Question

Starbucks is today the worlds leading roaster and retailer of specialty coffee. The company purchases and roasts whole coffee beans and sells them, along with

Starbucks is today the worlds leading roaster and retailer of specialty coffee. The company purchases and roasts whole coffee beans and sells them, along with variety of freshly brewed coffees and other beverages, food items, and coffee related merchandise, in its retail shops. It also produces and sells bottled coffee drinks, a line of premium ice creams, and most recently, instant coffee products. Starbucks is one of the most recognized and respected brands in the world.

Starbucks is today the worlds leading roaster and retailer of specialty coffee. The company purchases and roasts whole coffee beans and sells them, along with variety of freshly brewed coffees and other beverages, food items, and coffee related merchandise, in its retail shops. It also produces and sells bottled coffee drinks, a line of premium ice creams, and most recently, instant coffee products. Starbucks is one of the most recognized and respected brands in the world.

Required:

Evaluate the company's performance in terms of:

1. Liquidity

2. Profitability

3. Long-term Solvency

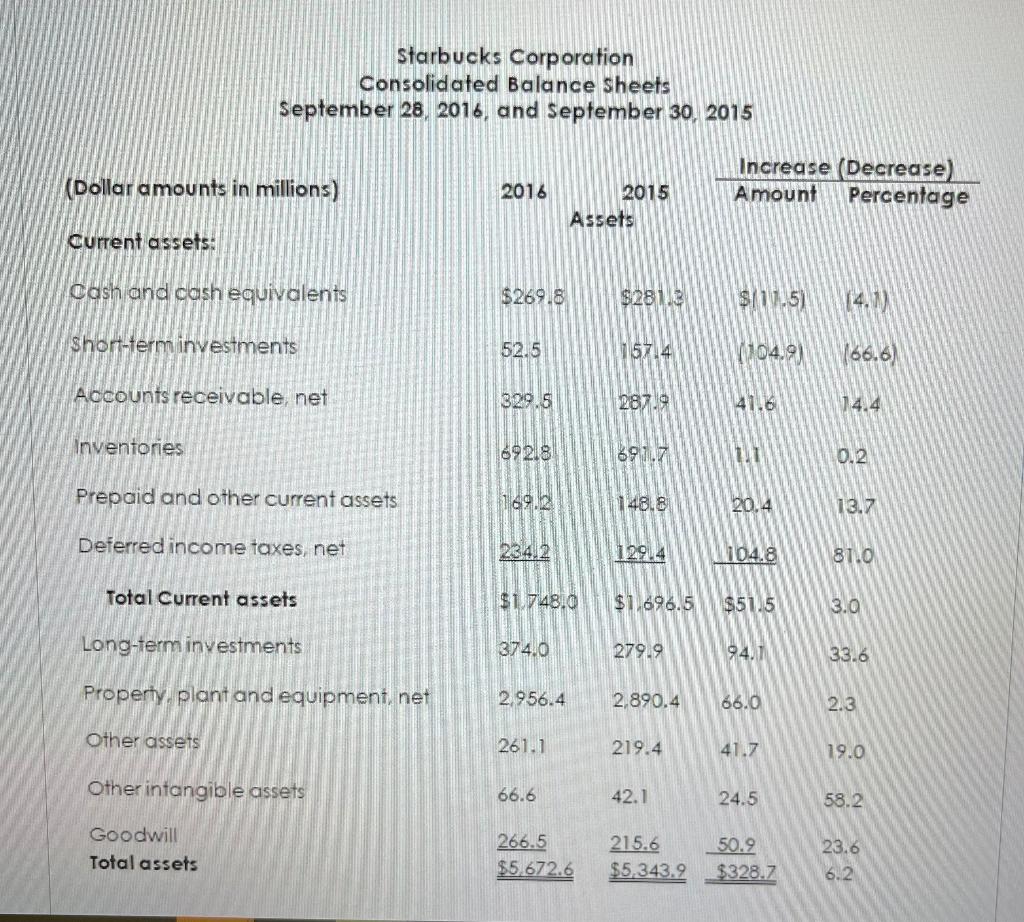

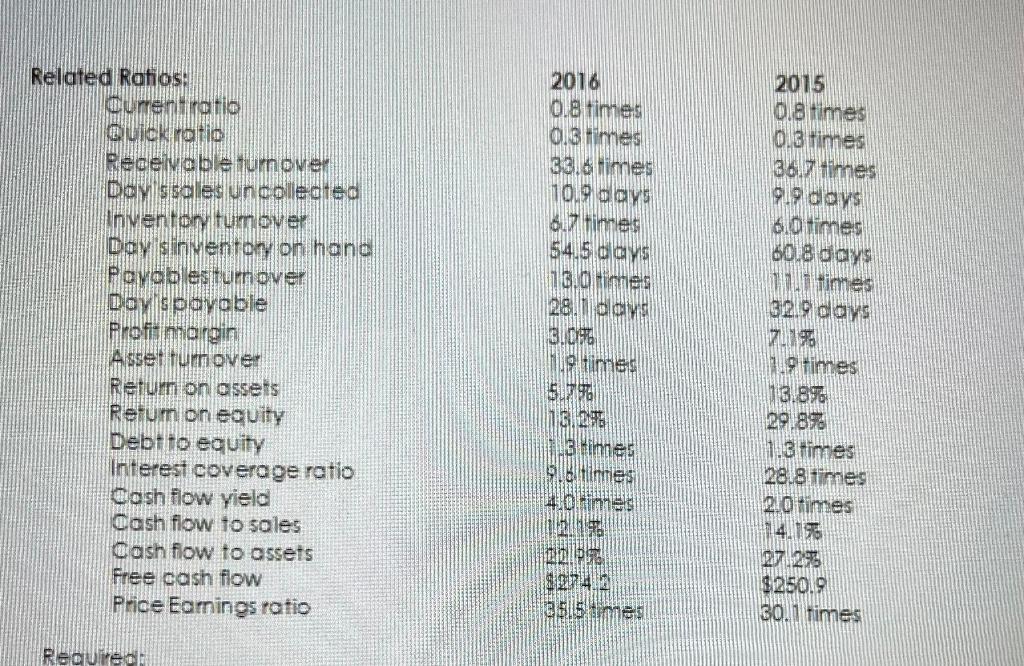

