Answered step by step

Verified Expert Solution

Question

1 Approved Answer

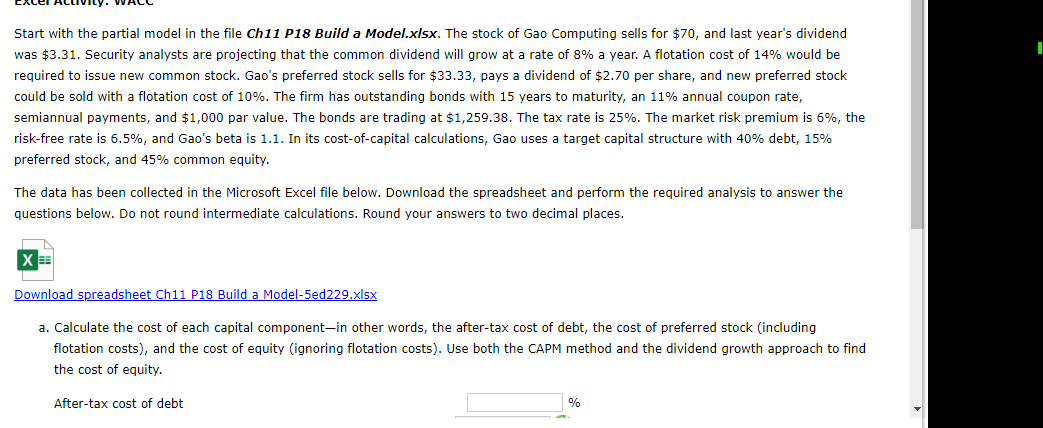

Start with the partial model in the file Ch 1 1 P 1 8 Build a Model.xlsx . The stock of Gao Computing sells for

Start with the partial model in the file Ch P Build a Model.xlsx The stock of Gao Computing sells for $ and last year's dividend was $ Security analysts are projecting that the common dividend will grow at a rate of a year. A flotation cost of would be required to issue new common stock. Gao's preferred stock sells for $ pays a dividend of $ per share, and new preferred stock could be sold with a flotation cost of The firm has outstanding bonds with years to maturity, an annual coupon rate, semiannual payments, and $ par value. The bonds are trading at $ The tax rate is The market risk premium is the riskfree rate is and Gao's beta is In its costofcapital calculations, Gao uses a target capital structure with debt, preferred stock, and common equity. Start with the partial model in the file Ch P Build a Model.xlsx The stock of Gao Computing sells for $ and last year's dividend

was $ Security analysts are projecting that the common dividend will grow at a rate of a year. A flotation cost of would be

required to issue new common stock. Gao's preferred stock sells for $ pays a dividend of $ per share, and new preferred stock

could be sold with a flotation cost of The firm has outstanding bonds with years to maturity, an annual coupon rate,

semiannual payments, and $ par value. The bonds are trading at $ The tax rate is The market risk premium is the

riskfree rate is and Gao's beta is In its costofcapital calculations, Gao uses a target capital structure with debt,

preferred stock, and common equity.

The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the

questions below. Do not round intermediate calculations. Round your answers to two decimal places.

Download spreadsheet Ch P Build a Modeledxlsx

a Calculate the cost of each capital componentin other words, the aftertax cost of debt, the cost of preferred stock including

flotation costs and the cost of equity ignoring flotation costs Use both the CAPM method and the dividend growth approach to find

the cost of equity.

Aftertax cost of debt Download spreadsheet Ch P Build a Modeledxlsx

a Calculate the cost of each capital componentin other words, the aftertax cost of debt, the cost of preferred stock including

flotation costs and the cost of equity ignoring flotation costs Use both the CAPM method and the dividend growth approach to find

the cost of equity.

Aftertax cost of debt

Cost of preferred stock including flotation costs

Cost of common equity, dividend growth approach

ignoring flotation costs

Cost of common equity, CAPM

b Calculate the cost of new stock using the dividend growth approach.

c Assuming that Gao will not issue new equity and will continue to use the same target capital structure, what is the company's WACC?

The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below. Do not round intermediate calculations. Round your answers to two decimal places.

Download spreadsheet Ch P Build a Modeledxlsx

Calculate the cost of each capital componentin other words, the aftertax cost of debt, the cost of preferred stock including flotation costs and the cost of equity ignoring flotation costs Use both the CAPM method and the dividend growth approach to find the cost of equity.

Aftertax cost of debt fill in the blank

Cost of preferred stock including flotation costs fill in the blank

Cost of common equity, dividend growth approach fill in the blank

ignoring flotation costs

Cost of common equity, CAPM fill in the blank

Calculate the cost of new stock using the dividend growth approach.

fill in the blank

Assuming that Gao will not issue new equity and will continue to use the same target capital structure, what is the company's WACC?

fill in the blank

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started