the chart below to help with your calculations:

What is the EBIT, Income tax, net investment, and change in net working capital in 2016? (all in $Thousands) A. EBIT = 38.88, Net Investment = 3.11, Increase in NWC = 3.89 B. EBIT = 42.38, Net Investment = 3.11, Increase in NWC = 3.89 C. EBIT = 38.88, Net Investment = 3.39, Increase in NWC = 4.24 D. EBIT = 42.38, Net Investment = 3.39, Increase in NWC = 4.24

What is their overall Free Cash Flow in 2016? ($Thousands) A. $25.66 B. $31.88 C. $28.60 D. $35.38

What is the terminal value in 2018? You may use the information provided in the table. A. $620.55 B. $562.80 C. $322.36 D. $292.36

2017 2018 FCF Forecast ($Thousands) 2016 ($ Sales Growth (year over year) EBIT Income Tax Less: Net Investment Less: Increase in NWC Free Cash Flow 32.16 35.46

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started