Starbucks Corporation Consolidated Balance Sheets September 28, 2016, and September 30, 2015 (Dollar amounts in millions) Increase (Decrease) Amount Percentage 2016 2015 Assets Current assets: Cash and cash equivalents $269.8 $2813 $117.5) 14. short-term investments 52.5 15714 104.9) 66.6) Accounts receivable, net 329.5 287.9 41.6 14.4 Inventories 69218 897.7 11 0.2 Prepaid and other current assets 169.2 148.8 20.4 13.7 Deferred income taxes, net 23.4.2 12014 104.8 81.0 Total Current assets $1 74810 $1.696.5 $51.5 3.0 Long-term investments 374.0 279.9 94.1 33.6 Property, plant and equipment, net 2.956.4 2,890.4 66.0 2.3 Other assets 261.1 219.4 41.7 19.0 Other intangible assets 66.6 42.1 24.5 58.2. Goodwill Total assets 266.5 $5.672.6 215.6 $5,343.2 50.2 $328.7 23.6 6.2 Related Rafios: Current ratio Quick Ratio Receivable urnover Dalys sales un collected Inventon tumover Do slinventory on hand Povables turn over Days payable Profit margin Asser fun over Return on assets Rerum on equity Debito equity Interest coverage ratio cash flow yield Cash flow to sales cash flow to assets Free cash flow Price Eamings ratio 2016 0.8 times OIB Himes 336 limes 10.9 days 67 times 54.5 days 16. mes 28. 13.0196 ng times 5.70 1G, 1996 3 times 91 blindes 0 Rimes TRENT 2015 0.8 times 0.3 Times 36.77 times 019 days 6.0 times 60.8 days times 329 days 741 96 10 times 13.8% 29.8% 1.3 times 28.8 times 20 times 4.1978 27.25 $250.9 30.1 times BESimman RequiredStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started