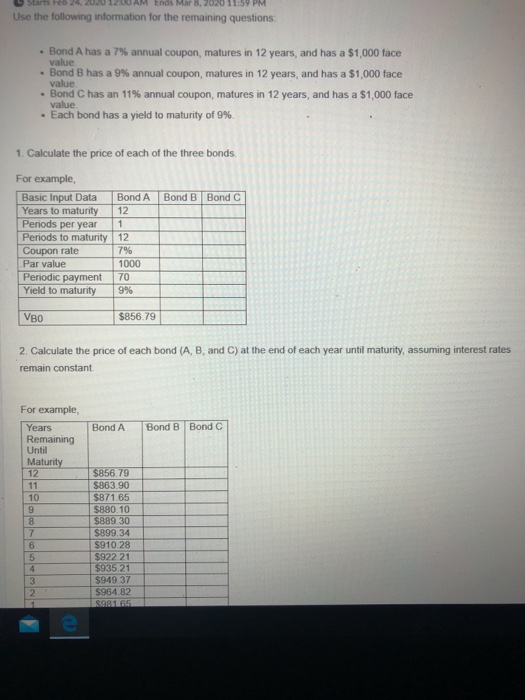

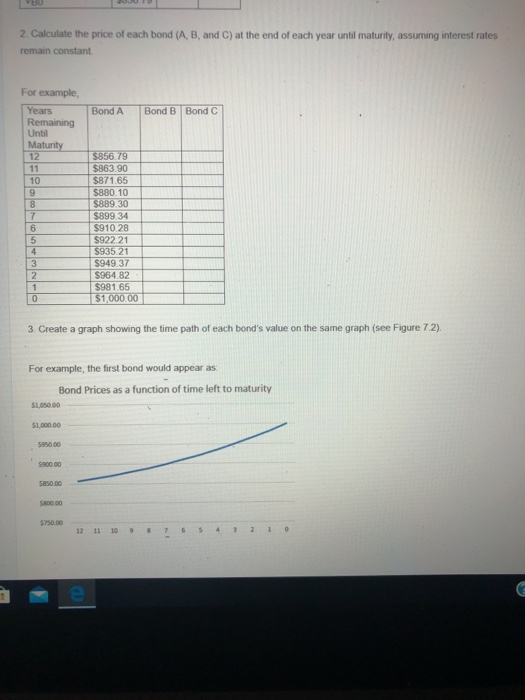

Starts feb 24, 2020 1200AM Ends Mar 8, 2020 11:59 PM Use the following information for the remaining questions Bond A has a 7% annual coupon, matures in 12 years, and has a $1,000 face value Bond B has a 9% annual coupon, matures in 12 years, and has a $1,000 face value Bond C has an 11% annual coupon, matures in 12 years, and has a $1,000 face value Each bond has a yield to maturity of 9% 1. Calculate the price of each of the three bonds Bond B Bond C For example, Basic Input Data Years to maturity Periods per year Periods to maturity Coupon rate Par value Periodic payment Yield to maturity Bond A 12 1 12 7% 1000 70 9% VBO $856.79 2. Calculate the price of each bond (A, B, and C) at the end of each year until maturity, assuming interest rates remain constant For example, Bond A Bond B Bond C Years Remaining Until Maturity 12 11 10 8 $856.79 S863.90 S871.65 $880 10 $889 30 $899.34 $910 28 $922 21 $935 21 5949.37 $964.82 $98165 BU 2. Calculate the price of each bond (A, B and C) at the end of each year until maturity, assuming interest rates remain constant For example, Bond A Bond B Bond C Years Remaining Until Maturity 12 11 10 7 6 5 4 3 $856.79 $863.90 $871.65 $880.10 $889.30 $899 34 $910.28 $922 21 $935.21 $949.37 $964.82 $981 65 $1,000.00 3. Create a graph showing the time path of each bond's value on the same graph (see Figure 7.2). For example, the first bond would appear as Bond Prices as a function of time left to maturity $1.OSO DO $1.000 DO 5950.00 $900.00 SO DO 12 11 10 9 8 7 6 5 4 3 2 Starts feb 24, 2020 1200AM Ends Mar 8, 2020 11:59 PM Use the following information for the remaining questions Bond A has a 7% annual coupon, matures in 12 years, and has a $1,000 face value Bond B has a 9% annual coupon, matures in 12 years, and has a $1,000 face value Bond C has an 11% annual coupon, matures in 12 years, and has a $1,000 face value Each bond has a yield to maturity of 9% 1. Calculate the price of each of the three bonds Bond B Bond C For example, Basic Input Data Years to maturity Periods per year Periods to maturity Coupon rate Par value Periodic payment Yield to maturity Bond A 12 1 12 7% 1000 70 9% VBO $856.79 2. Calculate the price of each bond (A, B, and C) at the end of each year until maturity, assuming interest rates remain constant For example, Bond A Bond B Bond C Years Remaining Until Maturity 12 11 10 8 $856.79 S863.90 S871.65 $880 10 $889 30 $899.34 $910 28 $922 21 $935 21 5949.37 $964.82 $98165 BU 2. Calculate the price of each bond (A, B and C) at the end of each year until maturity, assuming interest rates remain constant For example, Bond A Bond B Bond C Years Remaining Until Maturity 12 11 10 7 6 5 4 3 $856.79 $863.90 $871.65 $880.10 $889.30 $899 34 $910.28 $922 21 $935.21 $949.37 $964.82 $981 65 $1,000.00 3. Create a graph showing the time path of each bond's value on the same graph (see Figure 7.2). For example, the first bond would appear as Bond Prices as a function of time left to maturity $1.OSO DO $1.000 DO 5950.00 $900.00 SO DO 12 11 10 9 8 7 6 5 4 3 2